Revealed: The five biggest mortgage myths that could be costing you thousands

Mortgages Richard Blanco |

GB News

Hodge Bank warns common misconceptions are blocking people from securing competitive products

Don't Miss

Most Read

Thousands of UK homeowners could be missing out on better mortgage deals because they believe common misconceptions about the lending market.

Emma Graham, business development director at Hodge Bank, has identified five myths that are preventing people from exploring their options during difficult economic times.

Ms Graham said: "Mortgages are one of the biggest financial commitments people make, so it's no surprise myths take hold and stick.

"However, these misconceptions can stop people from even looking at their options, which means they might not be getting the most out of the market."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

TRENDING

Stories

Videos

Your Say

Here are five of the biggest myths still misleading UK homeowners.

1. You need a big deposit

It is true that deposits matter, but Ms Graham stressed that not every mortgage requires a huge lump sum.

She said: "Believing you need to put down tens of thousands of pounds can hold people back unnecessarily, when there are options that make buying or moving more accessible."

Lenders also look at credit history, affordability and missed payments — not just the deposit.

Here are five of the biggest myths still misleading UK homeowners

|GETTY/Google

2. Switching mortgages always means heavy penalties

Many homeowners believe changing deals early always results in big fees.

Ms Graham said: "While early repayment charges apply in some cases, they don't affect everyone and vary depending on the product and stage of the mortgage."

In some situations, the long-term savings can far outweigh any costs.

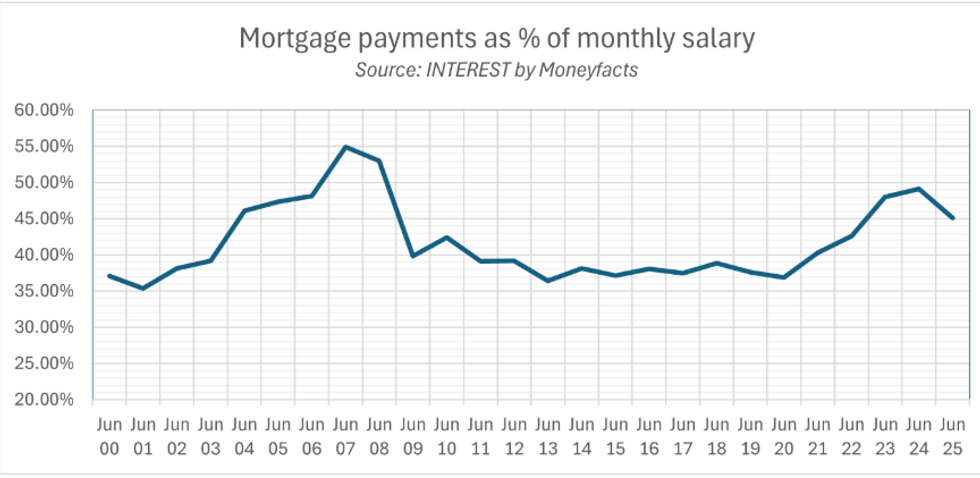

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS3. Self-employed people cannot get a mortgage

Working for yourself no longer means being locked out of the market.

Ms Graham said: "While it can take a little more paperwork, being self-employed doesn't lock you out of the market. More lenders than ever are recognising the different ways people earn and manage their income today."

Specialist lenders are also offering increasingly flexible terms to reflect modern working patterns.

4. You are stuck with your first lender

Some people assume signing with a provider ties them in for good.

Ms Graham said: "The mortgage market just doesn’t work that way. It’s a competitive space, and switching or remortgaging is a common part of homeownership."

Borrowers who stick with their first lender may miss out on products that better fit their changing needs.

LATEST DEVELOPMENTS:

Rachel Reeves

| GETTY5. Older borrowers cannot get mortgages

It is an outdated view that only younger buyers can secure loans.

Ms Graham said: "Age alone is no longer the barrier it once was, but the myth continues to make people think their options are more limited than they really are."

With people living longer and working later in life, lenders now regularly consider older applicants.

Experts say challenging these myths could help thousands of homeowners secure cheaper deals and save money over the long term.

With the cost of living still squeezing budgets, borrowers are being urged to review their options rather than assume they are locked out.

Industry specialists stress that advice from a mortgage broker can make navigating the market far simpler.

The message is clear: understanding fact from fiction could be the difference between struggling and saving.

More From GB News