Inflation warning: CPI to sit at 3.5% until the end of 2026, warns ex-Bank of England economist

'Inflation has remained unchanged.' |

GBNEWS

The UK inflation rate currently sits at 3.8 per cent

Don't Miss

Most Read

Latest

Inflation is set to stay higher for longer, meaning British households could be facing years of elevated living costs.

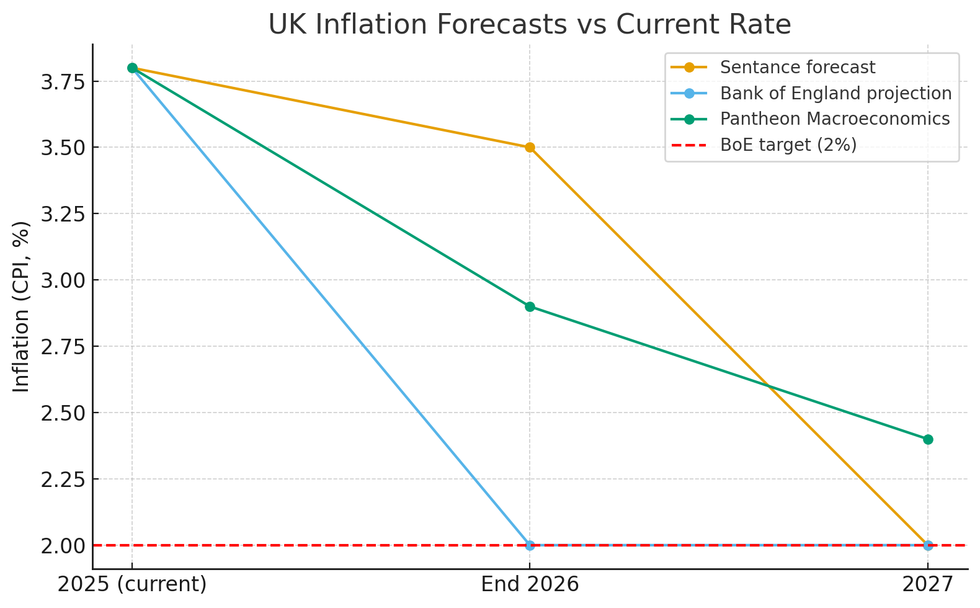

A leading economist expects prices to be rising at 3.5 per cent a year by the end of 2026, still well above the Bank of England’s two per cent target.

This would mean household budgets remain under pressure until 2027, when inflation is finally expected to ease back towards target levels.

The forecast comes from Andrew Sentance, a former member of the Bank of England’s interest rate-setting committee, who has warned that price pressures will take longer to fade than official estimates suggest.

The Bank itself predicts inflation will fall to two per cent by summer 2026, a full year earlier than Mr Sentance expects.

His forecast also exceeds predictions from other economic analysts.

Major forecasting firm Pantheon Macroeconomics anticipates inflation will decline to 2.9 per cent by late 2026 and 2.4 per cent twelve months later, both figures notably lower than Sentance's expectations.

The current inflation rate stands at 3.8 per cent, already nearly double the Bank's target.

Should Mr Sentance's projections prove accurate, British families would endure an additional two years of substantial price increases across essential goods and services.

Inflation is still well above the Bank of England's two per cent target

|GBNEWS

The implications extend beyond everyday shopping costs to the housing market, where mortgage rates could remain elevated for longer than currently anticipated.

Interest rate reductions typically follow when inflation shows a sustained trajectory towards the two per cent target.

With inflation potentially remaining well above this threshold, homeowners and prospective buyers may face persistently high borrowing costs.

This scenario would compound existing financial pressures on households already grappling with elevated prices, potentially delaying any meaningful improvement in living standards until the latter part of the decade.

Mr Sentance identifies three primary factors sustaining inflationary pressures. Food costs continue rising at 5.1 per cent annually, meaning products that cost £1 twelve months ago now average £1.05.

Wage increases represent another persistent pressure point.

The Bank itself predicts inflation will fall to two per cent by summer 2026

| GETTY

Household budgets could remain under pressure until 2027, when inflation is finally expected to ease back towards target levels

| GETTYHe said: "Average wage growth is still running at nearly five per cent and has continued to run at around this level despite unemployment starting to rise and vacancy rates dropping."

The retail and hospitality sectors show particularly concerning trends, with pay rising at 6.4 per cent annually. "These are sectors where labour costs have a direct impact on the prices paid by consumers," Mr Sentance noted.

Government fiscal policies constitute the third inflationary driver, with increased borrowing and taxation measures expected to filter through to consumer prices.

More From GB News