Pension crisis for workers as Rachel Reeves's £4.7bn 'salary sacrifice raid' to 'shrink retirement pots'

Chancellor Rachel Reeves confirms Labour will not increase national insurance, VAT and basic higher or additional rates of income tax |

GB NEWS

The Chancellor unveiled changes to salary sacrifice rules which could impact pension savings for millions

Don't Miss

Most Read

Latest

Business leaders are sounding the alarm over a potential pension crisis following changes to salary sacrifice rules announced by Chancellor Rachel Reeves in yesterday's Budget.

Analysts stark warnings about the Government's proposal to limit salary sacrifice pension contributions to £2,000 annually, a measure projected to generate £4.7billion in revenue for the Treasury.

The restriction on National Insurance benefits that employees and employers currently receive through pension salary sacrifice arrangements could "shrink retirement pots" for workers.

Anita Wright, chartered financial planner at Ribble Wealth Management, described the proposal as a "pension salary sacrifice raid" that would curtail the National Insurance advantages previously available to workers and businesses when funding retirement savings through these arrangements.

The Chancellor's 'salary sacrifice raid' could 'shrink retirement pots'

|GETTY

The scheme has traditionally enabled employees to increase their pension contributions while allowing employers to reduce their National Insurance obligations, creating mutual benefits that thousands of businesses have come to depend upon.

Business leaders have highlighted how the £2,000 threshold undermines a vital mechanism for attracting skilled workers, especially for smaller companies and emerging enterprises.

Simon Thomas, managing director and chartered accountant at Ridgefield Consulting, told Newspage: "For many growing businesses and start-ups that cannot yet compete on headline salaries, enhanced pension contributions through salary sacrifice form a crucial part of how they attract and retain talent."

He warned that the reduced tax benefits would render these arrangements significantly less appealing, potentially causing numerous companies to abandon them completely.

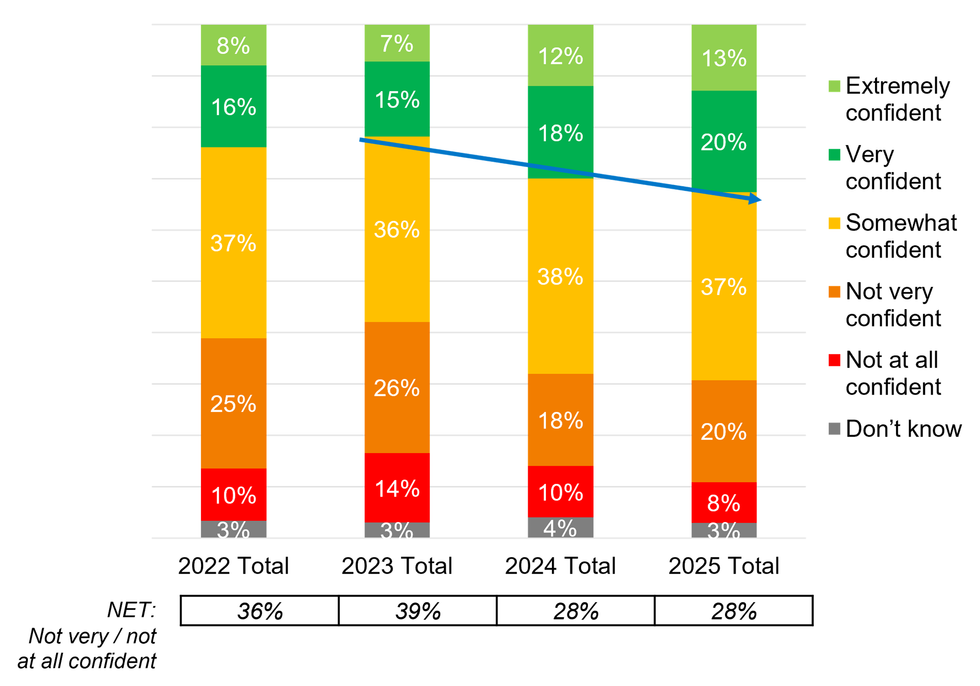

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON The timing compounds difficulties for businesses already grappling with increased employer National Insurance rates and squeezed profit margins, potentially hampering their competitive edge in recruitment.

Kate Underwood, founder and chief people strategist at Southampton-based Kate Underwood HR and Training, explained that pension salary sacrifice has been "one of the only ways to keep the numbers vaguely sensible" amid escalating wages, business rates and energy costs.

She predicted businesses would hesitate before expanding their workforce: "You will see more pauses on recruitment, slower replacement of leavers and fewer hours or perks being offered."

The restriction particularly hampers efforts to recruit seasoned professionals, removing what Ms Underwood called "one of the few tools" available for creating attractive employment packages within budget constraints.

Philly Ponniah, chartered wealth manager and financial coach at Philly Financial, noted that the cap represents a significant shift for the numerous workers who depend on this arrangement: "Salary sacrifice has been one of the simplest, safest ways for people to boost retirement savings and reduce their tax bill."

She explained that restricting relief beyond £2,000 would result in increased National Insurance payments for workers and employers alike, effectively reducing take-home pay when household budgets are already stretched.

Retirement savings face substantial long-term damage from the proposed changes, with independent financial advisers calculating potential losses in the tens of thousands.

David Stirling, independent financial adviser at Belfast-based Mint Wealth Ltd, warned that while the policy might appear sound to the Chancellor theoretically, the practical implications are severe:

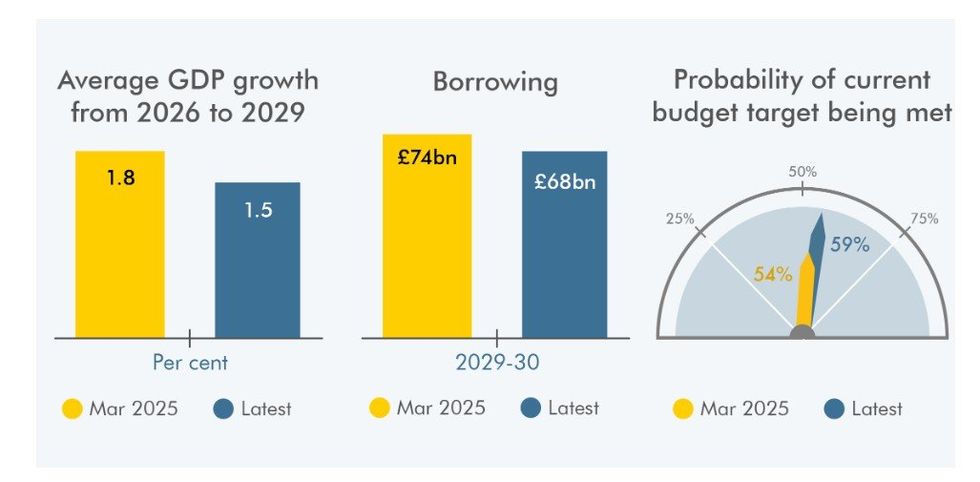

What is the state of the UK economy? | OBR

What is the state of the UK economy? | OBR "Higher earners stand to lose the biggest perk of their pension planning, employers may scale back contributions, and long-term retirement pots could shrink by tens of thousands."

He suggested the changes could transform retirement planning into what he termed a "bureaucratic minefield" for savers attempting to secure their financial future.

Following her Budget, the Chancellor claimed "taxes have been kept at “an absolute minimum on ordinary working people".

She added: "I do recognise that that will mean that working people pay a bit more. But I’ve kept that contribution to an absolute minimum by closing … a number of tax loopholes and also bearing down on Government spending, on waste and inefficiency."

More From GB News