Interest rate cut from Bank of England 'off the table' despite inflation hitting 2% target

A Bank of England rate cut is "off the table", economists claim

|GETTY

Mortgage repayments have skyrocketed in response to the Bank of England's decision to raise interest rates

Don't Miss

Most Read

Britons are being warned an interest rate cut from the Bank of England tomorrow is "off the table" in a blow to homeowners and families trapped in debt.

Earlier today, the Office for National Statistics (ONS) published figures which revealed that the Consumer Price Index (CPI) rate of inflation for the 12 months to May 2024 eased to two per cent.

In response to the news, Prime Minister Rishi Sunak claimed the economy had "turned a corner" in a potential boon to the Conservative Party's General Election campaign.

With these latest statistics, the CPI has finally reached the Bank's desired target but households are being told to not expect immediate action from the financial institution.

Mortgage holders and debt borrowers have been forced to pay record high repayments in recent years due to the UK's hiked base rate being passed onto customers by banks and building societies.

This has added to the existing cost of living woes many families are facing but the central bank is unlikely to slash rates following tomorrow's Monetary Policy Committee (MPC) meeting, according to economists.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Interest rate hikes have pushed up mortgage repayments for many | GETTY

Interest rate hikes have pushed up mortgage repayments for many | GETTY Suren Thiru, an economics director at Institute of Chartered Accountants in England and Wales (ICAEW), said: “Despite this landmark fall in inflation, concerns over both underlying price pressures and changing policy in the run-up to a General Election means a June interest rate cut is almost certainly off the table.”

Despite this warning, professional bodies are urging the Bank of England to reduce rates sooner rather than later.

According to the Confederation of British Industry (CBI), the economy was now in the right place for the central bank to cautiously cut interest rates.

CBI principal economist Martin Sartorius explained: “Another fall in inflation in May will come as welcome news to households as we move towards a more benign inflationary environment.

“However, many will still be feeling the pinch due to the level of prices being far higher than in previous years, particularly for food and energy bills.

“Today’s data sets the stage for the Monetary Policy Committee to cut interest rates in August, in line with our latest forecast’s expectations.

“However, rate-setters will still need to weigh the fall in headline inflation against signs that domestic price pressures, such as elevated pay growth, are proving slower to come down.

“This means that they are likely to move cautiously beyond August to avoid putting further upward pressure on inflation, especially as the growth outlook improves at home and geopolitical tensions remain heightened.”

The last time the CPI rate was last recorded at two per cent in July 2021, before jumping significantly amid the rise in the cost of living.

In October, inflation reached a staggering height of 11.1 per cent.

LATEST DEVELOPMENTS:

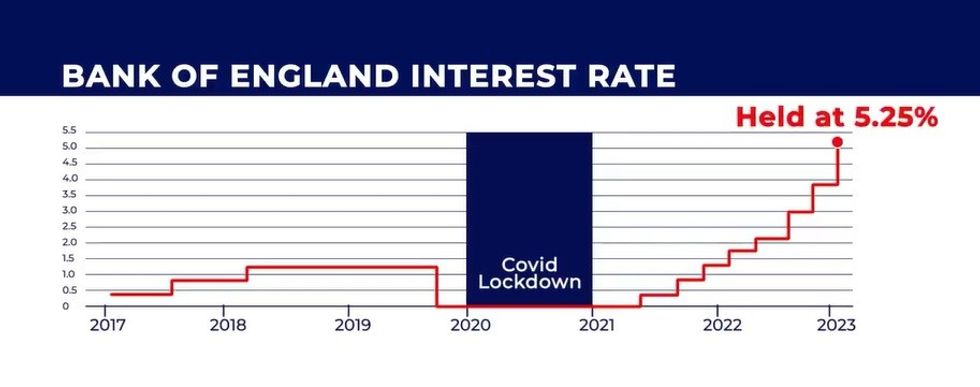

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWSIt should be noted that prices are still rising across the UK, but at a much slower rate than over the last nearly three years.

Chancellor Jeremy Hunt shared that hopes the Bank will now slash interest rates so mortgage costs can come down.

Speaking to broadcasters earlier today, he said: "A year-and-a-half ago, the Bank of England predicted the longest recession in 100 years.

“Instead, we have had a soft landing, with inflation that was higher than nearly any other major economy now lower than nearly all our major competitors. Now we have inflation down, taxes starting to come down and, hopefully soon, mortgages coming down as well.”