Homeowners rush to withdraw £636m from properties as inheritance tax fears grow

Martin Daubney fumes at Labour's latest 'cruel' inheritance tax raid as Rachel Reeves looks to plug the UK deficit |

GB News

Over-55s unlocking property wealth to gift funds before April 2027 changes

Don't Miss

Most Read

Latest

Homeowners over 55 have extracted £636million from their properties as inheritance tax (IHT) concerns grow following Chancellor Rachel Reeves’s Budget announcement last year.

The surge in activity among older property owners represents a 10 per cent increase compared with the previous year.

Data from the Equity Release Council shows the trend strengthened in the second quarter of 2025.

New borrowers are driving the movement, withdrawing an average of £126,422 from their homes.

Homeowners over 55 have extracted £636million from their properties.

|GETTY

The rush to unlock wealth comes as families prepare for pension assets to fall under inheritance tax (iHT) rules from April 2027.

Financial advisers report growing enquiries from older homeowners seeking to transfer wealth to younger generations.

Strategic borrowing allows retirees to gift funds to children and grandchildren whilst potentially reducing future tax liabilities.

Lifetime mortgages let property owners aged 55 and above access tax-free funds secured against their homes.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The borrowed sum plus interest is repayable upon death or entry into long-term care, allowing borrowers to retain ownership and continue living in their properties.

An alternative, home reversion plans, involves selling part of the property to a company in return for cash or payments. In both cases, borrowers keep the right to live rent-free in their homes.

A Treasury spokesperson said: “We continue to incentivise pensions savings for their intended purpose of funding retirement instead of being openly used as a vehicle to transfer wealth – with more than 90 per cent of estates each year will continue to pay no inheritance tax after these and other changes.”

Advisers report growing interest as families respond to inheritance tax changes announced in the Budget, with the average withdrawal of £126,422 highlighting the scale of sums being accessed.

Hundreds of thousands will pay hiked death taxes.

|CHAT GPT

Andy Shaw, the director broker SPF Private Clients, has seen a rise in homeowners gifting funds after the Government’s changes.

Mr Shaw said: "We expect this to continue as we move nearer to April 2027, when pensions are due to fall into the inheritance tax calculation.

"He explained that gifts usually go to children or grandchildren as potentially exempt transfers.

"Most commonly, the funds released are gifted by the borrowers to their children or grandchildren, and will usually become a potentially exempt transfer, and thus fall outside of their estate after seven years," he added.

Gifts often support house deposits or education costs. Annual tax-free gifting is capped at £3,000, with larger transfers requiring a seven-year wait to qualify for exemption.

David Forsdyke, an expert from Knight Frank Finance, said wealthy homeowners with estates over £3million are showing particular interest.

Mr Forsdyke said: "The fact that pensions will now be taxed has meant more wealthy homeowners in their 70s are thinking of ways to transfer funds out of their estate."

Inheritance tax allowances currently let individuals transfer £325,000 tax-free. This rises to £500,000 if leaving a primary residence to direct descendants.

Married couples can therefore protect £1million from taxation. the Chancellor’s decision to include pensions within calculations will drag thousands more estates into scope.

