British investors beat Wall Street amid Ftse surge as savers told how to 'build wealth long-term'

Britons are being encouraged to invest in 2026

Don't Miss

Most Read

Latest

British investors have been able to successfully beat Wall Street by betting big on US tech stocks in 2025, including NVIDIA and Alphabet, according to a leading investing platform.

UK retail investors using the Lightyear platform enjoyed a stellar 2025, with average portfolios gaining 17.5 per cent over the year. Analysts are breaking down how Britons can focus on "long-term wealth-building" in the New Year.

This performance surpassed both the S&P 500, which rose 16.39 per cent, and European Union investors on the same platform, who saw returns of 17.08 per cent.

According to Lightyear's analysis, this outperformance came from substantial investments in American technology companies with NVIDIA, Tesla, Amazon and Alphabet ranked among the most purchased shares by UK users throughout the year.

Despite their appetite for US tech, British investors retained affection for domestic firms. Rolls-Royce, Legal & General and Lloyds emerged as the most favoured London-listed individual stocks.

Britons are being encouraged to 'build wealth' through investing

|GETTY

When it came to spreading risk, British investors showed a clear preference over the last 12 years for exchange-traded funds (ETFs) over individual company shares.

Among sterling-denominated instruments, Rolls-Royce stood alone as the only single stock to feature in the top ten holdings. Across all portfolios, individual shares represented roughly one third of total investments.

The semiconductor and software & cloud services industries proved most lucrative for British investors, with the mobility sector following closely behind as artificial intelligence and future transport trends accelerated.

Financial stocks fell out of favour during the latter half of the year, with this sector experiencing the heaviest selling. Investors appeared to perceive greater opportunities elsewhere, particularly across the Atlantic.

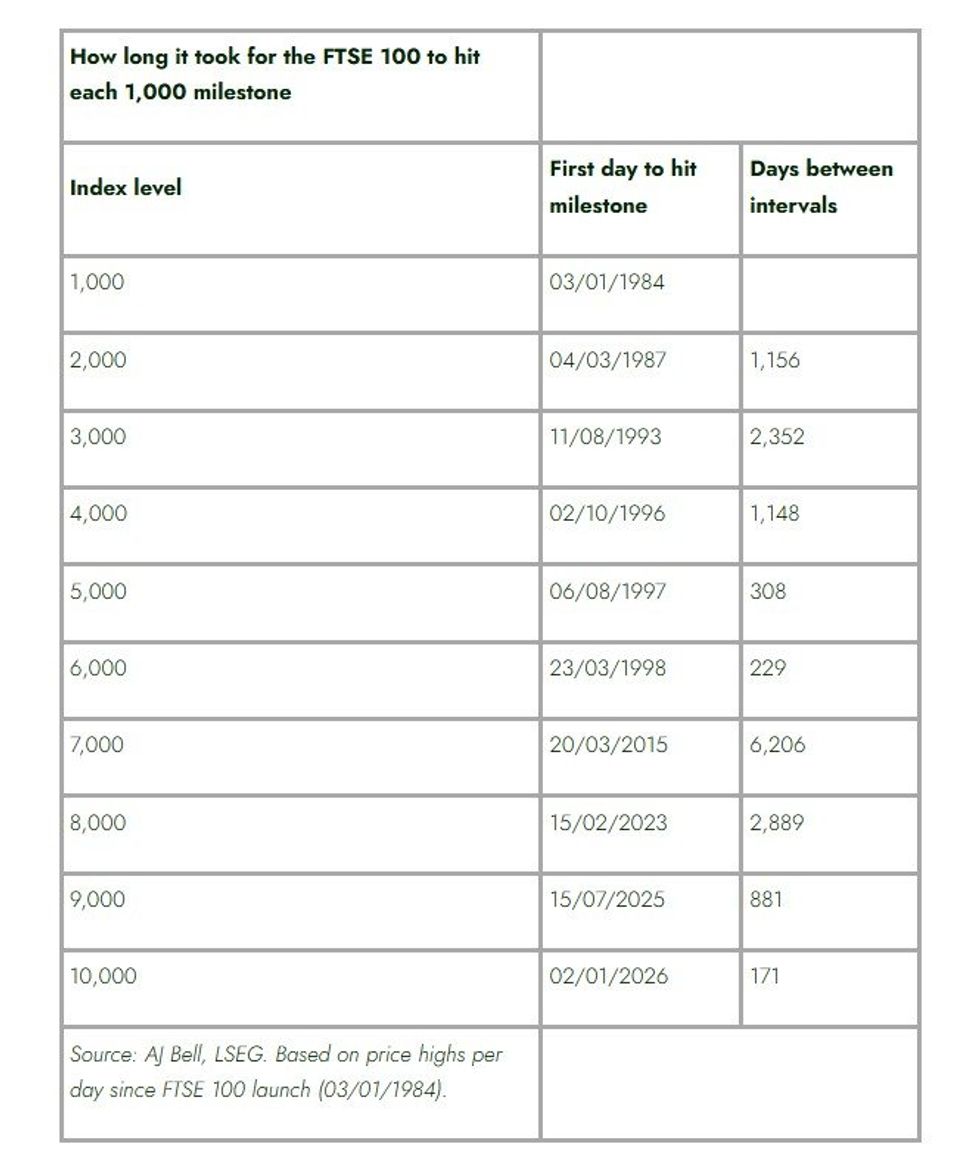

How long has it taken for the Ftse to reach every 1,000 mark? | AJ BELL

How long has it taken for the Ftse to reach every 1,000 mark? | AJ BELLPolitical turbulence and significant market swings in America during 2025 prompted British investors to look closer to home.

