Inflation remains almost double target at 3.8% as Rachel Reeves 'failing to grow the economy'

'Inflation has remained unchanged' as CPI rate remains at 3.8 per cent

|GB NEWS

The CPI inflation rate continues to be significantly higher than the Bank of England's target

Don't Miss

Most Read

Inflation has remained at its current level ahead of tomorrow's interest rate announcement from the Bank of England.

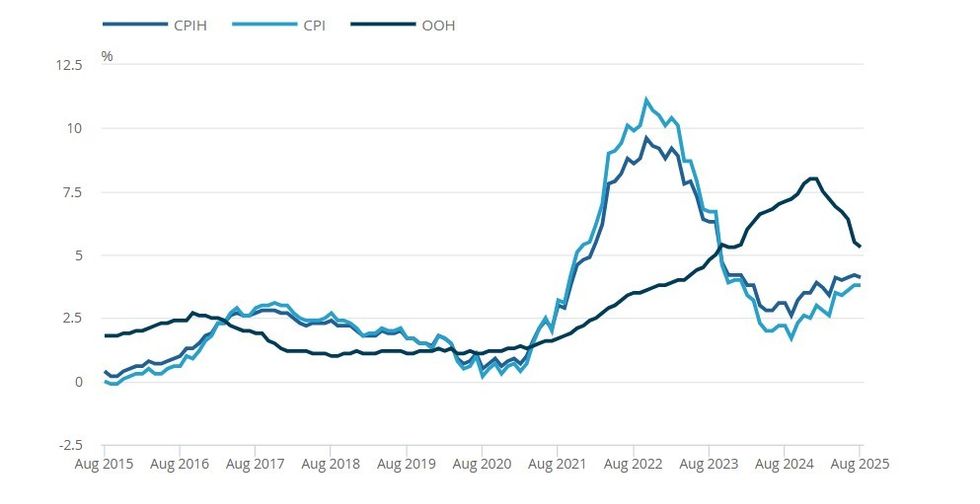

The consumer price index (CPI) rate of inflation rose to 3.8 per cent for the 12 months to August 2025, according to the Office for National Statistics (ONS).

This is lower than expectations, but signals further cuts to the base rate may not happen this year.

Over the period, the rate of food and drink inflation rose to 5.1 per cent in August, from 4.9 per cent in July, as shoppers continued to face higher prices for items at the till.

Inflation continues to rise

| ONS/GETTYThis marks the fifth month in a row that the rate for food services has increased.

ONS chief economist Grant Fitzner said: "The cost of airfares was the main downward driver this month with prices rising less than a year ago following the large increase in July linked to the timing of the summer holidays.

"This was offset by a rise in prices at the pump and the cost of hotel accommodation falling less than this time last year. Food price inflation climbed for the fifth consecutive month, with small increases seen across a range of vegetables, cheese and fish items."

Kevin Mountford, personal finance expert and co-founder of Raisin UK, said: "Last week inflation ticked up in the US, so all eyes are now on the UK figures. The Bank of England has said it expects inflation to peak at around four per cent in September, but with a two per cent target to hit there is still work to do.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

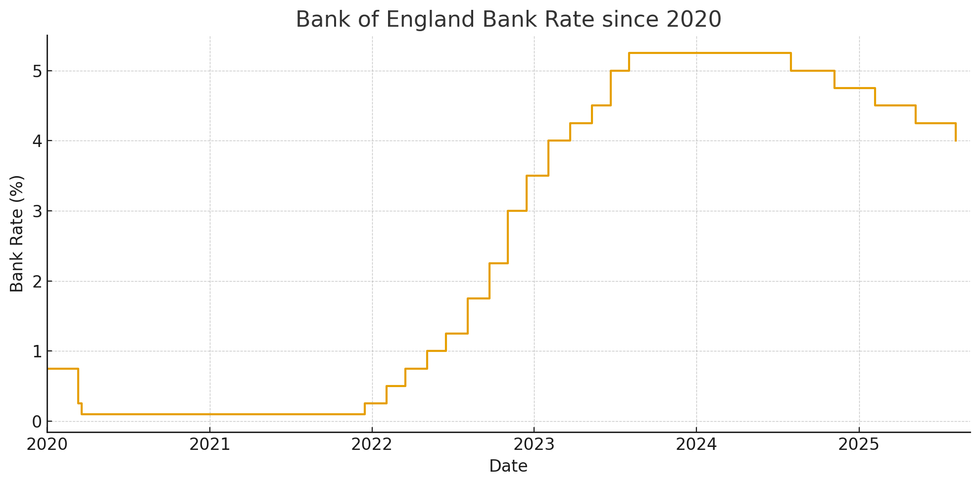

How has the base rate changed since 2020? | CHAT GPT

How has the base rate changed since 2020? | CHAT GPT "Markets are not expecting a rate cut this week, but if inflation cools over the coming months a reduction could come in November.

"For consumers this is a crucial moment. Higher inflation has meant competitive savings rates, but borrowers have been squeezed with mortgage and loan costs staying elevated.

"If inflation does ease and the Bank feels confident enough to trim rates, borrowing should get a little cheaper, but savings rates could start to drift lower."

Concerns had been raised over the Chancellor's decision-making over the past year, which some have claimed have contributed to rising costs on businesses.

Alastair Douglas, the CEO of TotallyMoney, added: "When it came into power, the government claimed to be pro-business, pro-worker, and with a plan to kickstart economic growth.

"But instead, we’ve seen a party who’s failing to boost the economy, backtracking on promises, and is finding itself wrapped up in a series of political scandals.

"With the Autumn Budget just around the corner, the party in power needs to show they have control, a real plan of action, and that things are starting to turn things around. Otherwise, voters will soon be looking elsewhere for answers."

LATEST DEVELOPMENTS:

The CPI rate has changed over the years

|ONS

Dean Butler, the managing director for Retail Direct at Standard Life, part of Phoenix Group, said: "August inflation data highlights the sustained nature of UK price pressure, with CPI remaining at 3.8 per cent. Food costs look to have been a driver along with restaurant and hotel costs.

"These figures come in the context of a finely balanced Bank of England MPC decision to cut interest rates in August. This only squeaked through after a second round of voting – and with inflation climbing higher, a further cut when they meet again this week looks very unlikely.

"For borrowers, this could mean costs stay elevated for longer, particularly for mortgage holders and those with other forms of debt. Savers, meanwhile, may still find some best-buy easy-access accounts offering inflation-beating rates, though real gains remain slim once rising prices are considered.

"For those able to accept some investment risk, options like a stocks and shares ISA or, looking longer-term, a pension could offer better prospects of growth above inflation."

Our Standards: The GB News Editorial Charter