Labour oversees biggest hiring slump since the pandemic as tax and regulation stalls growth

Experts warn tax rises and wage costs are holding back jobs growth

Don't Miss

Most Read

The UK is experiencing the lowest level of recruitment intention since the pandemic period of 2020, fresh employment figures show.

Just 23 per cent of UK businesses plan to increase their workforce in the next three months, according to new data from the British Chambers of Commerce (BCC).

It also represents a decline from the 25 per cent of firms that expected to grow staffing levels at the same point last year.

The proportion of businesses planning to hire has not been this low since lockdown restrictions forced widespread closures across the retail and hospitality sectors.

TRENDING

Stories

Videos

Your Say

The BCC said the figures show employers are becoming increasingly cautious about taking on new staff.

Rising costs are cited as a key factor behind the reluctance to expand payrolls.

The organisation’s quarterly business survey points to recent tax increases as a major contributor to the slowdown in recruitment.

Business leaders have linked the trend directly to measures introduced by Chancellor Rachel Reeves.

Jane Gratton, deputy director of public policy at the BCC, said employers are facing what she described as unsustainable cost pressures.

She said: "As more firms struggle under the weight of rising cost pressures, we are beginning to see an adverse impact on the jobs market.

"Fewer businesses are taking on new staff while others are having to let staff go.

Labour oversee the lowest level of recruitment intention since the pandemic period of 2020

|GETTY

"High taxes and rising wage bills present huge barriers to investment and growth."

The survey shows that 14 per cent of businesses are actively cutting staff numbers, matching the highest proportion recorded since 2020.

Around two thirds of firms reported that they expect to keep staffing levels unchanged over the next quarter.

The BCC said this reflects widespread caution across the private sector, with employers dealing with the impact of higher employer National Insurance contributions (NIC).

The increase has come alongside successive rises in the minimum wage, which has led to business groups warning that the combined effect puts pressure on margins, particularly for labour-intensive sectors.

The data suggests the slowdown in hiring is occurring against a weakening backdrop in the wider labour market.

LATEST DEVELOPMENTS

Investment in the workforce is also scaling back, which includes developing skills

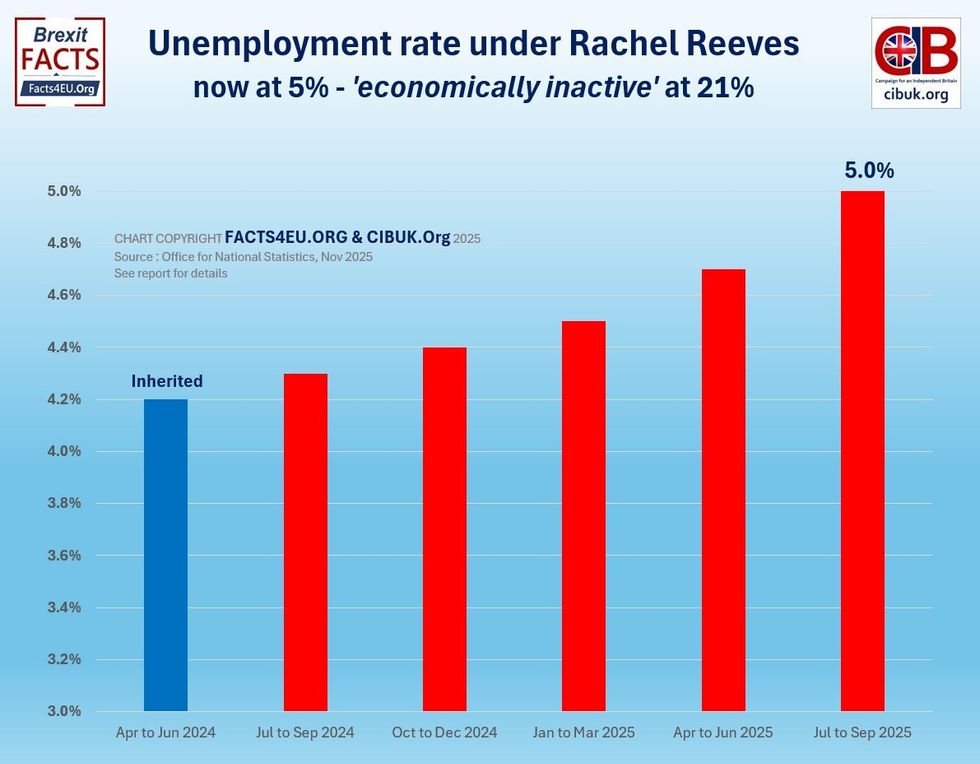

| Getty ImagesOffice for National Statistics (ONS) figures show the unemployment rate has risen to 5.1 per cent - the highest level in four years.

Economists at Société Générale have warned that unemployment could rise further, with the bank forecasting that the rate could reach 5.6 per cent by the end of the year.

Payroll data indicates that overall employment has fallen since Labour entered Government, who have overseen a total of 187,000 jobs lost during their tenure.

The retail and hospitality sectors have experienced the largest reductions in employment.

The BCC survey also highlights concerns beyond headline job numbers, with over 20 per cent of firms said they are reducing investment in their workforce.

This includes cuts to training and skills development budgets.

The chart above demonstrates the unemployment rate under Rachel Reeves is now at 5.0 per cent

| Brexit Facts4EU and CIBUKBusinesses told the BCC they are trimming spending on staff development to offset higher costs elsewhere.

The organisation said reduced training investment could have longer-term implications for productivity.

A Government spokesperson said: "We are delivering stability, cutting borrowing and debt and getting inflation down.

"That's helped deliver six interest rate cuts since the election, the fastest pace of cuts in 17 years."

The Treasury said lower interest rates are benefiting firms with loans and supporting confidence to invest.

More From GB News