Interest rates to FALL this week as Bank of England preps base rate cut to three-year low

Borrowers are hoping for much-needed relief as the Bank of England's policymakers prepare to discuss the base rate

Don't Miss

Most Read

Latest

The Bank of England is expected to be preparing an interest rate cut later this week when the financial institution's Monetary Policy Committee (MPC) meets on December 18.

Borrowers across Britain could receive welcome pre-Christmas relief this Thursday when the Bank of England is anticipated to lower interest rates by a quarter point to 3.75 per cent.

The reduction from the current four per cent level would mark the cheapest borrowing costs since early February 2023, nearly three years ago.

Economists are predicting the Monetary Policy Committee will deliver what Laith Khalaf, head of investment analysis at AJ Bell, described as "festive news for borrowers of all stripes".

Interest rates are expected to fall this week

|GETTY

The decision represents the final rate announcement of 2025, arriving as recent economic indicators point towards easing price pressures in the UK economy.

October's consumer prices index (CPI) rate dropped to 3.6 per cent, a four-month low, as energy costs increased at a slower pace compared with the previous year.

This cooling inflation data, combined with broader signs of economic slowdown, is expected to persuade rate-setters to proceed with the reduction.

Mr Khalaf noted that the central bank remains committed to achieving its two per cent inflation target, adding: "The Bank of England will be focused on hitting the two per cent inflation target here in the UK, and for the time being that means loosening policy."

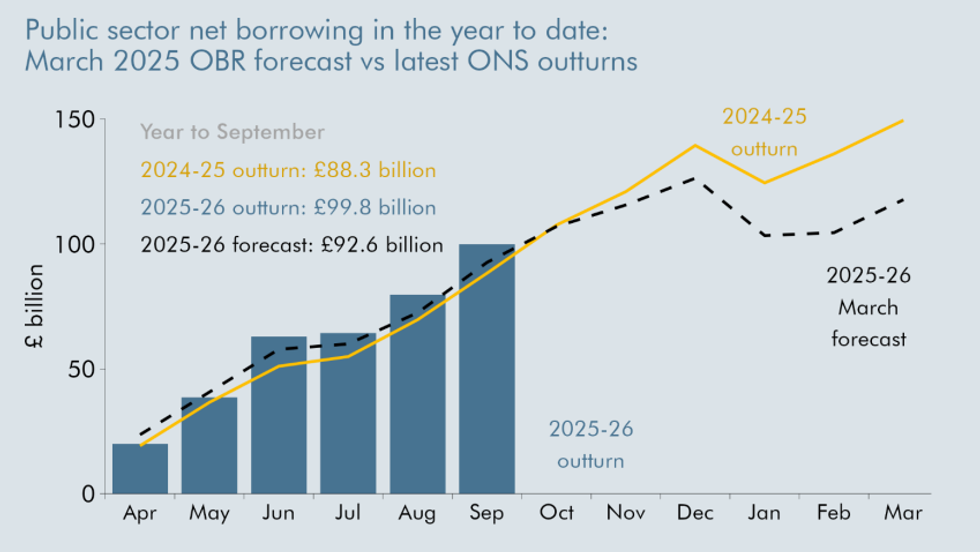

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBR

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBRThe easing of price pressures has strengthened the case for monetary loosening ahead of the year's final policy meeting.

Despite expectations of a cut, the MPC remains sharply split on the appropriate course of action.

Andrew Goodwin, the chief UK economist for Oxford Economics, cautioned that the outcome is "a closer call than markets think it is".

He explained: "The committee is deeply divided and four out of nine officials are unlikely to vote for the cut.

"According to Goodwin, the final decision will "hinge solely" on Governor Andrew Bailey, who has signalled his belief that the inflation outlook is improving.

Mr Bailey's vote will therefore prove decisive in determining whether borrowers receive their hoped-for Christmas present from Threadneedle Street.

The autumn Budget unveiled by Chancellor Rachel Reeves appears unlikely to significantly influence Thursday's deliberations.

Philip Shaw, an economist at Investec, observed that the tax measures announced "do not begin to bite until 2028-29 and therefore are of relatively little significance in the current interest rate debate".

The Bank of England base rate has fallen | CHAT GPT

The Bank of England base rate has fallen | CHAT GPT However, he acknowledged that the frozen income tax thresholds continue to weigh on economic activity.

Looking ahead, Khalaf tempered expectations for aggressive monetary easing, warning: "But we shouldn't expect a cascade of rate cuts next year."

He suggested that while previous loosening measures will continue supporting the economy, fresh stimulus "could be in short supply throughout 2026".

As well as this week's base rate announcement, the Office for National Statistics (ONS) will announce the CPI inflation rat for November 2025.

More From GB News