Britain heading for economic slowdown after Rachel Reeves's tax hikes, OECD warns

Jacob Rees-Mogg says 'no economy can thrive when its most productive sectors are being squeezed to fund spending commitments' |

GBNEWS

UK to lag behind United States and eurozone over next two years

Don't Miss

Most Read

Latest

The UK economy is expected to slow next year as tax rises and global uncertainty start to bite, the Organisation for Economic Cooperation and Development (OECD) has warned.

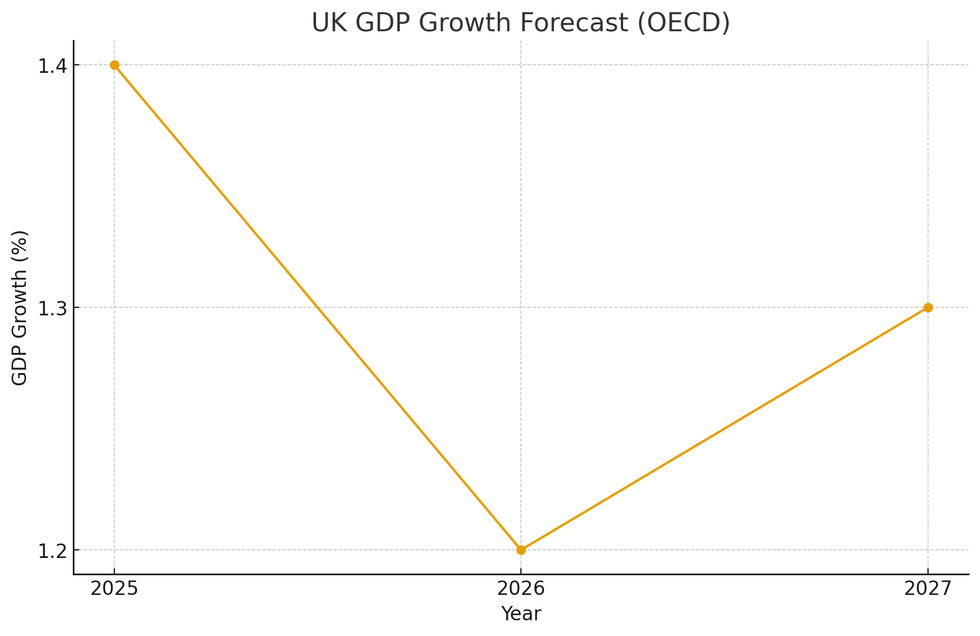

In its latest outlook, published less than a week after Rachel Reeves’s Budget, the OECD said growth of 1.4 per cent this year is likely to drop to 1.2 per cent in 2026.

Households are also set to stay under pressure. Inflation is forecast to be 3.5 per cent this year - the highest in the G7 - and still 2.5 per cent next year, meaning the cost of living squeeze will continue despite the recent fall in energy prices.

The international body projects economic expansion will decelerate to 1.2 per cent in 2026, down from 1.4 per cent this year, before marginally recovering to 1.3 per cent in 2027.

The OECD identified increased taxation and reductions in public expenditure as creating "headwinds" for the UK economy.

The organisation highlighted that "past tax and spending adjustments weighing on household disposable income and slowing consumption" would constrain economic activity.

The forecast carries "substantial" downside risks linked to the government's fiscal tightening measures, according to the OECD's latest economic outlook.

Rachel Reeves unveiled tax increases totalling £26billion in her November 26 budget, implementing measures that will create Britain's highest-ever tax burden according to the Office for Budget Responsibility.

The income tax threshold freeze alone will draw an additional 1.7 million individuals into higher tax brackets.

Britain heading for economic slowdown after Rachel Reeves's tax hikes,

|GETTY

The OBR delivered a stark assessment of the budget's economic impact, revising down its growth projections for all four years ahead.

This verdict arrives as the Chancellor faces intensifying criticism from business leaders who argue the budget lacks provisions to stimulate economic expansion, whilst political opponents accuse her of misleading the public about fiscal realities before the announcement.

The OECD analysis reveals Britain will experience the most elevated inflation amongst G7 nations this year at 3.5 per cent.

The UK will maintain the second-highest rate in 2026 at 2.5 per cent, trailing only America, though this represents an improvement from earlier projections of 2.7 per cent.

Rachel Reeves raises taxes by £26bn

| PAPrice pressures are expected to moderate to 2.1 per cent by 2027, approaching the Bank of England's target whilst remaining the G7's third highest.

The organisation warned that persistent food costs and the scheduled April payroll tax rise could keep rates elevated longer than anticipated, as businesses transfer increased wage expenses to consumers through higher prices.

The OECD anticipates two additional interest rate reductions, bringing borrowing costs down from the current 4 per cent to 3.5 per cent by the second quarter of 2026, marking the conclusion of the easing cycle.

Rachel Reeves' economy stands on the brink as rising unemployment has activated a critical economic warning signal

| paThe organisation expects improved global trade conditions and lower borrowing costs to deliver "moderate tailwinds from the second half of 2026, with investment and exports supporting the economy".

Defending her fiscal decisions, Reeves stated: "Last week, my Budget cut waiting lists, cut borrowing and debt, and cut the cost of living." She emphasised that the OECD had upgraded growth projections whilst reducing inflation forecasts.

Shadow Chancellor Mel Stride countered: "Rachel Reeves promised growth but growth is expected to weaken next year, because of her choices. This is the cost of policies that punish work, businesses and investment."

More From GB News