Gold rushes past record $5,000 as investors shelter wealth amid Donald Trump's tariff uncertainty

Precious metals rally intensifies amid global uncertainty and safe-haven demand

Don't Miss

Most Read

Latest

Gold has smashed through the $5,000 per‑ounce barrier for the first time in history, extending a dramatic rally in precious metals and marking its strongest performance in decades after surging more than 60 per cent in 2025.

Silver has also hit a historic milestone, climbing above $100 per ounce following gains of nearly 150 per cent last year.

Spot gold rose above $5,100 per ounce on Monday, setting a fresh record and underscoring the scale of investor demand for safe‑haven assets amid persistent geopolitical tensions and economic uncertainty.

Analysts said concerns over global policy and financial stability have driven buyers toward bullion, with market anxiety fuelled by trade disputes and diplomatic friction between the United States and key allies.

TRENDING

Stories

Videos

Your Say

President Donald Trump’s threatened tariffs on Canada and disputes over Greenland were singled out as factors unsettling markets.

Weakness in major currencies has further boosted precious metals, with the recent slide in the US dollar making gold and silver more attractive to international investors.

Central bank buying has also played a significant role in lifting prices, according to industry observers.

Banks and financial institutions have revised their forecasts sharply higher in response to the ongoing strength of the gold market.

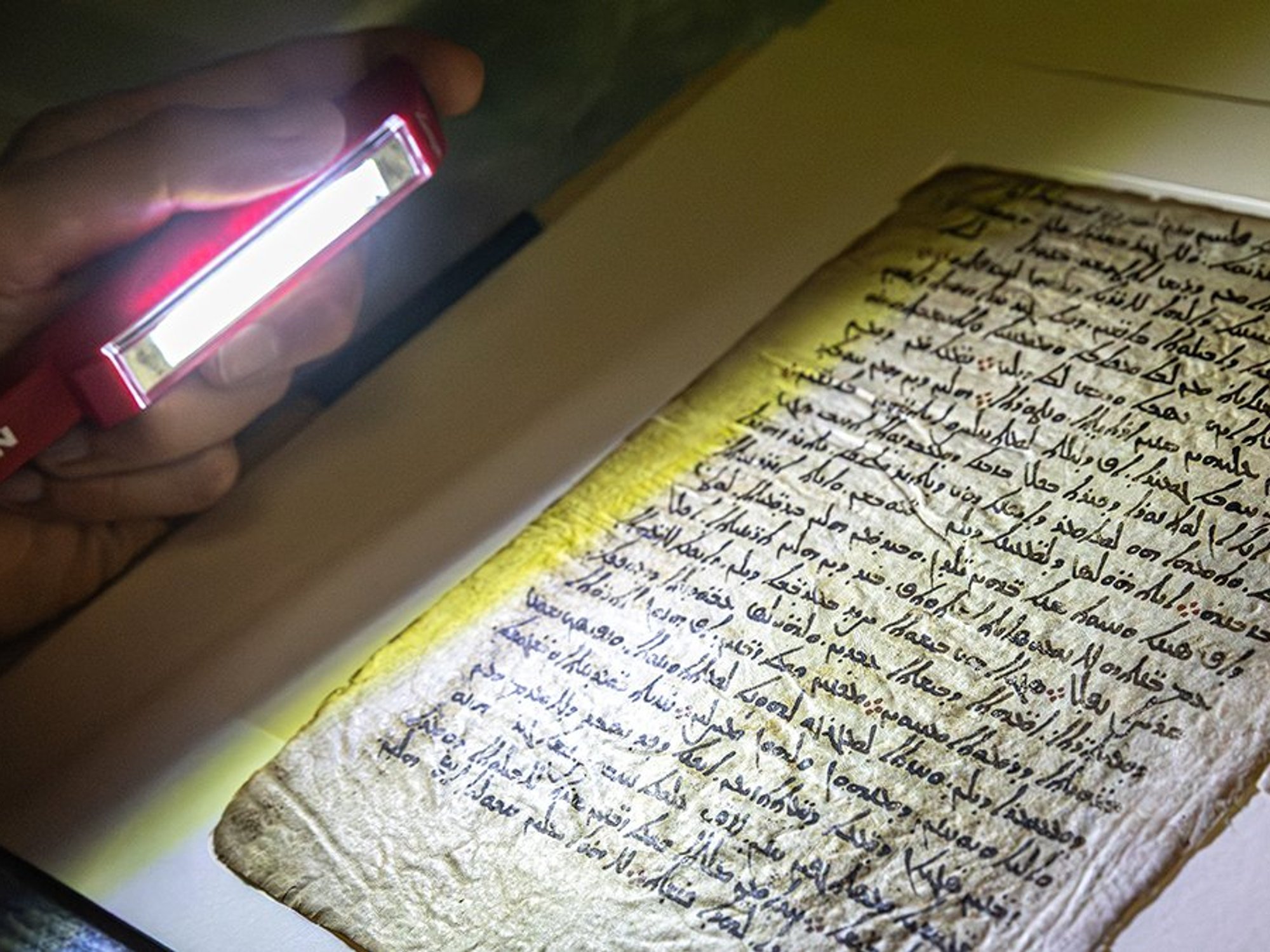

Precious metals rally intensifies amid global uncertainty and safe-haven demand

|GETTY

Some analysts now believe prices could climb toward $6,000 per ounce during 2026, with global survey data showing expectations for gold to average above previous long‑term estimates this year.

Silver’s surge into triple‑digit territory reflects both safe‑haven demand and rising industrial use.

Its move above $100 per ounce for the first time ever has extended the metal’s momentum alongside gold, with analysts saying the rallies in both markets point to heightened investor risk aversion.

Precious metals are often viewed as hedges when confidence in Government bonds and traditional currencies weakens.

LATEST DEVELOPMENTS

Precious metals are often viewed as hedges when confidence in Government bonds and traditional currencies weakens

|GETTY

The scale of gold’s rise has drawn comparisons with previous periods of market stress, though strategists cautioned that extended rallies require sustained demand and supportive macroeconomic conditions.

Silver’s gains, they added, reflect not only defensive positioning but also stronger industrial interest.

Investors have been urged to remain aware of potential volatility even as prices set new records.

Gold’s momentum has prompted institutions and retail buyers to reassess asset allocation, while analysts expect precious metals markets to remain highly sensitive to policy shifts, currency movements and developments in global tensions.

People are using and gold and Silver to protect their wealth in an uncertain economy

| GETTYThis historic phase for gold and silver comes against a backdrop of broader uncertainty across financial markets, reinforcing the appeal of traditional safe‑haven assets.

Ipek Ozkardeskaya, senior analyst at Swissquote, said: "There has been no new escalation over the weekend - no fresh breach of international law, no invasion, no immediate military threat.

"The US did, however, threaten Canada with 100 per cent tariffs, after Mark Carney approached China last week, defying the White House - a reminder that trade tensions remain alive and well.

"Beyond that, the news flow is thin. Yet the bid for precious metals suggests that market stress is far from over."

More From GB News