Millions at risk of losing tax refunds as HMRC scraps automatic repayments

Experts warn the new system creates difficulties for those who struggle with technology

Don't Miss

Most Read

Latest

HMRC has ended automatic tax refunds, shifting the burden onto taxpayers to reclaim overpaid cash.

Millions remain unaware of the change and risk missing out on their refund altogether.

Since May 2024, anyone who pays tax through PAYE must actively claim back any overpaid tax instead of receiving an automatic refund.

HMRC says the change allows repayments to be made faster through bank transfers and helps cut fraud by requiring identity checks.

In the past, taxpayers who were owed money would automatically receive a cheque within around three weeks if they had not already claimed online, however that system ended on June 1, 2024.

Refunds are no longer issued automatically. Instead, individuals must make a claim themselves online, by phone or through the HMRC app. If no claim is made, the money will not be paid.

Tax refunds can usually be claimed for up to four years. After that point, the tax year closes and repayments are no longer made unless the overpayment was caused by an official HMRC error. For example, anyone owed a refund for the 2020/21 tax year generally has until April 5, 2025 to make a claim.

However, financial experts have raised concerns that widespread ignorance of the policy change could result in significant sums going unclaimed.

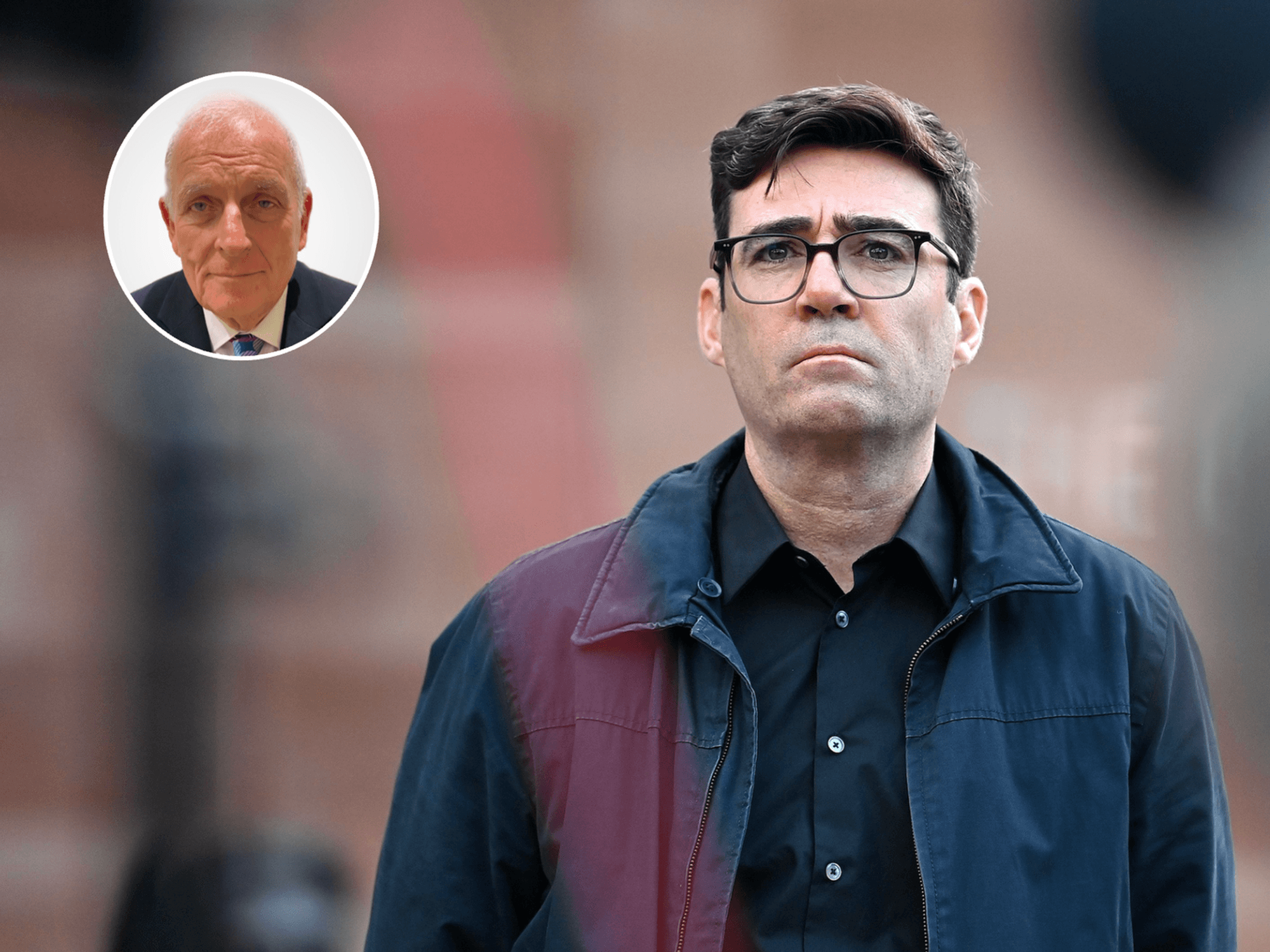

Alasdair Walker, a financial planner at Optimum Path Financial Planning, warned the new system creates difficulties for those who struggle with technology, describing it as "a whole lot of sludge added to a process."

Ellie Scoulding, a 24-year-old hairdresser from London, said she had no idea the rules had changed.

Having previously received several hundred pounds back after being placed on an emergency tax code when switching jobs, she expressed frustration at the new approach.

Millions at risk of losing tax refunds as HMRC scraps automatic repayments

| GETTY"It concerns me that it's becoming more of a one-sided burden on the taxpayer to co-ordinate their own income and tax," she told The i Paper.

"HMRC are able to be diligent in collecting owed tax but can't return that sentiment to those they owe."

The lack of public awareness has also sparked warnings about potential fraud. Mohammad uz-Zaman, a wealth manager at ADL Wealth, cautioned that criminals may exploit the situation.

LATEST DEVELOPMENTS:

- Pension tax relief bill surges to £60bn amid Rachel Reeves reform 'speculation'

- Thousands face 'sudden and unexpectedly large' inheritance tax bills as HMRC rake in £6.6billion

