Inflation warning: Rachel Reeves 'losing the battle' as tax hikes to push rates above 5% 'well into next year'

80% of Brits Feel No Better Off Under Labour - Cost of Living Crisis Deepens |

GBNEWS

Food inflation has hit an 18-month high with experts warning further rises are on the way

Don't Miss

Most Read

Rachel Reeves has been warned she could be "losing the battle to inflation" as families face growing fears over rising prices.

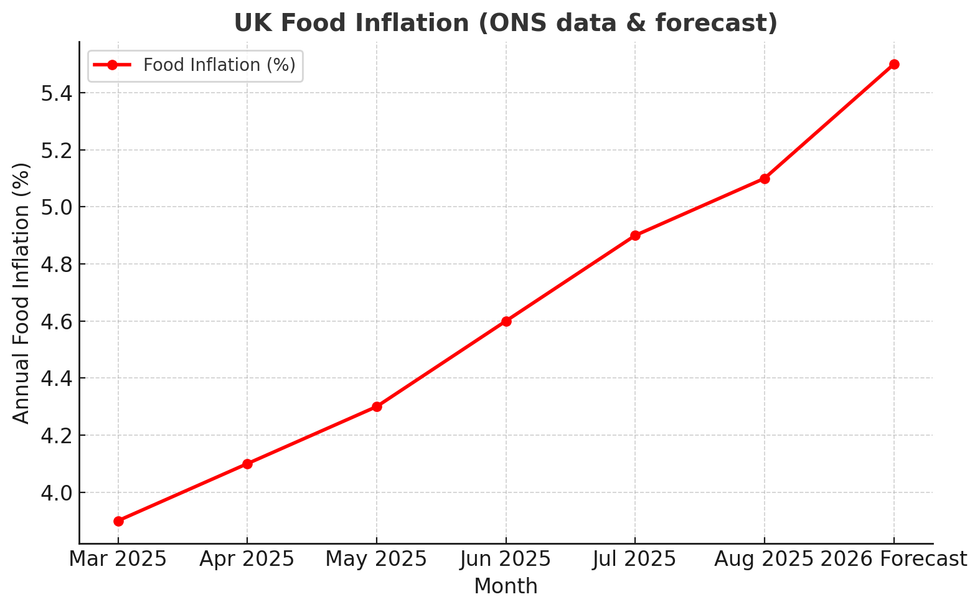

The British Retail Consortium has cautioned that food inflation may stay above five per cent well into 2026 if large retailers are hit with higher business rates in the upcoming Autumn Budget.

The trade body expressed concern that approximately 4,000 substantial retail premises, including supermarkets might experience higher tax bills should they fall within the government's proposed surtax for commercial properties valued above £500,000.

According to the BRC, this potential tax increase would compel retailers to pass additional costs onto consumers through higher prices.

The warning comes as food inflation has already reached 4.9 per cent, marking its steepest level since the cost-of-living crisis that gripped Britain in 2022-23.

Helen Dickinson, the BRC's chief executive, warned that "the Government risks losing the battle against inflation and working families are understandably worried."

She identified the inclusion of major retail outlets, particularly supermarkets, in the proposed surtax on substantial properties as "the biggest risk to food prices."

"This would effectively be robbing Peter to pay Paul, increasing costs on these businesses even further and forcing them to raise the prices paid by customers," Ms Dickinson stated.

LATEST DEVELOPMENTS:

British Retail Consortium has cautioned that food price inflation could persist above five per cent throughout 2026

|ONS/GBNEWS

The BRC suggests around 400 large supermarkets and department stores are at risk under a proposed surtax targeting properties with a rateable value above £500,000.

The stores are already struggling with "soaring employment costs, high taxes, and rising rates bills", pointing out that 1,000 similar outlets have disappeared from the high street in the last five years.

Official statistics reveal that overall inflation stands at 3.8 per cent, nearly twice the Bank of England's two per cent target.

The central bank recently decided against reducing interest rates, with concerns that escalating food costs were contributing to upward inflationary pressures.

The BRC attributes the steady climb in retail price inflation over the past twelve months partly to measures introduced in the previous budget.

The BRC suggests around 400 large supermarkets and department stores are at risk

| GETTYThese included substantial rises in employment expenses and the implementation of new packaging levies affecting retail enterprises.

A nationwide revaluation of business rates is scheduled for April in England, which will align payments with property market values from April 2024.

The BRC leader emphasised that exempting all retail premises from the surtax could be achieved without expense to taxpayers and would signal the Chancellor's dedication to reducing inflation.

Recent BRC research revealed that British consumers' primary worry centres on prices outpacing earnings, with 57 per cent of survey participants expressing this concern, increasing to 61 per cent amongst employed individuals.

Nearly half of households say they are cutting back on everyday spending, with 43 per cent blaming rising food costs for buying less

| GETTYFamilies are more worried about prices rising faster than their wages than about tax hikes or job losses.

Nearly half of households say they are cutting back on everyday spending, with 43 per cent blaming rising food costs for buying less.

Even higher earners, who usually drive consumer spending, are now pulling back, according to consultancy BCG.

A sign that the pressure of stubbornly high prices is starting to hit across all income groups.

More From GB News