Bank of England likely to cut interest rates to lowest level in nearly THREE YEARS next week

Borrowers have been saddled with high interest costs thanks to the Bank of England's decision-making

Don't Miss

Most Read

Financial markets are pricing in a greater than 90 per cent probability that the Bank of England will reduce interest rates this month, according to Laith Khalaf, head of investment analysis at AJ Bell.

Such a move would bring the base rate down to its lowest point in nearly three years from its current level of four per cent to 3.75 per cent.

"The last time base rate began with a 'three' was on February 2, 2023, just before the Bank hiked rates to four per cent in the face of a brutal inflationary storm," Mr Khalaf said.

At the most recent Monetary Policy Committee (MPC) meeting, four members voted in favour of a reduction but were narrowly outvoted.

The Bank of England is forecast to slash the base rate once again

|GETTY / CHATGPT

A December reduction would provide welcome relief for borrowers across the board, from businesses and households to the Government itself. However, the longer-term picture offers less cause for celebration.

Markets currently anticipate just a single interest rate cut throughout 2026, representing a significant departure from the regular quarterly reductions witnessed this year.

"A look at the longer term picture may dampen festive spirits," Mr Khalaf noted, adding that this would mark "a step-change from the metronomic quarterly cuts we have seen in 2025".

While economic data could shift expectations in either direction, signs of the rate-cutting cycle drawing to a close are becoming increasingly apparent.

The Bank of England base rate has fallen

|CHAT GPT

The global picture reinforces this trend, with European rates expected to remain unchanged throughout next year.

Indeed, hawkish remarks from European Central Bank (ECB) board member Isabel Schnabel have sparked discussion about potential rate increases rather than cuts.

Markets in Japan, Canada and Australia are similarly forecasting that the next movement in borrowing costs will be upward.

"This signals the beginning of a shift in the tectonic plates of global monetary policy," Mr Khalaf observed.

The United States remains an outlier, with expectations that the Federal Reserve will continue easing rates gradually, though seven of nineteen Fed committee members believe rates should stay at current levels or rise by the end of 2026.

Yesterday, the Fed voted to cut the cost of borrowing in the US to a range of 3.5 per cent to 3.75 per cent.

The Bank of England remains committed to achieving its two per cent inflation target, which for now means continuing to loosen monetary policy.

Yet borrowers should not anticipate a wave of further reductions next year.

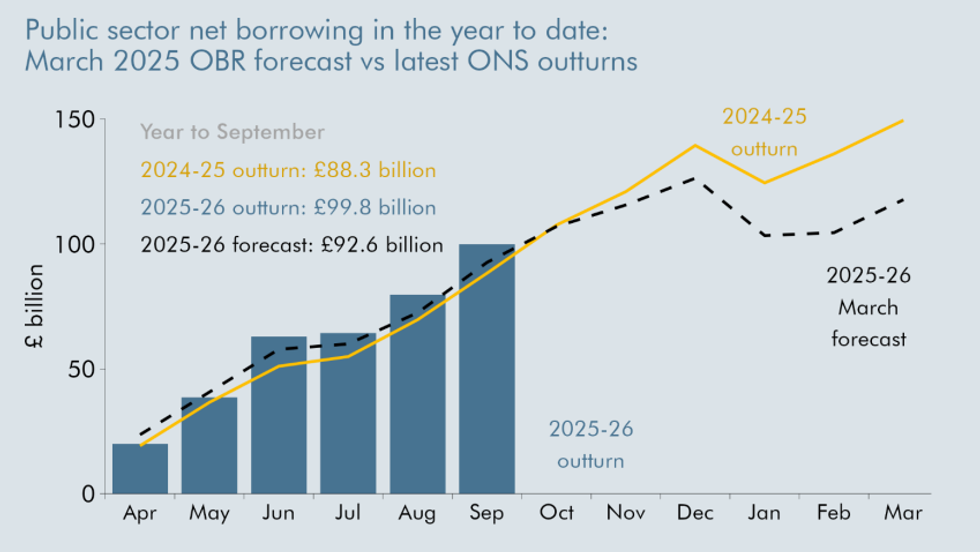

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBR

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBRYet borrowers should not anticipate a wave of further reductions next year.

"We shouldn't expect a cascade of rate cuts next year," Mr Khalaf said.

"Previous monetary easing will still be working through the system and greasing the wheels, but fresh stimulus could be in short supply throughout 2026."

The Bank of England's next MPC meeting is scheduled to next take place on December 18, 2025.