Homeowners urged to 'face reality' as mortgage rates rise to highest level in months

Mortgage rates have risen in recent months, according to new research

|GETTY/PA

The Bank of England's decision to hike interest rates has impacted mortgage repayments for millions

Don't Miss

Most Read

Homeowners "have to face reality" as mortgage rates in the UK have skyrocketed to new heights in recent months, according to new research conducted by Moneyfactscompare.

The finance experts' UK Mortgages Trends Treasury Report found that average interest rates on overall two and five-year deals increased, albeit modestly, by 0.02 per cent.

While this is slightly lower than the rates reported for December 2023, Britons coming off a five-year fixed rate mortgage looking for an equivalent deal face much higher rates; 2.65 per cent higher compared to June 2019.

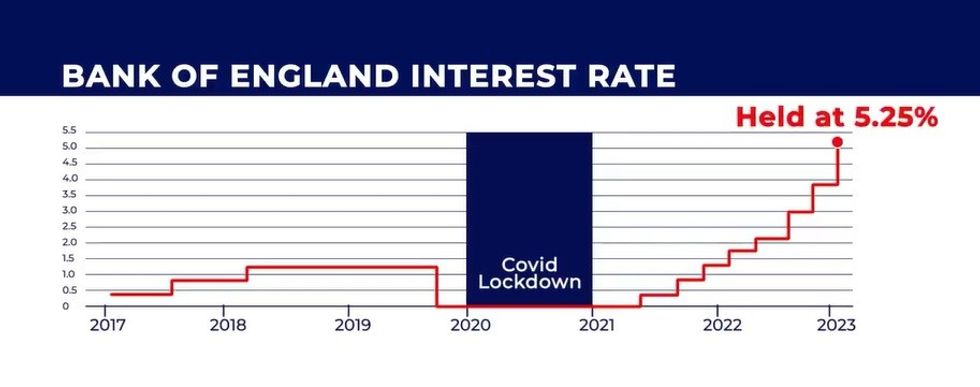

Mortgage repayments have risen dramatically in recent years due to the Bank of England's decision to raise the country's base rate in an attempt to rein in inflation.

As a result, the central bank has increased and held interest rates at 5.25 per cent since August 2023 which has impacted borrowers, including homeowners and those in debt.

However, the consumer price index (CPI) rate has eased to 2.3 per cent with analysts betting on a potential cut from the Bank in the later half of this year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWSOverall, the average two- and five-year fixed rates increased between the start of May and the start of June, to 5.93 per cent and 5.50 per cent, respectively.

Due to this, the average two-year fixed rate continues to be 0.43 per cent higher than the five-year equivalent with the gap between these averages having not been this wide since October 2023.

Furthermore, the average standard variable rate (SVR) continues to be at 8.18 per cent which is just below the record 8.19 recorded towards the end of last year.

Notably. the average two-year tracker variable mortgage dropped to 5.94 per cent over the period.

Rachel Springall, finance Expert at Moneyfacts, broke down what the current state of the property market looks like for homeowners and prospective buyers.

She explained: "Borrowers may feel disheartened to see another consecutive month of rises to the average two- and five-year fixed mortgage rates.

"However, both rose by a modest 0.02 per cent, the smallest month-on-month rise this year. The incentive to fix for longer remains, with the average five-year fixed rate standing 0.43 per cent lower than its two-year counterpart, and the incentive to remortgage is prevalent, as the average Standard Variable Rate (SVR) stands at 8.18 per cent.

"Lenders spent the first few weeks of May repricing, in reaction to a volatile swap rate market, but the latter end of the month was more subdued, around the time the Government announced there would be a General Election in July."

Despite hopes of a potential rate cut from the Bank in the near future, official figures from the Office for National Statistics (ONS) published today suggest homeowners will have a longer wait.

Average earnings growth failed to ease for another consecutive month, remaining at six per cent, which experts highlighting how this will push the Bank to remain "cautious".

LATEST DEVELOPMENTS:

The Bank of England is being urged to cut interest rates to help homeowners

| GETTYHowever, Moneyfacts' resident expert warned Britons to "face reality" about what the recent trend of rate hikes means for their mortgage repayments.

Springall added: "Consumers concerned about rising rates would be wise to seek advice from an independent broker to see if they can lock into a deal early, as some will let borrowers do this from three to six months in advance.

"However, there may well be some borrowers sitting on the fence, hoping the market gets a base rate cut this year, but they could still grab a lower rate deal than if they were to sit on their SVR without fixing, such as with a tracker deal.

"Those about to come off a five-year fixed mortgage will have to face the reality that rates are much higher now on an equivalent deal, 2.65 per cent in fact, compared to June 2019, so consumers must ensure they can afford the higher repayments.”