Hunt urged to make ‘tax system fairer for all’ as pensioners at risk of 'keeping less’ of income

Older Britons are at risk of paying more tax on pension payments due to Jeremy Hunt’s allowance freeze

Don't Miss

Most Read

Latest

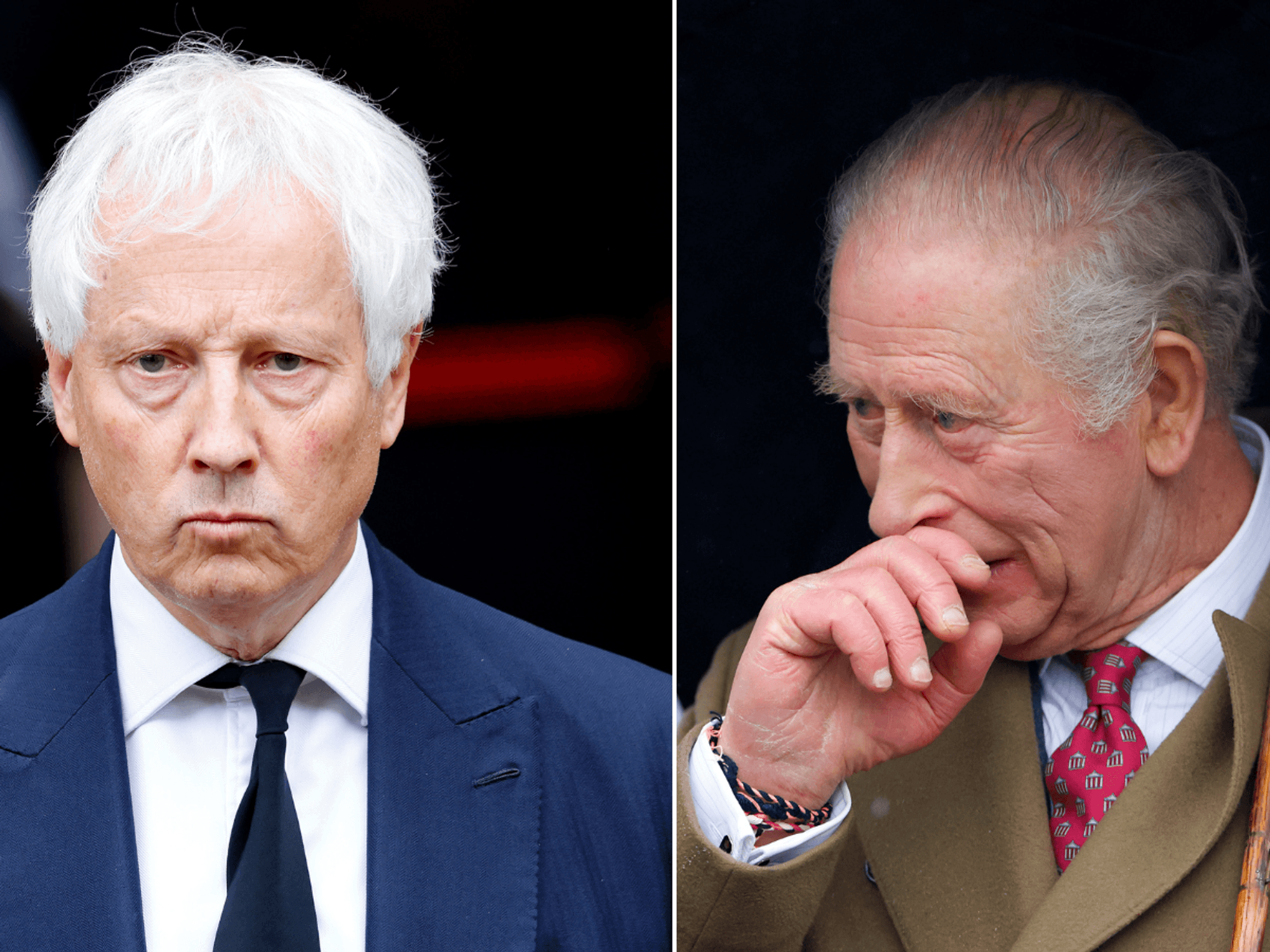

Chancellor Jeremy Hunt is being called to make the “system fairer for all” as pensioners face paying more tax in years to come.

Britons face their tax burden increasing as income increases but tax allowance thresholds remain frozen.

The state pension payment rates are forecast to rise by 8.5 per cent in 2024 thanks to the triple lock being in place, but the personal allowance will stay at £12,570 until 2028.

It means despite the recent National Insurance rate cut, workers and pensioners and facing being taxed on more of their income.

The Chancellor is being called to make changes to tax allowances

|GETTY

Fiscal drag is the term used for when wages rise but tax allowances remain the same resulting in taxpayers being dragged into higher brackets.

Andrew Gosselin, a finance expert and senior editor at The Calculator Site, told GB News explained how retirees also face the impact of fiscal drag.

He said: “Say your state pension goes up three per cent for inflation each year.

“It's not a real increase since everything costs more. But if tax brackets stay frozen, that small pension bump could move you into a higher tax bracket eventually.

“While your income only went up to maintain its buying power, you pay more tax and keep less of each payment.”

Mr Gosselin urged the Government to consider making changes to tax allowances to factor in the impact of mitigating factors, such as the cost of living.

The finance expert added: “Regularly adjusting tax brackets for inflation would make the system fairer for all.”

Currently, a taxpayer’s earnings up to the personal allowance of £12,750 pay no tax. If they make between £12,751 and £50,270 they pay basic rate of 20 per cent.

LATEST DEVELOPMENTS:

Fiscal drag has been branded the 'ultimate stealth tax' | GETTY

Fiscal drag has been branded the 'ultimate stealth tax' | GETTYThe higher rate of tax of 40 per cent is applied to incomes between £50,271 and £125,140 with any earnings above this threshold being subject to the additional rate of 45 per cent.

The full new state pension is expected to reach £11,541.90 a year once it rises by 8.5 per cent, in line with the triple lock, in April.

While this is below the personal allowance, a similar rate hike in 2025 could see pensioners dragged into the 20 per cent basic rate tax band based on their state pension alone.