HMRC alert: Millions warned they are set to miss key tax deadline as £100 penalty looms

HMRC urges taxpayers to file before January 31 deadline

Don't Miss

Most Read

Millions of taxpayers are running out of time to file their tax returns, with HMRC warning that 5.65 million people have yet to submit their Self Assessment.

The filing deadline falls on January 31, leaving those who have not yet completed their 2024-2025 tax year return with less than a month to act.

Anyone who misses the deadline faces an automatic £100 penalty, which applies even if no tax is owed or if the tax bill has already been paid.

HMRC said the £100 charge is only the first stage of potential penalties for late filers.

TRENDING

Stories

Videos

Your Say

More than 6.36 million people have already submitted their returns, heading into 2026 with their tax affairs up to date.

HMRC figures show a surge in filings around the New Year period, with a total of 54,053 people submitting their returns across New Year’s Eve and New Year’s Day.

New Year’s Day also saw 19,789 taxpayers submitted their returns on January 1.

Myrtle Lloyd, chief customer officer at HMRC, urged those who have not yet filed to take action.

"New Year is a great time to start afresh. What better way than to ensure your tax affairs are in order for another year than completing your tax return.

"If you have yet to start, the clock is ticking, go to GOV.UK and start today."

Millions of taxpayers are running out of time to file their tax returns

| GETTYHMRC said extensive support is available online for people completing their returns.

Taxpayers can start their return, save their progress and return to it as many times as needed before submitting, and does not need to be made at the same time as filing.

However, any tax owed must be paid in full by January 31.

The HMRC app can be used to make payments, which allows users to set up reminders and notifications ahead of key deadlines.

LATEST DEVELOPMENTS

HMRC warned that penalties increase the longer a return remains outstanding

| GETTYHMRC warned that penalties increase the longer a return remains outstanding.

After the initial £100 fine, anyone more than three months late faces daily penalties of £10, with those daily charges building up to a maximum of £900.

At six months late, an additional penalty is applied - five per cent of the tax owed or £300, whichever is higher.

After 12 months, a further penalty is added at the same rate.

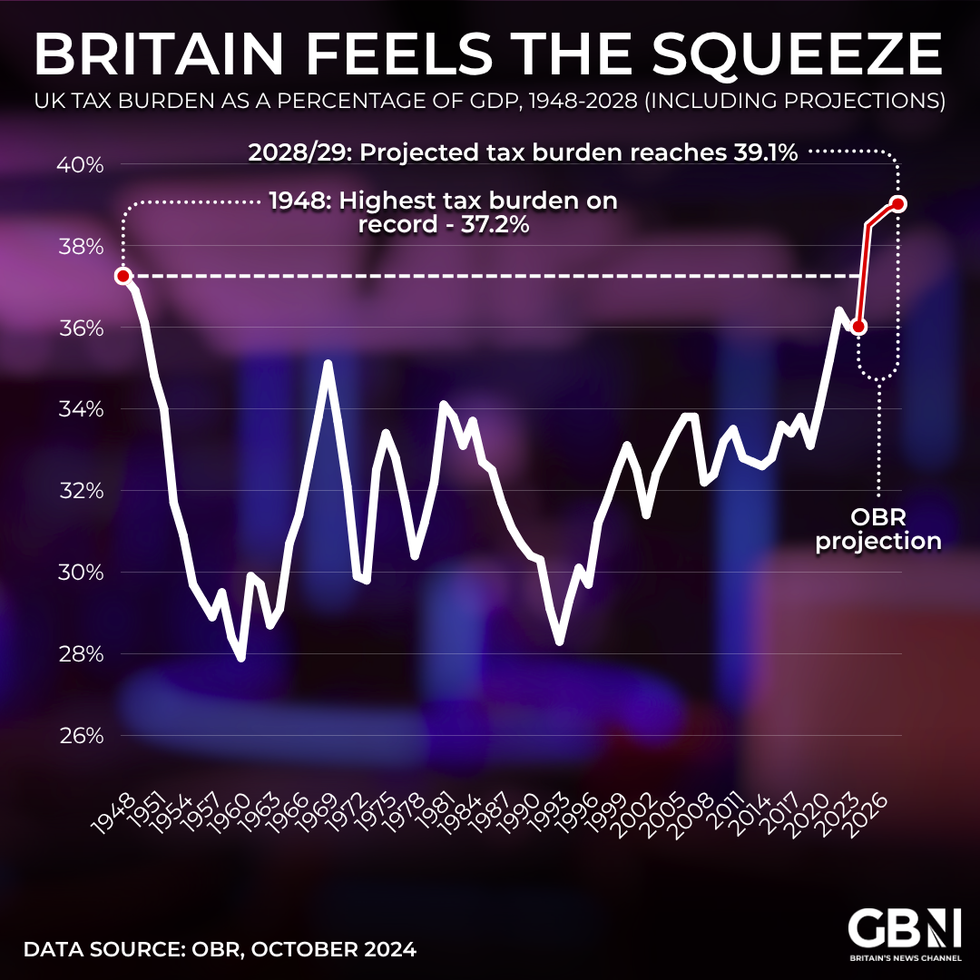

Tax Burden as a percentage of GDP | GETTY

Tax Burden as a percentage of GDP | GETTYLate payment penalties are applied separately from late filing fines.

HMRC said a five per cent charge is added to unpaid tax at 30 days, six months and 12 months after the deadline.

Interest is also charged on any outstanding tax.

HMRC said the combination of penalties and interest means the cost of missing the deadline can rise quickly.

Our Standards: The GB News Editorial Charter

More From GB News