'I’m 70 and live with five strangers' Retirees flock to flat sharing as pensions fail to cover rent

Home sharing among people aged 55 to 64 has surged, more than doubling from 2.6 per cent to 5.3 per cent over the past decade

Don't Miss

Most Read

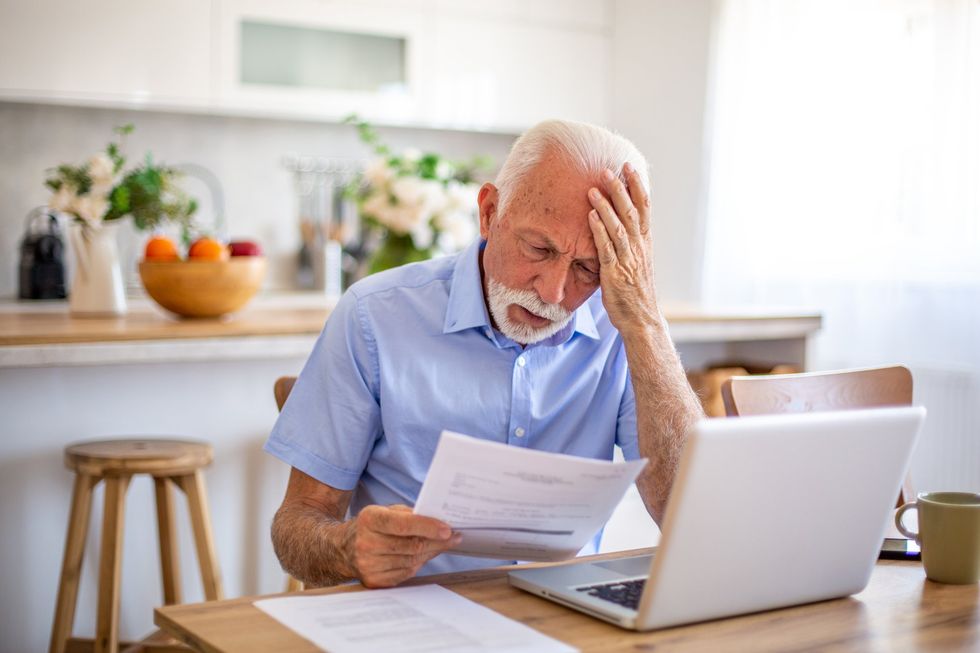

Retirees across Britain are increasingly turning to flatsharing as rising rents and living costs outpace their pension income.

What was once seen as a short-term solution for younger renters is now becoming a necessity for many people in later life.

David Kowal never anticipated that reaching his seventieth birthday would mean sharing accommodation with strangers.

The former engineering machine operator, who left work at 67, now lives in a Birmingham property alongside five other men.

His monthly outgoings total approximately £450, covering rent of £420 that includes gas heating, council tax and water, plus around £30 for electricity on a meter.

"It works out a lot cheaper than living on my own and it helps my pension go further," Mr Kowal told The i Paper.

With a monthly income of around £1,250 from his state pension and small workplace pensions, sharing a home means Mr Kowal has more money left over than he would if he rented a place on his own.

