HMRC error leaves savers in 'real danger' of overpaying tax bills - check if you're affected

Thousands of savers are at risk of overpaying after HMRC sent duplicate tax demands

Don't Miss

Most Read

Taxpayers are being left confused after receiving duplicate tax bills from HMRC, sparking fears that some could end up paying twice.

The tax authority has sent follow-up letters to many savers that wrongly combine new charges on savings interest with amounts already included in earlier bills.

These new "simple assessment" notices show total figures that add both new and old liabilities together, even when the original payment has already been made.

Tax experts have warned that the mix-up is causing widespread confusion, with some people at risk of accidentally paying the same tax twice.

The issue began when HMRC sent out tax letters earlier this year that left out charges on interest earned from bank and building society accounts.

To correct this, the tax office later issued new "simple assessment" letters for the 2024–25 tax year, adding the missing savings interest tax.

However, these new letters mistakenly showed combined totals that included both the new interest charges and the full amounts from the earlier bills, even for people who had already paid the original sum.

The mix-up has caused major confusion for savers trying to work out how much tax they actually owe.

HMRC error leaves savers in 'real danger' of overpaying tax bills - check if you’re affected

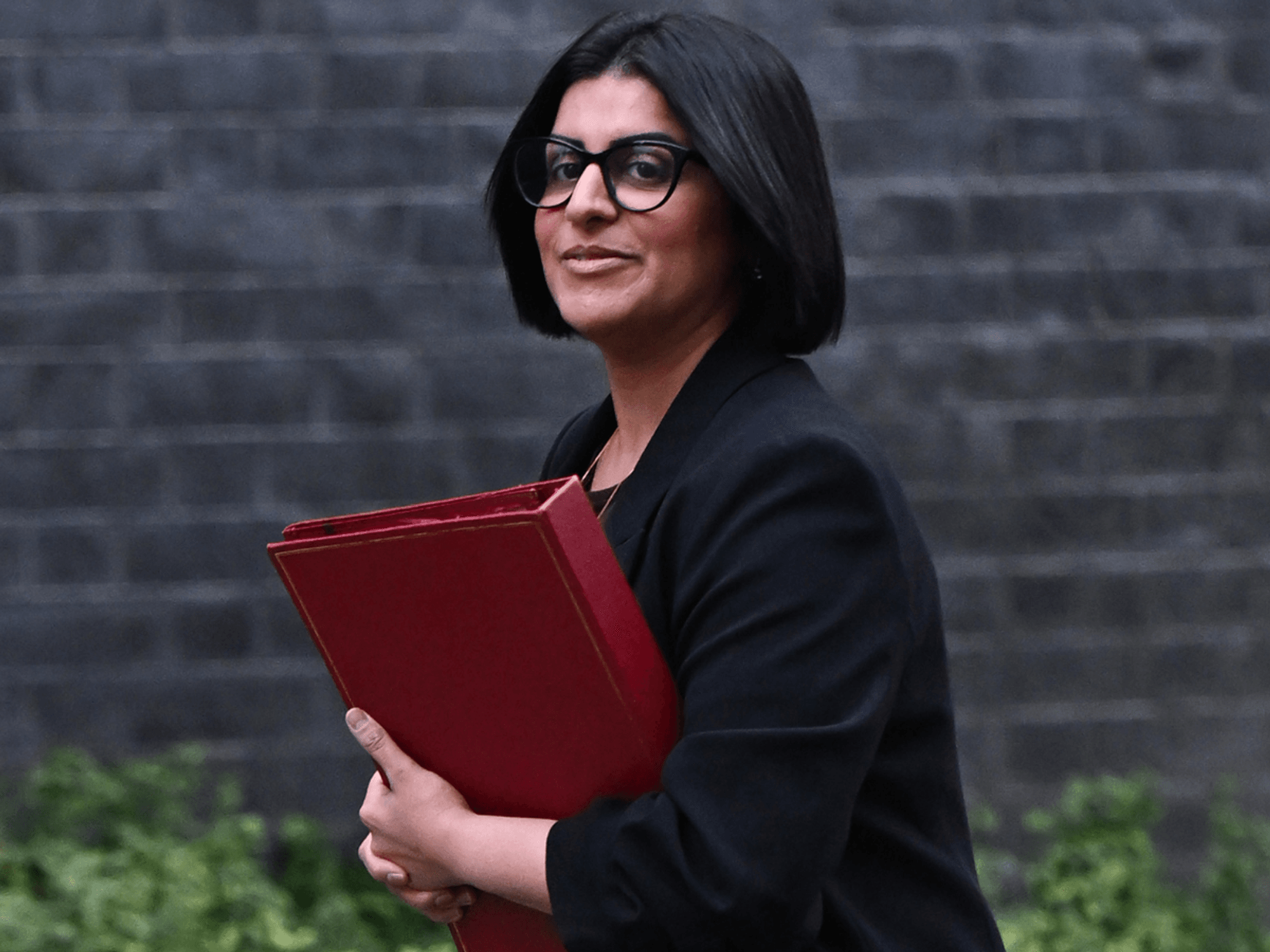

| GETTYJoseph Adunse, from tax consultancy Moore Kingston Smith, cautioned about a "real danger" that those receiving secondary tax notices might "panic" and settle the entire sum without recognising they may owe nothing or merely a portion.

"In the rush to collect as much tax as possible, HMRC has been sending several simple assessment letters to bewildered taxpayers," Mr Adunse stated.

He explained: "The problem is that the agency has bypassed its vast data warehouse and is sending affected taxpayers a total tax bill including tax that was demanded in an earlier letter."

New letters mistakenly showed combined totals that included both the new interest charges and the full amounts from the earlier bills

| GETTYThe confusion appears to have arisen because HMRC failed to cross-check earlier letters before sending out the updated tax assessments.

During the 2023-24 tax year, the revenue authority issued 1.32 million "simple assessment" notices - a sharp rise of 74 per cent compared with 757,745 the previous year.

These notices allow HMRC to collect tax without requiring a full self-assessment return and are often used for pensioners or employees who owe extra tax.

The duplication problem specifically impacts individuals who received their 2024-25 simple assessment correspondence before October 2025

| GETTYThe duplication problem specifically impacts individuals who received their 2024-25 simple assessment correspondence before October 2025.

Mr Adunse anticipates that over one million such notices will be distributed for the current tax year, with potentially thousands receiving revised assessments incorporating savings interest data.

HMRC guidance to accountants this month advised recipients to subtract any previously settled amounts from secondary notices to calculate actual liabilities.

More From GB News