UK homes worth £1million dragged into NEW mansion tax

New council tax bands will increase taxes for £1million properties

Don't Miss

Most Read

Latest

A new 'mansion tax' on Scotland’s most expensive homes has been unveiled by the SNP Government as part of its draft Budget for 2026/27.

Under the plans announced today, two new council tax bands would be created for residential properties valued at more than £1million, with the changes set to take effect from April 1, 2028.

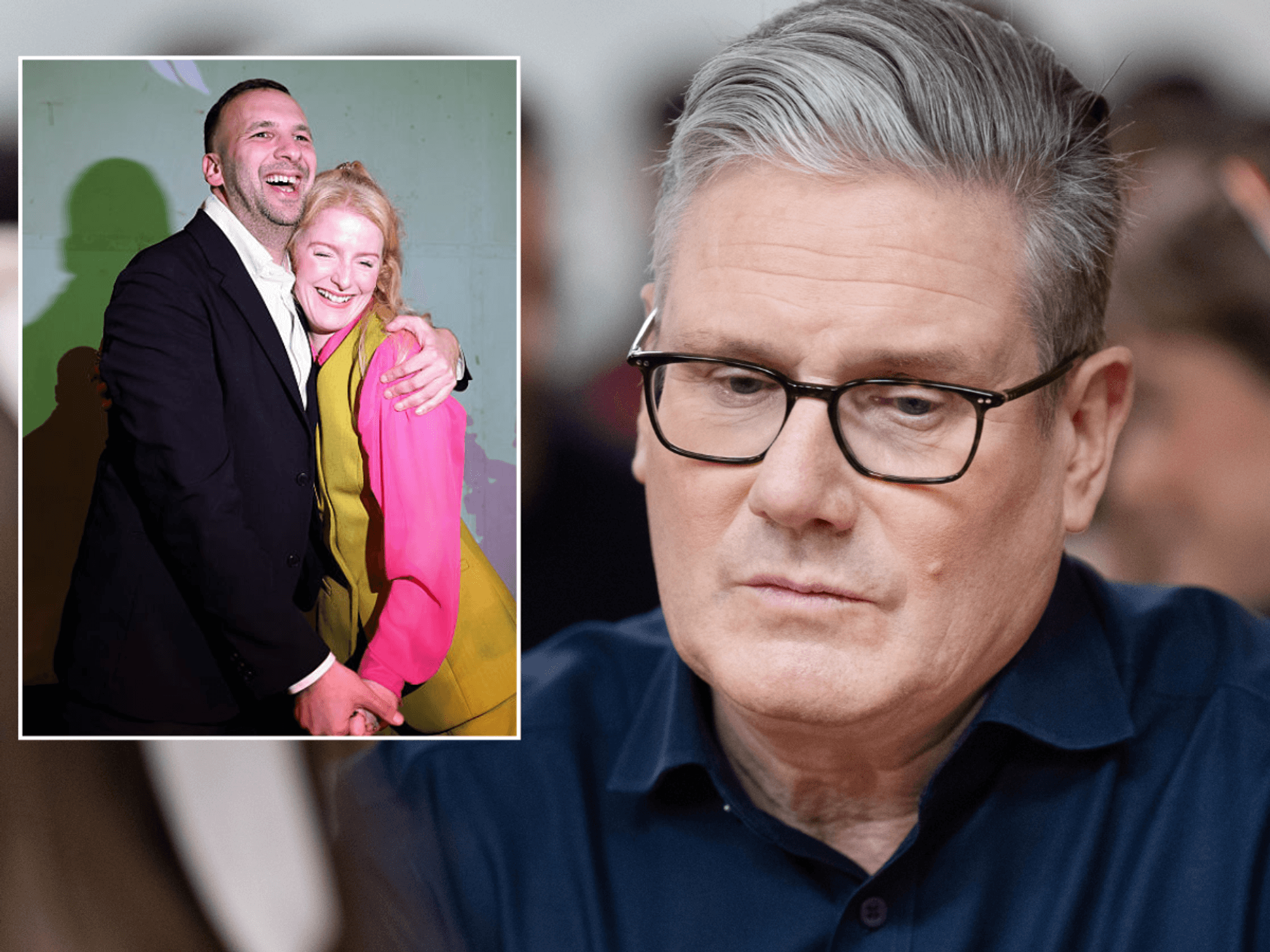

Scotland’s Finance Secretary Shona Robison announced the proposal at Holyrood on Tuesday as part of a wider package of measures, which also includes an increase to the Scottish Child Payment and a new departure levy on private jet travel.

Financial experts have described the move as Scotland's version of a 'mansion tax', similar to proposals announced by Chancellor Rachel Reeves in November's Budget.

However, rather than introducing a new standalone tax, the Scottish approach would work through the existing council tax system.

Properties will be assessed using current market valuations rather than the outdated figures that underpin the existing council tax system.

Budget documents reveal that £5million has been earmarked for the coming financial year to conduct targeted revaluations of homes exceeding the £1million threshold.

According to Charlene Young, senior pensions and savings expert at AJ Bell: "Estimated to affect fewer than one per cent of Scottish households, two new council tax bands will be introduced for properties worth more than £1million from 1 April 2028 using up to date values."

She added: "Although this might appear tougher than the England and Wales mansion tax, it is unlikely to raise much in the way of extra revenue for Scottish councils and is more about the message and optics of moving to what the SNP views as a fairer system."

The Scottish Government has framed the policy as a matter of social equity.

The Scottish Government has framed the policy as a matter of social equity

|PA

Ms Robison told MSPs: "To deliver even more for those with the least, we'll ask those with the most, the very wealthiest in our land, to contribute that little bit more."

She continued: "That measure will bring greater fairness as well as increased revenues to councils."

Official budget documents admit that some multimillion-pound homes currently pay council tax that is not much higher than much cheaper properties.

LATEST DEVELOPMENTS:

- Rachel Reeves set to push record two million workers into £100,000 tax trap

- Labour oversees biggest hiring slump since the pandemic

- HMRC alert: 16 million Britons in firing line of tax crackdown on certain types of work

The new council tax bands are intended to fix this imbalance and make the system fairer.

Cosla, which represents Scottish local authorities, responded cautiously to the announcement.

The new council tax bands are intended to fix this imbalance and make the system fairer

|PA

A spokeswoman stated: "On the announcement of new council tax bands, it is vital that councils - as the rate setters and collectors of council tax - are involved in shaping any policy relating to council tax."

Financial planners have raised concerns about the potential consequences for Scotland's property market.

Stephen Cotter, financial planning area lead at Rathbones, warned: "We still need clarity on how such properties will be valued for council tax purposes, but the announcement alone could distort activity at the top end of the market as buyers and sellers adjust ahead of the changes."

Taxpayers are struggling with the unsustainable burden of council tax | PA

Taxpayers are struggling with the unsustainable burden of council tax | PAHe cautioned: "Economically, the measure risks creating price cliffs at the threshold, discouraging transactions and renovations.

"That could slow housing market activity and potentially reduce overall tax revenues ultimately working against the government's wider objectives."

Timothy Douglas, head of policy and campaigns at Propertymark, criticised the budget for failing to address Scotland's housing emergency, arguing that "additional levels of council tax brings yet more disparity in pricing and costs across the property sector."

More From GB News