Inheritance tax: 7 year rule explained as grandparents 'gift £100k to grandkids' in hopes they keep 'as much money as possible'

Everyone has a £3,000 gift annual exemption, which can be carried forward one year if unused

Don't Miss

Most Read

A couple's plan to gift £100,000 to their young granddaughters has sparked questions about inheritance tax implications.

The grandparents, who wish to provide funds for future university fees or house deposits, are concerned about potential tax consequences if one of them dies within seven years of making the gift.

As the granddaughters are currently aged five and two, the couple aims to ensure that as much of the money as possible reaches the children.

The couple said: "My wife and I want to gift money to our two granddaughters to use for either university fees or a house deposit when they are older. They are currently five and two years old.

"If we give them each £50,000 from a joint bank account how would the tax on gifting work if one of us dies in the next seven years? Does the relevant tax apply on the first death or the second, given that the money has come from a joint account?

"How can we ensure that they get as much of this money as possible?"

Their query, sent to This is Money, has shed light on various strategies to minimise tax liability whilst maximising the benefits for their grandchildren.

Inheritance tax is charged at 40 per cent over the nil rate band of £325,000. So if their estate is worth more than the threshold it is understandable that they would like to protect their granddaughters from having to bear some of this by giving them gifts now.

Under the seven-year rule gifts above the annual allowance are considered potentially exempt transfers. If the donor survives for seven years after making the gift, it becomes fully exempt from inheritance tax. However, if the donor dies within this period, the gift may be subject to inheritance tax.

In this case, as the £100,000 gift comes from a joint account, it would be split equally between the couple for tax purposes. This means that if one grandparent dies within seven years, £50,000 would potentially be liable for inheritance tax from their estate.

However, when calculating inheritance tax, there is a specific order in which the nil rate band is applied.

Richard Allan, financial planning director at Schroders Personal Wealth explained that lifetime gifts made within the seven years before their death are the first component to use up the nil rate band.

He said: "You would have to be mindful of any other gifts given away before this gift to your granddaughters as this may impact any tax that may be payable."

Those approaching retirement are being urged to take advantage of tax-free allowances | GETTY

Those approaching retirement are being urged to take advantage of tax-free allowances | GETTYThe amount of inheritance tax to pay will depend on the value of the gift and the value of the person’s estate at the time of their death as well as the number of years that have passed if less than seven.

If the estate of the deceased is above the nil rate band, their share of the gift (£50,000) could be taxed, Allan stated. If they have made previous gifts and the total value of the gifts is over the £325,000, taper relief may apply.

The taper relief only applies if the total value of gifts made in the seven years before they die is over the £325,000 tax-free threshold. If someone dies between three and seven years after making a gift, the inheritance tax due is tapered down on a sliding scale.

For example, the tax burden falls from 40 to 32 percent if someone lives for three years after making a gift, and from 32 to 24 percent if they survive for four years.

If the person dies between five to six years after the gift, it will be taxed at 16 percent and between six to seven years it will be taxed at eight percent.

To mitigate the tax impact, the couple can utilise their annual gifting allowances. Allan said: "One of the allowances that you have is the annual gift allowance, which allows both of you to make a gift of £3,000 each year, without being impacted by the seven-year rule and possible 40 per cent tax charge.

"The gifts to your granddaughters could be part of the annual gift allowance of the previous year if no gifts were made in that tax year. As your intention is that the gifts will be used in the future for university fees or a house deposit, it is unlikely that they will need access to the money for well over 10 years."

This £3,000 annual exemption, can be carried forward one year if unused. This means they could potentially reduce the taxable gift by £12,000, bringing it down to £88,000. Additionally, they can make use of the £250 small gifts allowance for other individuals each year.

Shelley McCarthy, financial planner at Informed Choice, added that if the couple has excess income, they could make regular gifts out of income, which are immediately exempt from inheritance tax. But she noted "such gifts are usually paid on a regular basis so may take some time to build into a decent lump sum."

