Pension disaster as nearly half of pots overdrawn in 'real risk' to retirement savings

Work and Pensions Secretary Pat McFadden says the Morgan McSweeney donations row has already 'been looked into' and 'there is nothing more to add' |

GB News

Analysis reveals 45 per cent of retirement savings accessed at rates which are considered to be 'unsustainable'

Don't Miss

Most Read

Fresh analysis of Financial Conduct Authority (FCA) figures shows pension withdrawals at unsustainable rates have reached record levels.

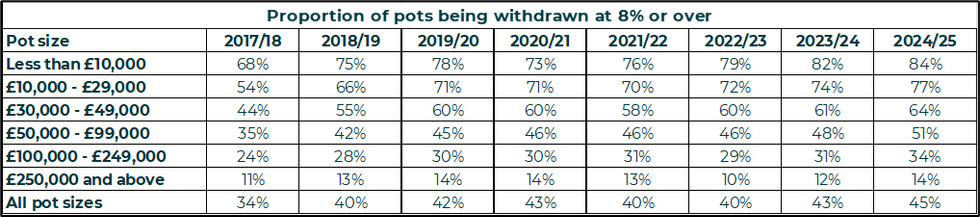

In 2024/25, 45 per cent of all retirement savings pots were accessed at eight per cent or higher.

Financial experts generally regard four per cent as a prudent annual drawdown rate, meaning many retirees are drawing down at double the recommended pace.

The findings come from consultancy firm Broadstone, which compiled eight years of FCA retirement income market data.

TRENDING

Stories

Videos

Your Say

The 45 per cent figure is the highest recorded and represents a two percentage point increase from the previous year’s 43 per cent.

The pattern is seen across all pension sizes.

Smaller pots under £10,000 had 84 per cent being withdrawn at eight per cent or more.

About one third of pots worth £100,000 to £249,000 were being accessed at elevated rates.

Pension withdrawals at unsustainable rates have reached record levels.

| GETTYEven 14 per cent of pots exceeding £250,000 were being drawn down at this level.

David Brooks, head of policy at Broadstone, said: "This data is cause for alarm in the sheer number of pots that are being drawn down rapidly by pensioners."

He noted that the figures do not show whether these are retirees’ main pensions, but said the consistent increase over eight years is "startling".

Mr Brooks added: "Some individuals may be choosing to front-load income in early retirement or meet temporary financial needs, so the headline figures need not imply a permanent, year-on-year pattern."

Proportion of pots being withdrawn at 8% or over

|Broadstone

Retirees accessing their savings at double the prudent rate may risk hardship in later years.

Mr Brooks said: "The rising proportion does, however, suggest that this is a trend worth closely monitoring as the full impact on retirees’ long-term financial wellbeing remains to be seen."

The trends raise concerns for long-term financial security.

The data comes just over ten years after the introduction of pension freedoms in 2015, which gave retirees more control over how they access their savings.

Mr Brooks warned: "This data raises the very real risk that many people are depleting their savings unsustainably and risk facing serious financial challenges later on in retirement."

The consistent upward trend across all pot sizes suggests that future generations of retirees may face growing risks of running out of retirement funds.

Figures from the Office for National Statistics show retired households now have a typical disposable income of £29,728, down £558 compared with 2020/21.

LATEST DEVELOPMENTS:

- Britons could claim £1,700 savings boost to credit card debt hack: 'Shop around for best deal!'

- Rachel Reeves 'proud of what Labour's achieved' on economy despite stagnant growth

- Universal Credit payments at risk for thousands under Rachel Reeves's DWP reforms

The consistent upward trend across all pot sizes suggests that future generations of retirees may face growing risks of running out of retirement funds.

| GETTYMr Brooks said pensioners’ circumstances have "remained essentially stagnant, or even decreased, since the pandemic."

Proposals to means-test the state Ppnsion or remove the triple lock could further reduce incomes and living standards.

The Joseph Rowntree Foundation projects that by the end of this Parliament, disposable incomes will have fallen by £570, marking the poorest performance since 1961.

Mike Ambery, retirement savings director at Standard Life, noted the new state pension is approaching the income tax threshold, leaving retirees with minimal additional income before taxation.

More From GB News