Inheritance tax raid hands Rachel Reeves's Treasury £3.1bn windfall as 'death is becoming costly'

Alan Miller fumes at the revelation that British taxpayers are forking out billions so migrants can receive freebies, such as gym memberships |

GB NEWS

Many Britons are making financial decisions based on looming changed to inheritance tax, which were announced by Rachel Reeves last year

Don't Miss

Most Read

Chancellor Rachel Reeves's Treasury received a £3.1billion windfall from inheritance tax collections during the initial four months of the 2025/26 financial year, Government data has revealed.

This marks a £200million increase from the corresponding period twelve months earlier. The latest HM Revenue and Customs (HMRC) statistics demonstrate an eight per cent year-on-year growth/

Over the April to July 2025 period, IHT generated £3.06billion for the Treasury compared to £2.83billion in 2024/25. This surge extends a pattern of consecutive annual records, following last year's unprecedented £8.2billion total.

Treasury projections indicate the current financial year will maintain this upward momentum, with the Office for Budget Responsibility (OBR) anticipating collections to reach £9.1billion by year-end.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Inheritance tax is generating money for Rachel Reeves's Treasury

|GETTY

Based on this forecast, inheritance tax receipts could exceed £14billion by the 2029/30 tax year, underlining the expanding scope of this controversial levy.

In last year's Autumn Budget, the Chancellor unveiled major reform to the levy with pension pots and farming assets to be considered liable for IHT by April 2027.

"Death is becoming an increasingly costly business," says Rebecca Williams, Divisional Lead of Financial Planning at Rathbones, noting that estates liable for IHT increased by 13 per cent during the 2022/23 tax year and are rapidly approaching the 2006/07 peak.

Analysis from Rathbones indicates that 3,524 estates will face IHT bills exceeding £500,000 by the conclusion of the 2025-26 tax year, assuming an average yearly growth of 8.74 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Treasury is under fire over looming changes to inheritance tax | PA

The Treasury is under fire over looming changes to inheritance tax | PAStephen Lowe, the director at retirement specialist Just Group, attributes the expanding tax net to "rising asset prices, frozen thresholds and constrained public finances," warning that the current year appears destined to become the fifth consecutive record-breaker.

The inclusion of pension assets in inheritance tax calculations from April 2027 represents a significant expansion of the levy's reach, according to financial planning experts.

"The decision to include pensions for inheritance tax purposes has garnered a lot of attention and has put the tax firmly on people's radar," notes Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

Ian Dyall, the head of estate planning Evelyn Partners highlights that while pension inclusion will not take effect until 2027, alongside business and agricultural property relief changes beginning next April, these modifications could prompt behavioural shifts among wealthier households.

MEMBERSHIP:

- They went to the police. Tried to shut my pub. But Epping won. The genie is out of the bottle - Adam Brooks

- Interactive map reveals how many illegal migrants have entered on Keir Starmer's watch - find out the number in YOUR area

- MAPPED: The councils that could now take legal action after Epping ruling torpedoes Labour's asylum plans

- REVEALED: The 32 seats that could parachute Nigel Farage into No10 as General Election petition hits 800k

- Reform UK faces eight pivotal tests TODAY as Nigel Farage gears up for battle following shock resignation

"For ordinary families, simply inheriting a grandparent's home - which they lived in all their lives and is now worth a tidy sum - can be enough to be on the hook for IHT bill," Ms Williams said.

Financial planning professionals emphasise the importance of early preparation whilst cautioning against precipitous action that could compromise personal financial security.

LATEST DEVELOPMENTS:

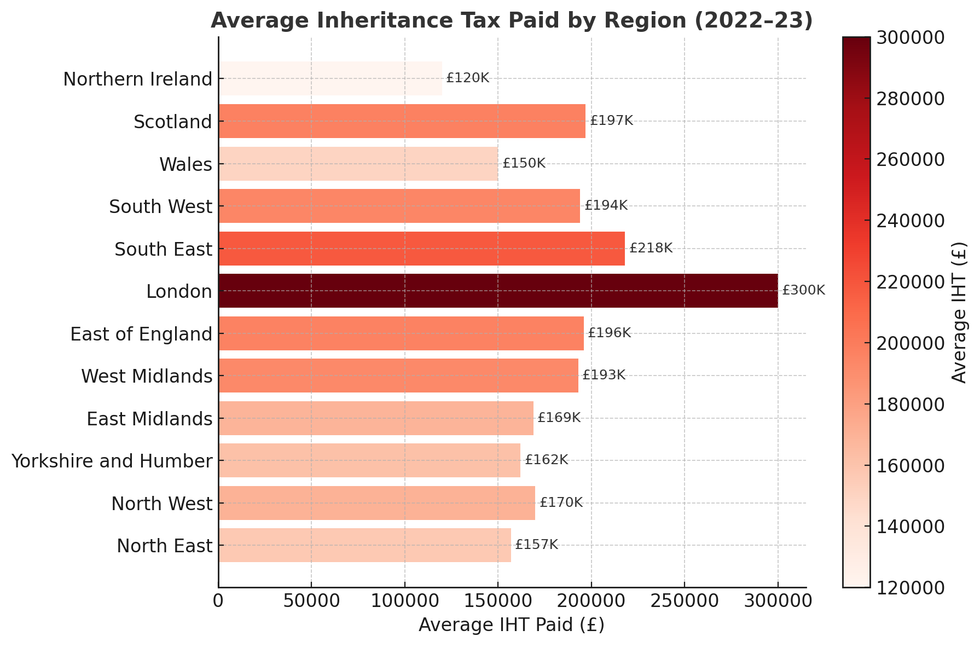

How much is London paying in inheritance tax compared to the rest of the country | GETTY

How much is London paying in inheritance tax compared to the rest of the country | GETTY "If you want to maximise the wealth you pass to the next generation early financial planning is key," Williams advises, recommending professional guidance to navigate potential tax liabilities without endangering one's own financial position.

Ms Morrissey identifies various mitigation strategies including the £3,000 annual gifting allowance and transfers from surplus income, though she warns:

"It is hugely important that someone does not gift away too much too early to loved ones and potentially leave themselves short in their haste to avoid this tax."

Furthermore, Mr Lowe underscores the complexity of estate planning, suggesting many families would benefit from professional financial advice to comprehend their circumstances and available options for reducing tax exposure.

More From GB News