NatWest confirms major £2.7bn takeover deal that will 'transform services for 20 million customers'

The banking group has purchased wealth management firm Evelyn Partners

Don't Miss

Most Read

Latest

NatWest has secured a £2.7billion agreement to purchase Evelyn Partners, one of Britain's most prominent wealth management firms, marking the banking group's biggest takeover since its taxpayer rescue during the 2008 financial crisis.

The deal, announced this morning, saw NatWest outbid rival Barclays for the company. Evelyn Partners' private equity backers, Permira and Warburg Pincus, initiated the sale process last summer, attracting interest from several major financial institutions including Lloyds and Royal Bank of Canada.

The acquisition brings approximately 2,400 Evelyn Partners staff under NatWest's ownership and represents a significant expansion of the bank's wealth management operations.

Notably, the transaction establishes what NatWest describes as Britain's foremost private banking and wealth management operation, merging Evelyn Partners' £69billion in assets under management with NatWest's existing £59billion portfolio.

NatWest has confirmed the £2.7billion takeover of Evelyn Partners

| GETTYOverall, this combined £127billion asset base will serve the bank's 20 million customers through an integrated offering spanning financial planning, discretionary investment management, and the direct-to-consumer platform BestInvest.

NatWest already owns the prestigious private bank Coutts, and the enlarged wealth division will account for roughly 20 per cent of the group's total customer assets and liabilities.

The deal is expected to boost fee income by approximately 20 per cent before revenue synergies are factored in. Evelyn Partners traces its origins to 1836, when Thomas Tilney established his stockbroking firm in the City of London.

Permira acquired Tilney in 2014, subsequently merging it with the 145-year-old Glasgow investment house Smith & Williamson in 2019, with the combined entity adopting its current name three years later.

Paul Thwaite, who assumed the NatWest chief executive role in 2024 following Alison Rose's departure amid the Nigel Farage banking controversy, has prioritised expanding into higher-margin areas such as wealth management.

The deal is set to 'transform services for 20 million customers'

| GETTYSince taking charge, Mr Thwaite has already overseen the purchase of much of Sainsbury's banking operations and a £2.5billion mortgage portfolio from Metro Bank.

In a statement, he said: "Bringing together these two leading businesses creates a unique opportunity to provide financial planning, savings and investment services to more families and people across the UK.

"We look forward to welcoming our new clients and working with our colleagues at Evelyn Partners to transform the services our 20 million customers across the Group can expect from us.

At a time when the benefits of saving and investing are increasingly part of the national conversation, we can help customers to make more of their money through a broader range of services, as well as helping to drive growth and investment across the economy.

This transaction creates the UK’s leading Private Banking and Wealth Management business, delivering the scale and capabilities needed to succeed in a market with significant growth potential. It accelerates delivery of NatWest Group’s strategy and positions us to realise our longer-term ambitions.

LATEST DEVELOPMENTS

"This represents a strategically and financially compelling use of capital, enhancing income diversification and strengthening returns in a high‑growth segment, to deliver sustainable long‑term value creation."

NatWest simultaneously revealed plans to return £750million to shareholders through a share buyback, continuing its established pattern of capital distribution.

The bank anticipates the Evelyn Partners integration will deliver around £100million in yearly cost savings, representing approximately 10 per cent of the combined wealth division's expenses, though achieving these efficiencies will require an estimated £150million investment.

Despite the strategic rationale, investors responded coolly to Monday's announcement, with NatWest shares dropping more than 5% in early trading to rank among the Ftse100's worst performers.

The transaction requires regulatory approval and is anticipated to complete during summer 2026.

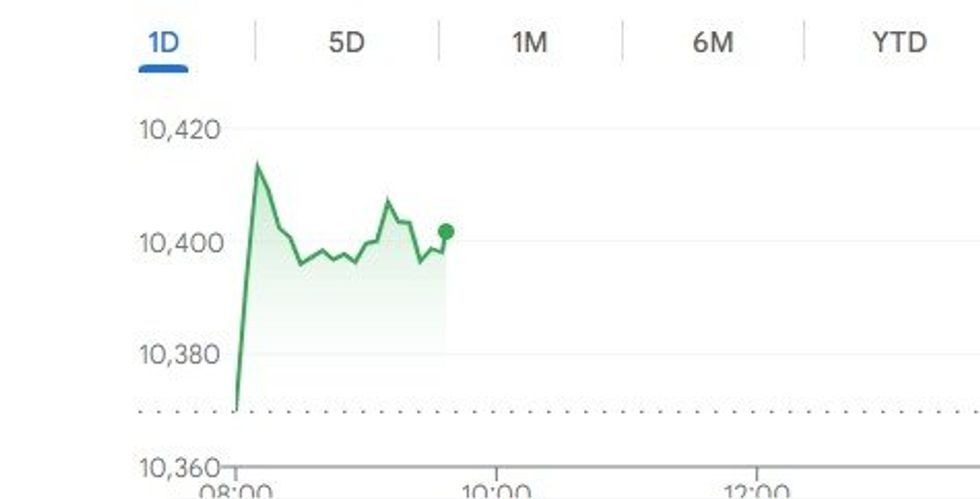

The Ftse 100 jumped as trading started this morning

|When trading opened this month, the Ftse 100 surged 45 points higher to 10,414.5, thanks to a rally in mining and defence sectors stocks

Precious metals producers Endeavour Mining and Fresnillo topped the list of best performing firms, a 2.9 per cent jump, followed by copper digger Antofagasta, up 2.4 per cent.

Furthermore, defence contractor Babcock and aerospace parts supplier Melrose, both up 2.4 per cent.

NatWest is at the bottom, down 4.7 per cent as investors don't seem to agree with its view that acquisitions are better than share buybacks.

More From GB News