Labour's war on business: High street warned over rising insurance costs

Small businesses urged to act early as premiums face fresh upward pressure

Don't Miss

Most Read

Small and medium-sized enterprises (SMEs) across the UK are being warned to prepare for higher commercial insurance costs this year as repair expenses rise, inflation remains elevated, and claims continue to increase.

Over half of SMEs saw their business insurance costs increase over the past 12 months, new figures from the 2025 Premium Credit Insurance Index show.

One in 10 businesses said those increases were particularly significant.

Insurance broker SJL said further pressure on premiums could follow measures announced in the Autumn Budget.

TRENDING

Stories

Videos

Your Say

The broker said smaller firms should take steps to manage their insurance risk before renewal dates to avoid unexpected cost increases.

Cash-flow pressures among SMEs are already evident, according to the data.

More than half of small businesses, 54 per cent, are now using credit facilities to pay their insurance premiums.

Those borrowing to cover insurance costs took out loans averaging £1,180, an increase of nearly 10 per cent compared with the previous year.

The figures come as many businesses face higher operating costs following recent policy changes.

Measures announced by the chancellor in the Autumn Budget have added to concerns among SMEs about squeezed margins.

SJL said insurance costs are an area where businesses may be caught off guard when policies are renewed.

UK SMEs are being warned to expect higher commercial insurance costs this year as repair bills, inflation and claims continue to rise

|GETTY

The broker warned that rising material costs, labour expenses and claims inflation are continuing to push premiums higher across several sectors.

Craig Morgan, commercial account executive at SJL, said: "Premiums have been rising steadily across several key business sectors."

"With material costs, labour costs and claims inflation all still elevated, many SMEs will see increases at renewal unless they proactively manage their risk."

SJL said businesses that wait until renewal notices arrive may face limited options to reduce costs.

The broker said engaging with insurers earlier can provide greater flexibility and more opportunities to negotiate.

It outlined five measures SMEs can take to help keep insurance costs under control.

1. Review policies annually instead of auto-renewing

Many small businesses are paying more than necessary because their policies simply roll over each year. Reviewing assets, staffing and operational risks annually allows businesses to remove unnecessary add-ons and adjust limits to current needs.

LATEST DEVELOPMENTS

With material costs, labour costs and inflation elevated, SMEs continue to feel the squeeze

| PA2. Strengthen security to reduce theft and damage claims

Improving physical security such as CCTV, upgraded locks, alarms, lighting, or tracking for tools and vehicles can directly reduce premiums because insurers assess risk based on the likelihood of theft or damage. Sectors facing a rise in tool theft are urged to prioritise this.

3. Increase voluntary excess (only if financially safe)

Raising the excess can lower premiums, but only as long as you can comfortably cover that excess should a claim arise.

“It’s a cost-saving strategy, not a shortcut, so only increase it if cash flow allows,” Mr Craig says.

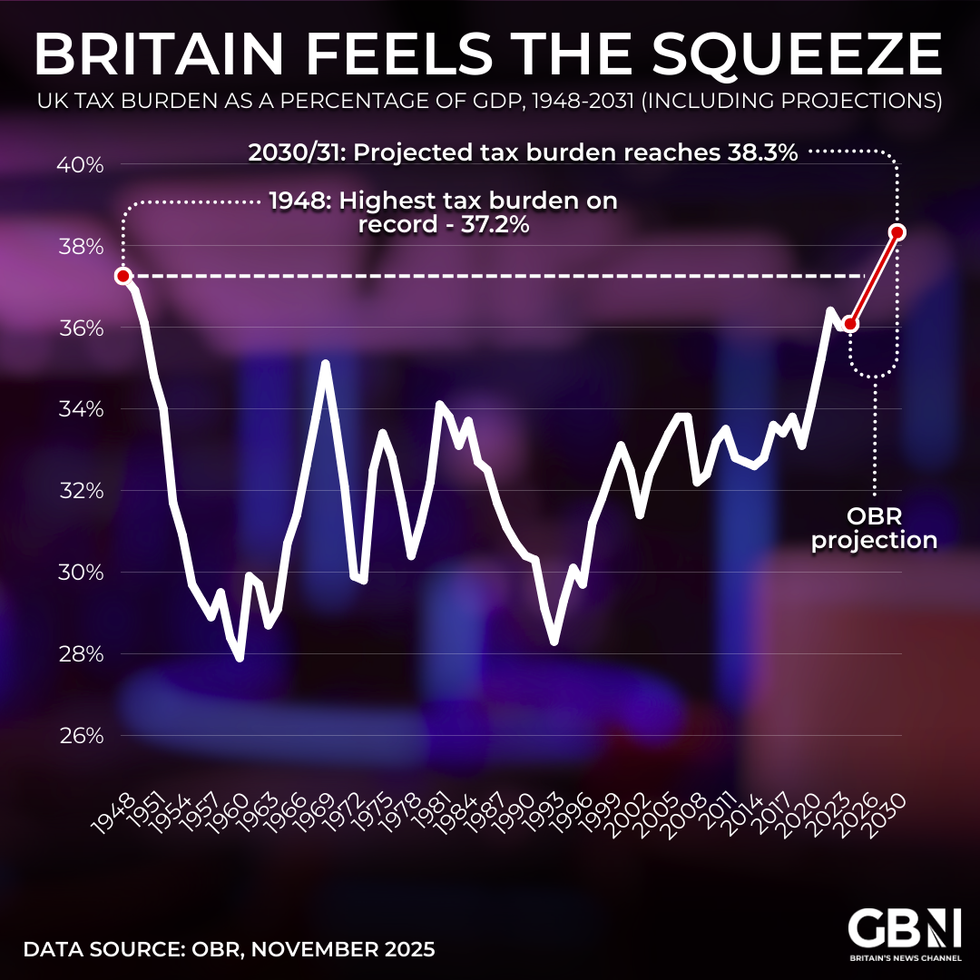

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR4. Invest in staff training and safety compliance

Claims frequency is a major driver of premium increases. Better training whether in health and safety, cyber awareness, manual handling or safe driving reduces incidents and helps keep future premiums down.

5. Use a broker to compare insurers and negotiate

With premiums fluctuating across different sectors, it’s vital for SMEs to shop around. Brokers can access a wide range of insurers, negotiate on behalf of clients and identify sector-specific cover that may be more competitively priced.

Mr Craig concluded saying: “The Autumn Budget has provided some clarity for the year ahead, but it has not eased the wider cost pressures many SMEs continue to face. Reviewing insurance early can help avoid bill shock when renewal dates come around.”

More From GB News