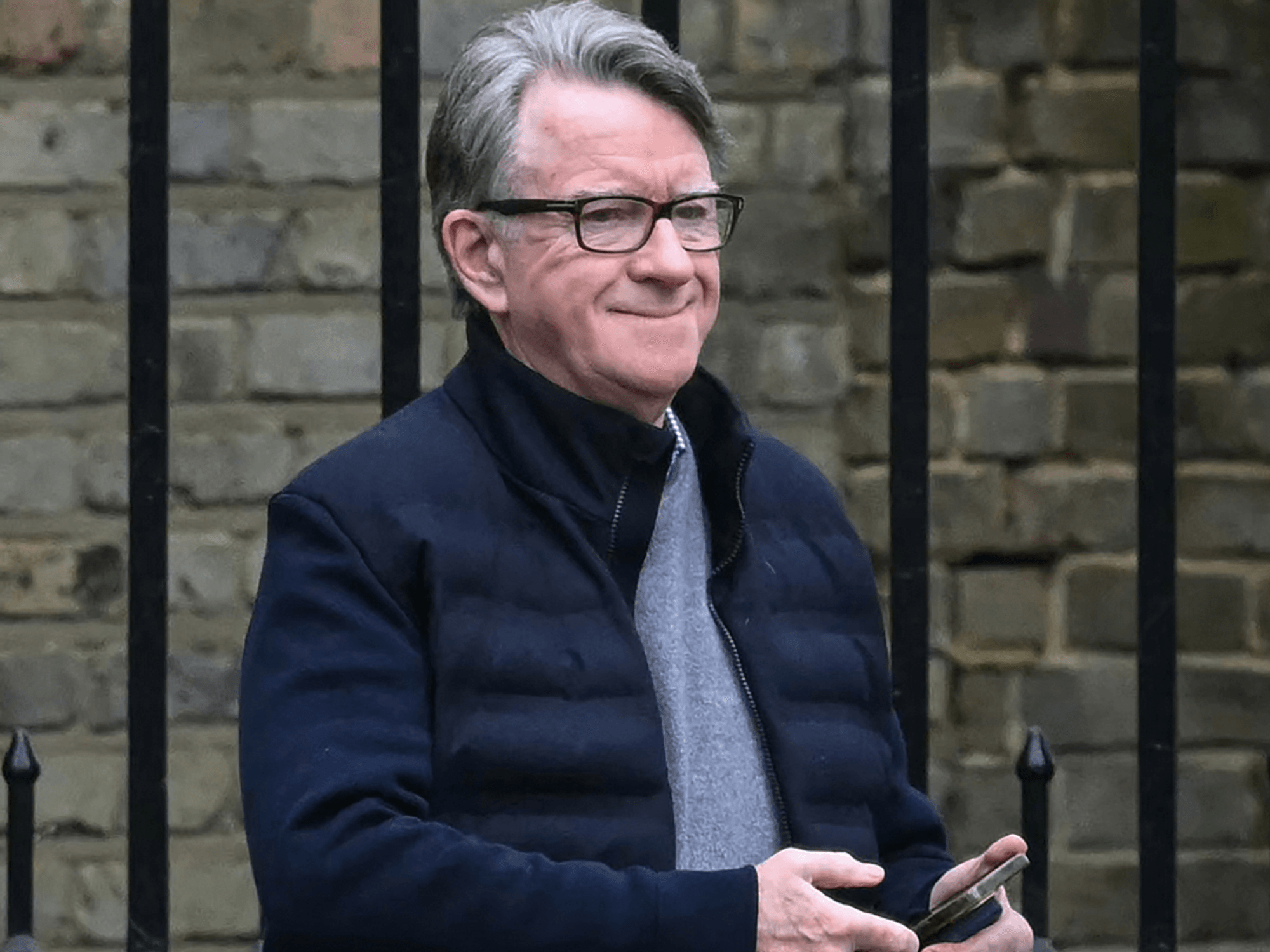

It is speculated that inheritance tax may be reformed at the Autumn Budget | PA Media

It is speculated that inheritance tax may be reformed at the Autumn Budget | PA MediaMcCarthy also suggested using a 'Bare' or Absolute Trust, which would keep the money inaccessible until the granddaughters turn 18. The grandparents can appoint themselves as trustees to maintain control over the funds. However these payments will constitute a gift (a potentially exempt transfer) that could be subject to inheritance tax if they die within seven years of making the gift.

Allan recommended they consider Junior ISAs, which have an annual limit of £9,000 tax free. He also proposed Premium Bonds as a safe option for uninvested cash.

Both experts emphasised the potential benefits of investing the money, given the long timeframe before the granddaughters will need it.

Allan said: "As this is the case it may be appropriate to take investment risk to reap potentially better rewards."

LATEST DEVELOPMENTS:

However, he cautioned that professional advice may be necessary, especially when considering more complex arrangements like trusts.

By utilising annual gifting allowances, exploring investment options, and potentially setting up trusts, they can maximise the value of their gift.

It's crucial to keep detailed records of all gifts and exemptions claimed, as McCarthy stated to assist executors in administering the estate.

The seven-year rule remains a key factor, with tax liability decreasing over time. While the strategies discussed can help reduce potential tax burdens, seeking professional financial advice is recommended for such significant gifts.