- HMRC warning as new rules increase late filing penalty to £200

He said: "There may be a ramp up in texts and emails claiming a HMRC refund. The victim could be expecting a refund too and think mistakenly that such a 'timely' message was genuine."

The scale of potential unclaimed refunds is substantial. According to recent HMRC figures, more than 5.6 million people paid too much income tax during the 2023/24 financial year, with the total overpayment reaching £3.5billion.

Experts attribute much of this to errors in tax code allocation and the complexity of the system.

More than 5.6 million people paid too much income tax during the 2023/24 financial year, with the total overpayment reaching £3.5billion

| GETTYTax codes, which employers and pension providers use to calculate deductions, can be issued incorrectly for various reasons.

HMRC may wrongly assume workers are still receiving company benefits such as cars or healthcare, or make incorrect assumptions about additional income from sources like rental properties or freelance work.

Neela Chauhan, partner at accountancy firm UHY Hacker Young, said: "Millions of people are paying the wrong amount of tax simply because HMRC is almost guessing what they earn. For too many people, this will go completely unnoticed."

How to claim back your overpaid tax:

Anyone who has paid too much or too little tax will usually receive a tax calculation letter, known as a P800, or a simple assessment from HMRC after the end of the tax year on 5 April.

These letters are sent between June and March and apply to people who are employed or receive a pension. Those who believe they have overpaid must claim their refund themselves using the HMRC app.

By selecting the "Pay as you earn" section, a green "claim"button will appear if a refund is due, allowing the money to be paid directly into their bank account, typically within a week.

Those who believe they have overpaid must claim their refund themselves using the HMRC app

| GETTYHMRC says the fastest and easiest way to check eligibility and claim a refund is through the HMRC app, though experts warn the process can be daunting for first-time users.

However, accountant Leanne Gunns of My Profit Hero warned these notifications can be delayed or missed entirely, leaving refunds unclaimed for years.

An HMRC spokesperson said: "We contact all customers who've overpaid tax so they can claim their repayment quickly and easily via the HMRC app or online, as well as providing options for those who aren't online."

The spokesperson added that the authority remains committed to tackling tax scams through education and customer support.

More From GB News