HMRC repays £48.5million in overpaid tax as pensioners caught out by 'outdated' system

Pension savers reclaim £1.5bn after HMRC overtaxes withdrawals

Don't Miss

Most Read

Pension savers have now reclaimed more than £1.5billion from HM Revenue & Customs (HMRC) after being overtaxed on retirement fund withdrawals, marking a significant milestone in a decade-long administrative issue.

New data shows £48.5million was returned to savers in the third quarter of 2025 alone.

During July, August and September, more than 13,700 individuals were required to submit reclaim forms to recover money incorrectly taken through taxation.

Each person received an average of £3,539 back from the tax authority.

TRENDING

Stories

Videos

Your Say

The figures highlight the continued impact of HMRC's approach to taxing flexible pension withdrawals, in place since pension freedoms were introduced in 2015.

The system imposes emergency tax on people accessing their retirement savings for the first time in a tax year, meaning many face excessive deductions until they submit refund claims.

The issue stems from HMRC's use of so-called 'Month 1' taxation on initial flexible withdrawals.

This divides annual tax allowances by 12 and applies one month's allowance to the withdrawal, often resulting in overtaxation worth thousands of pounds.

Tom Selby, director of public policy at AJ Bell, said: "Now over a decade since pension freedoms and flexible pension withdrawals were introduced, HMRC is still yet to address one of the longstanding flaws in its approach to taxing those who choose to flexibly access their hard-earned pension pots."

Pension savers reclaim £1.5billion after HMRC overtaxes withdrawals

| GETTYThe system particularly affects those making one-off withdrawals from their pension.

Individuals taking regular income via drawdown may have tax adjusted automatically during the year, but those taking single withdrawals face immediate overpayment with no automatic correction unless they intervene.

The £1.5billion total likely represents only part of the overall tax burden, according to Selby.

He said: "These figures are likely to only be the tip of the iceberg, as they only capture those who fill in the relevant HMRC reclaim form. In reality, many will be reliant on HMRC putting their affairs in order at the end of the tax year."

Some improvements have been introduced for regular pension income recipients.

LATEST DEVELOPMENTS

From April 2025, updated tax code procedures are designed to move people more quickly from emergency codes to correct rates

| GETTYFrom April 2025, updated tax code procedures are designed to move people more quickly from emergency codes to correct rates, although this does not assist those making one-off withdrawals.

Mr Selby suggested a potential workaround for those planning single withdrawals.

He said: "One way savers planning to take a single withdrawal in a tax year can potentially avoid the shock of a big overtaxation bill is by taking a notional withdrawal first.

This should mean HMRC is able to apply the correct tax code to the second, larger withdrawal."

Those affected can reclaim money within 30 days by completing one of three HMRC forms.

Form P53Z applies when a person has fully withdrawn their pension while working or receiving benefits.

Form P50Z is used by those who have emptied their pension pot but are not working or receiving benefits.

Form P55 is for partial withdrawals.

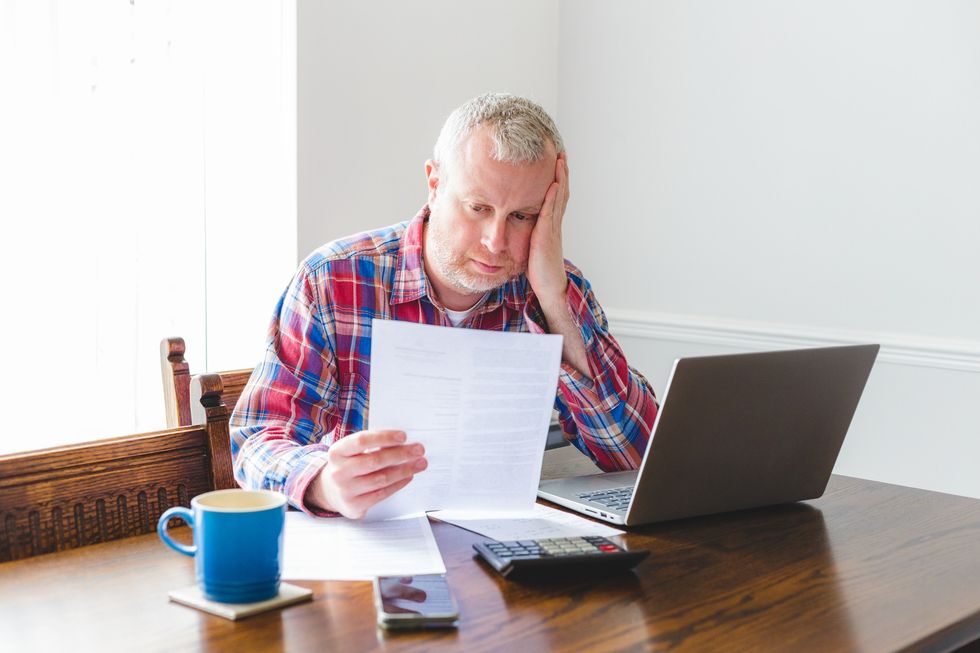

Mr Selby also warned that future changes could add further complexity.

| GETTYMr Selby said: "Alternatively, you can fill out one of three HMRC forms and you should receive your tax back within 30 days.

"If you don't do this, the Revenue says it will put you back in the correct tax position at the end of the tax year."

He also warned that future changes could add further complexity.

Mr Selby said proposed inheritance tax changes for pensions from April 2027 may lead to additional cases requiring refunds, adding: "Some beneficiaries will find they overpay income tax in the process and will need to claim a refund, heaping yet more fiddly admin on taxpayers."

More From GB News