During periods of heightened uncertainty in March and April, particularly around President Trump's 'Liberation Day', investment flows into UK and EU stocks reached approximately 30 per cent of net inflows which is the highest proportion recorded in the past two years.

October witnessed the greatest trading volumes of the year among UK investors. This surge was likely driven by media coverage questioning whether an 'AI bubble' was forming and speculation surrounding technology company earnings.

Lightyear users checked their portfolios an average of 240 times during 2025, reflecting heightened engagement amid global events.

Wander Rutgers, Lightyear's UK chief executive, said: "This is a generation of investors who are globally aware and increasingly focused on long-term wealth-building, even when markets are uncertain.

"As people set financial targets for 2026, it's more proof that investing is one of the best ways to grow your money steadily and meet your long-term goals."

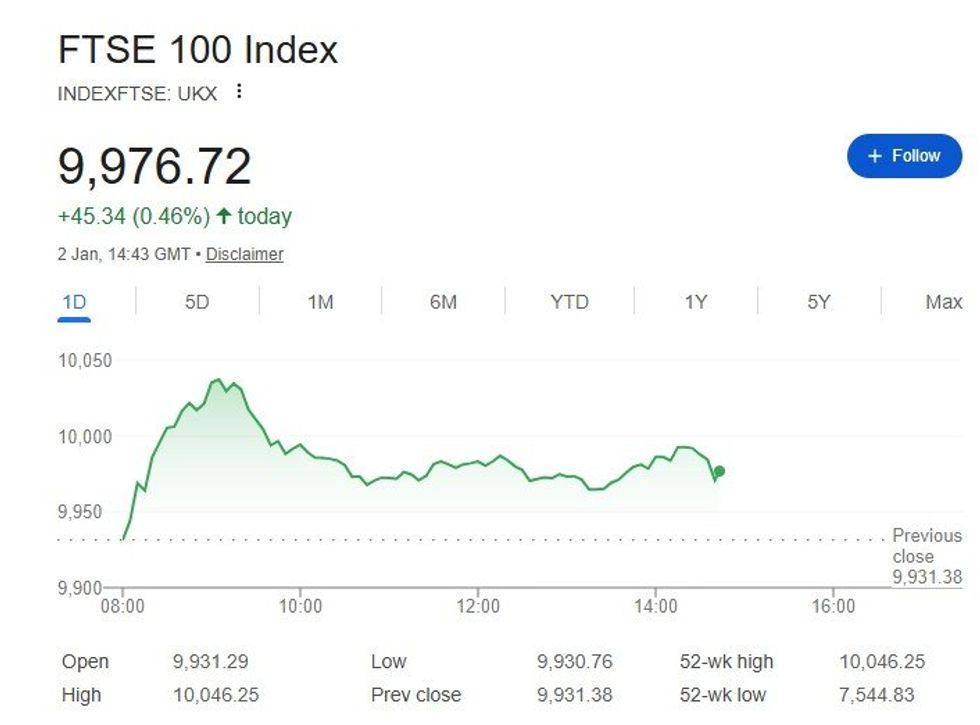

Earlier today, the Ftse 100 jumped above 10,000 points as miners and defence firms rallied towards the end of 2025 in a welcome boost for the UK economy.

Jemma Slingo, a pensions and investment specialist at Fidelity International, said: "The Ftse 100 breaking through 10,000 on the first trading day of 2026 is a historic moment for UK markets and a powerful signal of how far sentiment has shifted over the past year.

The Ftse jumped above 10,000 points before dipping slightly

|"After years in the shadows, London’s so-called ‘dinosaur’ index has roared back to life, driven by strength in banking, mining and defence stocks.

"Higher interest rates have boosted banks after years of underperformance, and defence companies have benefited from rising global military spending.

"Meanwhile, miners have benefited from the soaring price of precious metals. Gold rocketed in 2025 - as did silver - pushing miners such as Fresnillo and Endeavour Mining to fresh highs.

"Silver is seldom on the radar of small investors but a more than 130 per cent price rise in 2025, most of it in the second half of the year, has grabbed their attention.

“Despite the milestone, valuations remain attractive - the Ftse100 still trades at a discount to the US and Europe, even as sentiment towards UK companies improves. With around a quarter of FTSE 100 revenues coming from the US, investors are gaining exposure to global growth at a discount - and with a healthy dividend yield to match."

More From GB News