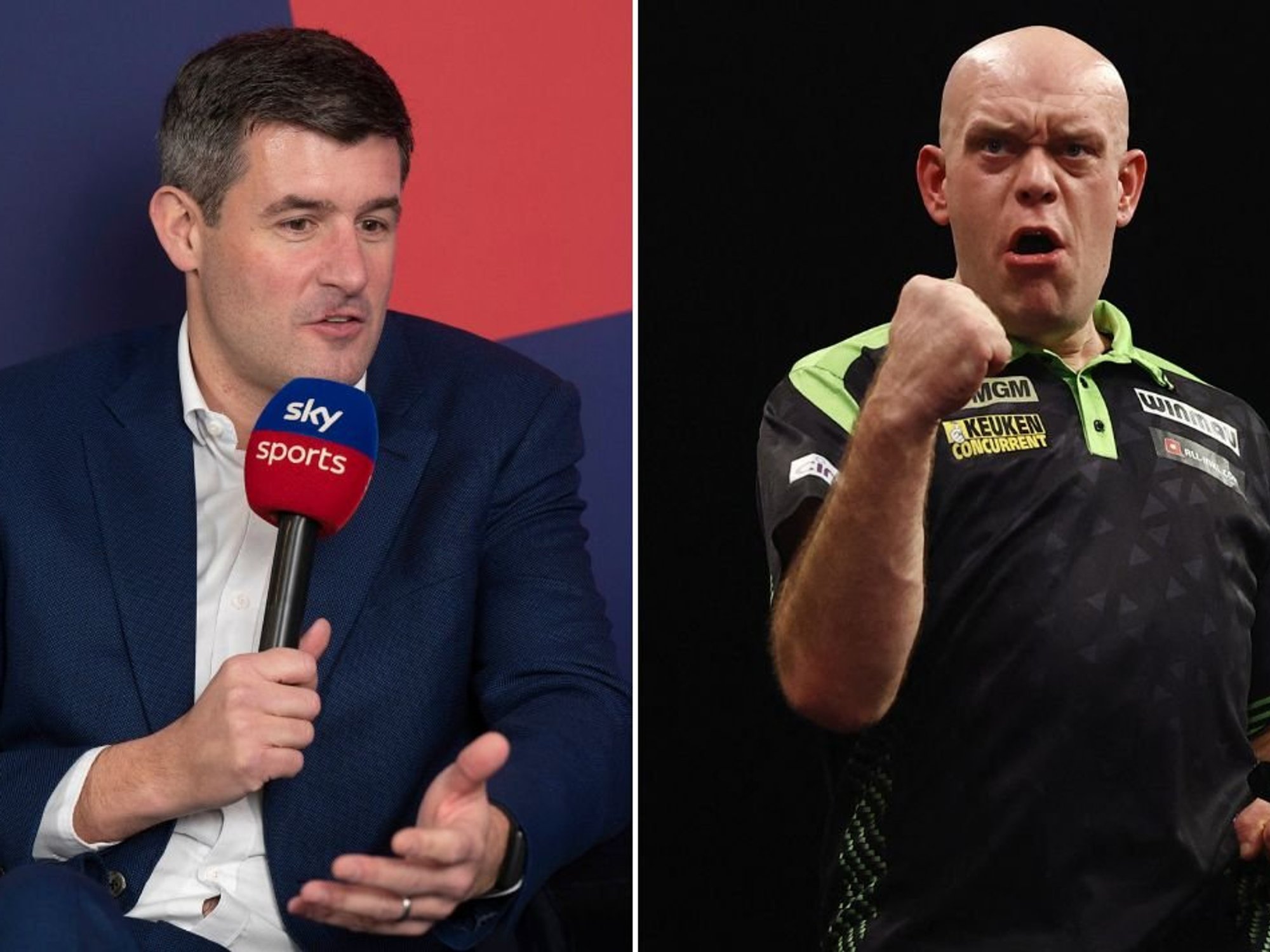

His situation reflects a growing trend in the UK rental market. New figures from flatshare website SpareRoom show that people aged 65 and over now make up 2.4 per cent of those living in shared accommodation, up from just 0.8 per cent ten years ago.

The number of people aged 55 to 64 sharing homes has also risen sharply, more than doubling from 2.6 per cent to 5.3 per cent over the same period.

Rising rents across the country are eating into savings and forcing older renters to stay in shared housing for longer. At the same time, this is making it harder for younger people to find affordable places to live.

His situation reflects a growing trend in the UK rental market

| GETTYPeople aged 25 to 34 still make up the largest group in flatshares at 42 per cent, but this has fallen from 45 per cent a decade ago. Meanwhile, the share of under-35s continues to shrink as more older renters move into shared homes.

Without the safety net of generous pensions or property wealth, growing numbers of older people are being pushed into shared housing, while younger adults are delaying key life milestones because they cannot afford to move out on their own.

Michelle Williams, a 68-year-old renter from Earlsfield, is another one of them. After living in south west London for 40 years, she was forced to leave her room last year when rising rents priced her out.

Unable to find an affordable option through Zoopla, she eventually turned to SpareRoom, where she now lives in a flatshare with three other people, more than twice the age of the youngest tenant.

Ms Williams said: "Having to move into a house share at 66 really just made me feel like I’d failed. My housemates are lovely but it doesn’t change the fact we are at different stages of life – it’s strange being a lodger at my age and I still don’t know how I’m meant to get back onto the property ladder."

Without the safety net of generous pensions or property wealth, growing numbers of older people are being pushed into shared housing

| GETTYMs Williams described feeling as though she had lost a sense of self, and that she constantly feels like a guest in someone else’s home. She added: "Where do I even go from here? I’m almost 70, there isn’t another step on the ladder for people like me."

Campaigners say the rise in multi-generational flatsharing is a clear sign of mounting financial pressure and overcrowding in the housing market.

At the same time, more older homeowners are renting out spare rooms as a way to cope with the rising cost of living, further reshaping who flatsharing is for in modern Britain.

Mr Kowal previously owned his own home but had to sell it in 2020 after a relationship ended. He tried switching to an interest-only mortgage to cut costs, but remortgaging would have meant paying more than £1,000 a month, which he could not afford.

Mr Kowal now occupies his own room with a shower, sharing a spacious kitchen, garden and laundry facilities with his housemates, most of whom are working men approaching retirement themselves.

Mr Kowal believes the trend will only intensify as pensioners find themselves with no alternative

| GETTYMr Kowal believes the trend will only intensify as pensioners find themselves with no alternative.

"Housesharing is the only way forward for pensioners as it allows your money to go further," he said. "I think there will be an increase in the numbers of older people housesharing in the coming years because they will have no choice as they won't be able to afford anything else."

Matt Hutchinson, director of SpareRoom, said: "David, and many like him, are finding their pension income isn't enough to meet the high cost of living and have enough disposable income to enjoy their free time, and so they're making the best of shared living later in life."

He added that shared accommodation remains the most affordable rental option, with bills frequently bundled into the rent, helping to ease financial strain during retirement.

More From GB News