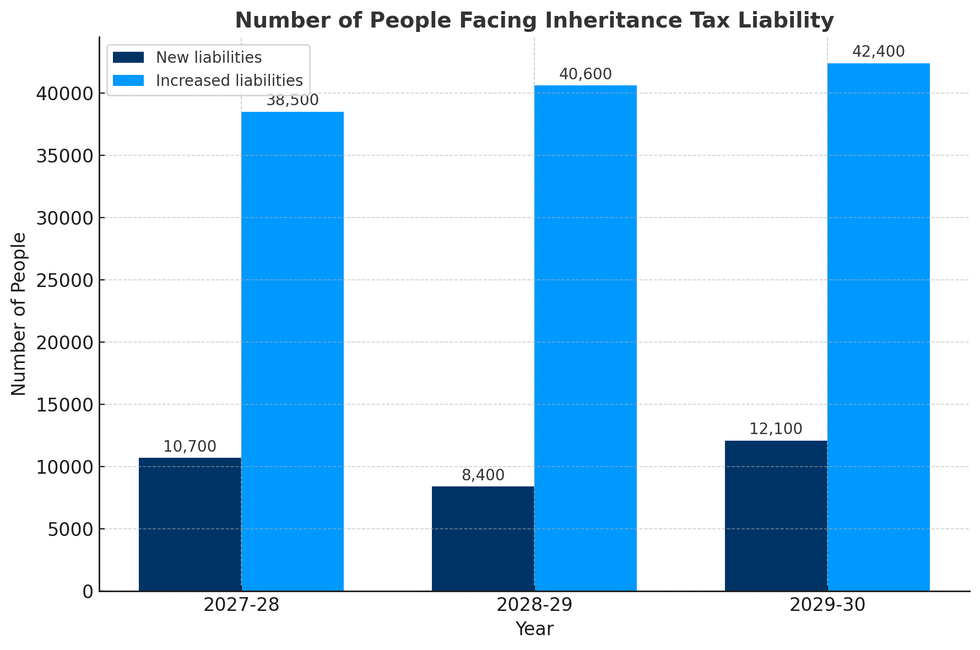

Official forecasts show 10,700 new inheritance tax liabilities in 2027-28, with 38,500 estates facing bigger bills. By 2029-30, that rises to 12,100 new liabilities and 42,400 higher bills.

Property wealth among homeowners over 60 is close to £3trillion, according to Savills.

That makes equity release attractive for asset-rich but cash-poor families.

LATEST DEVELOPMENTS:

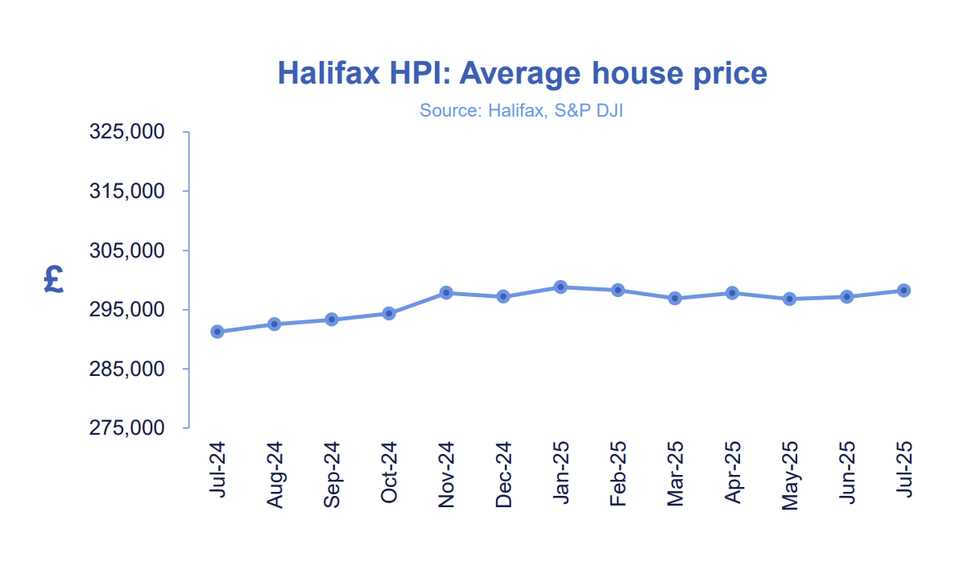

House prices have soared this year | Halifax

House prices have soared this year | HalifaxHowever, market-leading lifetime mortgage rates are around 6.5 per cent, with typical rates nearer 7.5 per cent.

These track gilt yields rather than Bank Rate, and interest compounds over time.

Mr Forsdyke warned: "It can become an expensive way of borrowing. The challenge for us is working out whether the inheritance tax saving is more than the cost of borrowing."

He said property debt may limit downsizing or care options later.

More From GB News