Borrowing costs surge slaps Britons with £7bn a year bill but 'UK premium easing' in win for Rachel Reeves

UK borrowing costs are on a downward trajectory in much-needed relief for taxpayers

Don't Miss

Most Read

Latest

Britain has been forced to contend with higher borrowing costs of up to £7billion a teae than over major economies but this "premium" on taxpayers could be coming to an end in a win for Chancellor Rachel Reeves.

The additional costs the UK has faced when borrowing compared to other nations may finally be diminishing, according to fresh analysis from the Institute for Public Policy Research (IPPR).

Since the Chancellor delivered her address at the Labour Party conference, yields on 10, 20 and 30-year government bonds have dropped by 20 basis points more than equivalent falls in comparable nations.

This shift suggests the premium that had built up on British debt since Labour entered Government in 2024 could be unwinding. The think tank's findings offer some relief for the Treasury, which had seen borrowing expenses climb significantly higher than those faced by peer countries in the months following the general election.

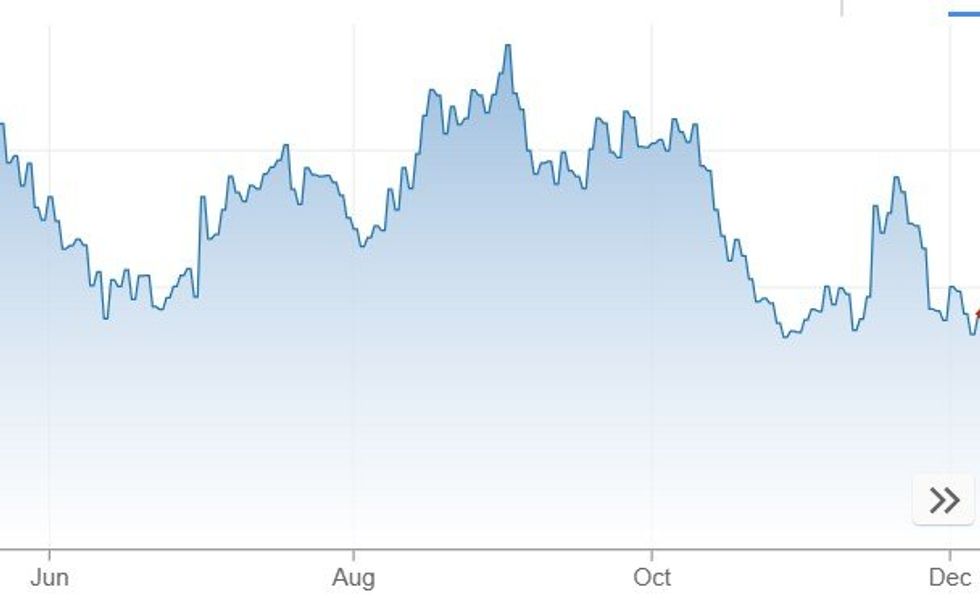

Borrowing costs could plummet after historic highs

|GETTY / MARKETWATCH

Over the years, the scale of this borrowing premium had been substantial. UK gilt yields rose between 0.4 and 0.8 percentage points more than those of competitor nations following the 2024 election, adding an estimated £2billion to £7billion annually to the exchequer's costs.

At their worst, the government's borrowing expenses reached six times their pre-pandemic levels. 30-year gilt yields had climbed by 4.1 percentage points since 2022, outpacing increases in the United States by 150 basis points and the Eurozone by 100 basis points.

The origins of this elevated premium stretch back further still with the initial spike occurring in the aftermath of former Prime Minister Liz Truss's ill-fated mini-Budget, which coincided with a broader global surge in borrowing costs.

According to the IPPR report. there are several factors behind the UK's elevated borrowing costs. Market uncertainty about whether the government will actually deliver on its fiscal commitments appears to be a key driver.

The Bank of England's quantitative tightening programme has also contributed, with the central bank selling Government bonds at a faster pace and higher volumes than its international counterparts.

Additionally, the withdrawal of UK defined benefit pension schemes from the gilt market has increased dependence on overseas investors to purchase government debt.

Notably, Britain's underlying economic position compares favourably with nations paying less to borrow. The UK's debt-to-GDP ratio stands at 101 per cent, considerably lower than America's 122 per cent and Japan's 237 per cent.

The government also plans to halve annual borrowing by parliament's end. The IPPR urges ministers to maintain their current fiscal rules to demonstrate credibility to investors.

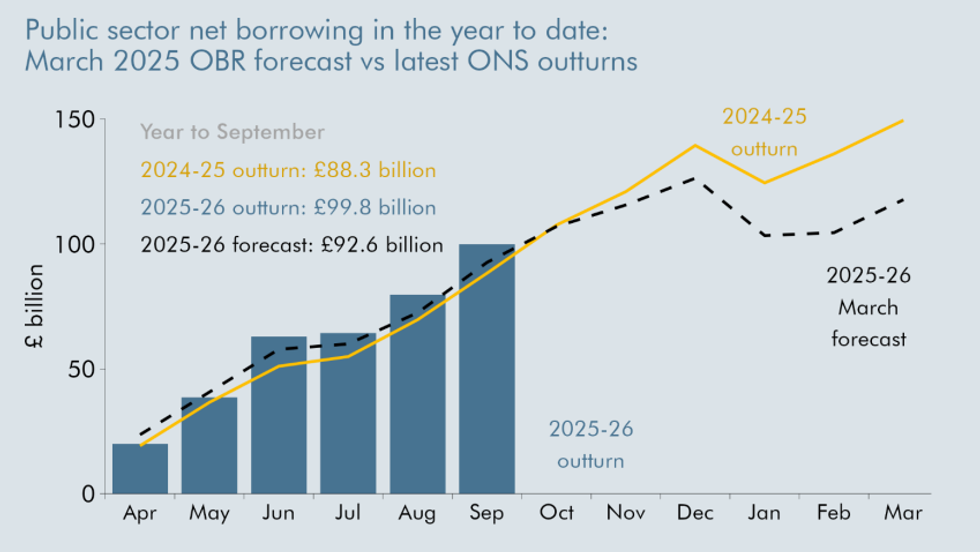

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBR

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBRThe think tank also calls on the Bank of England to halt its active gilt sales, arguing this would help reduce the UK "premium" and save the Treasury billions years down the line..

A further recommendation involves significantly cutting the issuance of long-dated bonds, with the Debt Management Office shifting towards medium-term debt instead.

William Ellis, a senior economist at IPPR, said: "The premium on UK borrowing costs appears to be easing, showing that markets are responding to growing confidence in the Government's fiscal approach.

"Sticking to its fiscal plans could save the Exchequer billions and free up fiscal space in the future."

Long-term borrowing costs are falling

|CNBC

Carsten Jung, associate director for economic policy at IPPR, added: "The UK is paying more than other major economies to borrow.

"To be clear, we’re not at risk of going broke — but investors are unsure how to price UK debt because they don’t know how much more borrowing is coming down the line.

"With clear, credible fiscal plans, the UK could be a star performer in the G7 — and simply reassuring markets that we’ll stick to those plans could save billions.

"The Bank of England also needs to pull its weight. Actively selling government bonds is adding unnecessary pressure to the gilt market. It should stop — just as every other major central bank has."

More From GB News