HMRC confirms taxpayers 'will be refunded' after tax code error leaves Britons owing money

A tax code mistake left some residents of an estate in Scotland paying the wrong rate of tax

Don't Miss

Most Read

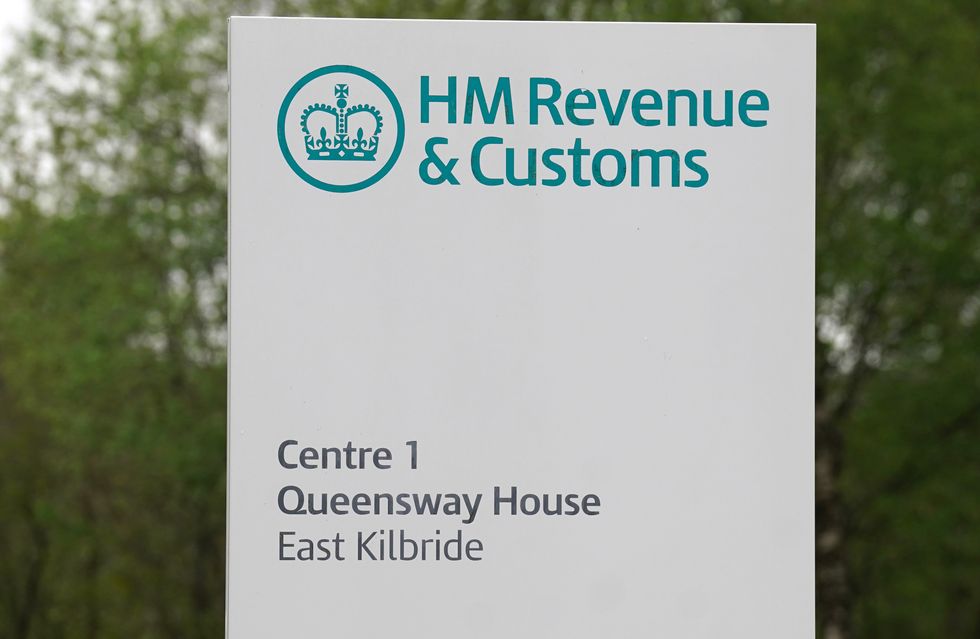

HM Revenue and Customs (HMRC) has issued an apology to those affected by a tax error which left people owing money.

The department mistakenly gave England tax codes does to taxpayers living in Scotland with around 30 residents in Mauricewood, Midlothian being affected.

HMRC has since corrected the tax codes of residents and confirmed that any overpaid tax will be refunded. HMRC is urging taxpayers to check they are in the right code.

According to one resident, the gaffe meant that they had underpaid their tax bill and owed an extra £10.

A tax code error lead to residents on estate paying more than they should have

|GETTY

They noticed that their tax code did not have a “S” at the start of it which is a change from how it usually looks.

The taxpayer told The National said they were worried the Scottish Government was being "short-changed" for income taxes.

HMRC has clarified that the Scottish Government tax take was not affected by the error.

While Scotland and England are part of Great Britain, both countries have different rates of income tax.

How much someone pays depends on both their earnings and where they live, with higher rates applied to taxpayers living in Scotland.

According to the Chartered Institute of Taxation, Britons earning £27,850 a year would pay the same tax in Scotland and England.

However, if someone earns less than this amount, they will pay less tax in Scotland. If someone in Scotland earns more than this threshold, they will pay more in tax.

Tax codes in Scotland are same as they are in England and Northern Ireland but are prefixed with a “S”.

LATEST DEVELOPMENTS:

HMRC has issued an apology over the error

| PAWhen a tax code has this letter in front of it, an employer payroll will apply the Scottish tax bands and rates to someone’s pay check.

In comparison, residents living in Wales will have a “C” at the beginning of their tax code which will lead to the Welsh rates of tax being applied.

A HMRC spokesperson said: "We've corrected the tax codes of residents from the estate and we apologise to those affected. Any overpaid or underpaid tax will be refunded or collected via PAYE as normal.

“People can check their code on the free HMRC app and online and if they think they're on the wrong tax code, they should tell us by using their online personal tax account."

GB News has contacted HMRC for comment.