US interest rates SLASHED but Federal Reserve 'deeply split' on future cuts in blow to Donald Trump

The Federal Reserve also warned inflation will remain above the desired two per cent target, which could impact future interest rate changes

Don't Miss

Most Read

Latest

The US Federal Reserve has slashed interest rates by 0.25 percentage points, bringing the cost of borrowing across the Atlantic to a new range of 3.50 per cent to 3.75 per cent.

This represents the third cut in the US base rate this year, but members of the Federal Open Market Committee (FOMC) warned inflation will likely remain above the central bank's two per cent target in 2026.

President Donald Trump has put pressure on Fed chair Jerome Powell to cut rates faster but only more cut is projected to take place in 2026 in a blow to his economic agenda.

Policymakers have sought to keep the American labour market intact, despite concerns from several key Fed officials who believe the financial institution should be prioritising the cost of living.

The Fed has cut interest rates but warned inflation will remain above 2%

|GETTY

Notably, today's decision appeared to signal division among FOMC policymakers with three members voting "no", which has not happened at a meeting since September 2019.

The vote to cut interest rates won nine-to-three with Governor Stephen Miran being in favour of a larger 0.5 percent rate reduction while regional presidents voted for the base rate to remain at its current level.

Hawish Fed policymakers are generally focused on addressing inflation with high interest rates being used as a tool to bring the consumer price index (CPI) rate down.

In comparison, dovish members of the FOMC are usually supportive of the wider labour market and in favour of lower interest rates to achieve this long-term.

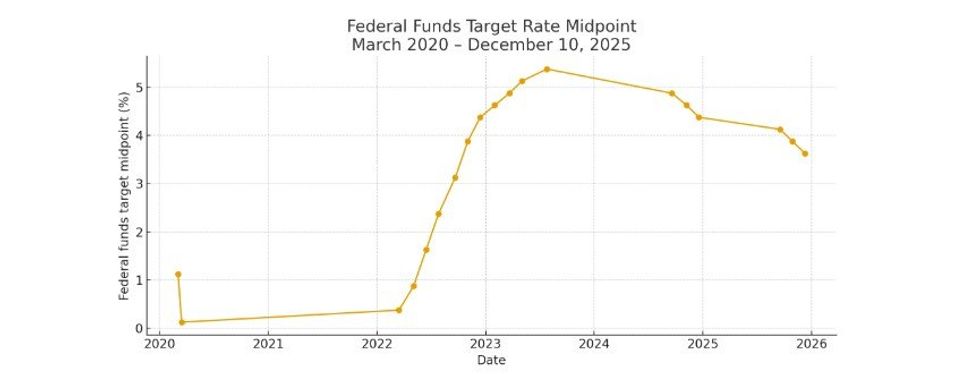

How has the Federal Funds Rate changed?

|Federal Reserve / Chat GPT

In its statement, the FOMC shared: "In considering the extent and timing of additional adjustments to the target range for the Federal Funds Rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks."

Based on its latest report, the Federal Reserve puts the inflation rate for September 2025 at 2.8 per cent, which is considerably higher than the central bank's two per cent target.

Furthermore, the FOMC revised its projections for gross domestic product (GDP) for 2026, boosting its September projection by half a percentage point to 2.3 per cent.

Reacting to the news, Naeem Aslam Chief Market Analyst at Zaye Capital Markets, said: "Markets gave us the usual sugar rush on the back of the Fed decision but the important thing to keep in mind is that 25 basis point rate cut was already priced in so beaware of the sugar rush easing off.

US Federal Reserve Chair Jerome Powell speaks during a press conference | Reuters

US Federal Reserve Chair Jerome Powell speaks during a press conference | ReutersLATEST DEVELOPMENTS

"The real message is the deeply split vote and 78 per cent odds of no move in January — the Fed just slammed the brakes on the easing cycle."

Isaac Stell, Investment Manager at Wealth Club added: "As widely expected, the Federal Reserve has cut rates by 0.25% at its pre-Christmas meeting, as labour market worries trump inflationary concerns for the time being.

"The Federal Reserve’s rate cut, the third in a row comes even as inflation remains stubbornly at three per cent. Once again, not all members were in favour of the cut with two dissenting voters wishing to hold and one member voting to lower rates by 0.5 per cent.

"This dissension in the ranks not only reflects differing outlooks for the economy but also lays bare the issues any incoming Chairman will face in corralling his subordinates around a consensus view.

"Despite today’s rate cut, the road ahead remains uncertain. The jobs market remains on shaky ground and inflationary concerns could yet reignite if rate cuts boost demand.

"Markets are similarly uncertain predicting just 0.50 per cent worth of cuts in 2026, down from 0.75 per cent just a week ago. The only certainty right now is uncertainty.

"The Fed’s report card for 2026 will differ depending on who is asked, but one thing for is for sure, the institution has weathered some almighty economic storms, mainly emanating from the White House. However, the Fed ends the year on an even keel, but the question is will it be storm clouds or plain sailing during 2026?"

More From GB News