1.6 million homeowners ‘face significant increases’ to mortgage repayments despite rate reductions

Mortgage rates are slowly being cut but this will not stop repayments rising for 1.6 million households in 2024

Don't Miss

Most Read

Latest

More than a million homeowners “face significant monthly increases” to their mortgage repayments this year despite interest rates easing, an expert has claimed.

Some 1.6 million households on a fixed rate will be impacted despite signs that the Bank of England could cut the base rate in the coming months.

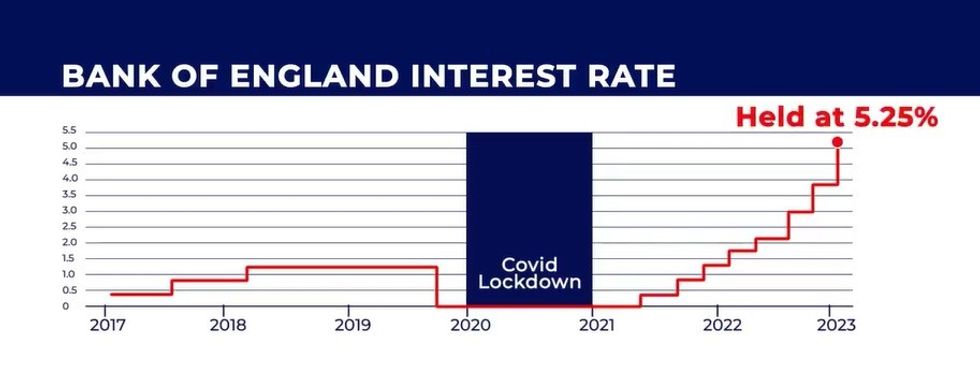

Britons have been forced to contend with high interest rates over the past year-and-a-half as the central bank has hiked rates in its fight against inflation.

While experts predict interest rates to drop during the year, repayments for many homeowners will be too costly to bare.

Kevin Mountford, a personal finance expert for Raisin UK, told GB News he believes mortgage rates will “continue to fall throughout 2024”.

He said banks need to move money and have seen their deposit levels rise thanks to the improved savings environment.

Mortgage rates are falling but 1.6 million homeowners face higher repayments

|GETTY

Furthermore, inflation has eased to 3.9 per cent in the year to November 2023 and experts are speculating the Bank of England could reduce the base rate by as soon as spring.

Despite this forecast, Mr Mountford warned that the “future is not all rosy” with 1.6 million households likely to see their mortgage repayments soar in the neat future.

He explained: “We know that global events can impact the economic outlook and, in turn, increase inflation.

"Plus, we need to avoid any real recession in the UK as this will also have negative impacts.

“Beyond this, around 1.6 million fixed mortgage products will mature during 2024, and many borrowers will face significant monthly increases.

“However, the outlook is far more positive than it was, and overall, there will be a degree of cautious optimism as we move through the year."

Those concerned about being unable to make their mortgage repayments should contact their lender, according to MoneyHelper.

The money guidance website said lenders may be able to discuss options with mortgage holders as they “want to help you meet repayments”.

LATEST DEVELOPMENTS:

The Bank of England base rate has been held at 5.25 per cent | GB NEWS

The Bank of England base rate has been held at 5.25 per cent | GB NEWSFor example, lenders could arrange temporary payment arrangements with the customer or lengthen the terms of the mortgage.

Furthermore, a temporary switch to interest-only repayments could be set up to help households struggling with costs.

The Bank of England’s base rate is expected to remain at 5.25 per cent until at least spring of this year.

The central bank’s Monetary Policy Committee (MPC) will announce any further changes to the base rate on February 2, 2024.