UK borrowing costs surge to highest level since 1998 as global markets spooked by Donald Trump's Fed overhaul

Education Secretary Bridget Phillipson MP reacts to news the UK economy grew by 0.3% in the first financial quarter this year |

GB NEWS

Investors are becoming increasingly anxious over recent developments impacting the US and UK economies

Don't Miss

Most Read

Latest

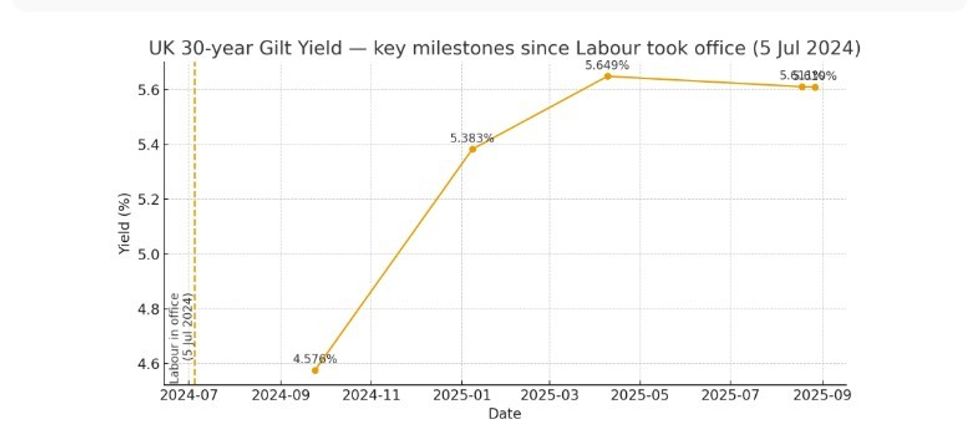

Long-term UK borrowing costs have climbed to levels not seen since the end of the last century, with the yield on 30-year gilts touching 5.64 per cent earlier this morning.

This marks the highest point in four months, approaching levels last recorded in 1998, adding further pressure to Chancellor Rachel Reeves as she attempts to bolster the economy.

This surge comes amid growing anxiety among global investors following President Donald Trump's attempt to dismiss US Federal Reserve governor Lisa Cook from her position.

President Trump alleged false statements regarding mortgage agreements in and claimed constitutional authority for the removal, marking an drastic intervention in central bank independence.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Borrowing costs continue to rise with the fiscal issue being compounded by Donald Trump's recent overhaul to the Federal Reserve

|GETTY

The dramatic developments have sent shockwaves through global bond markets, with UK gilts appearing to bear some of the brunt of investor concerns. Following the White House's decision, the dollar fell against major currencies after the president's latest salvo against the Fed but recovered some ground.

Notably, the interest the US was paying investors in its 30-year-bonds rose after Trump moved to remove Ms Cook from her position. She has firmly rejected Trump's authority to terminate her position, stating she would not resign from her role.

Mr Trump has intensified his campaign against the Fed, particularly targeting chair Jerome Powell, over what he perceives as reluctance to reduce interest rates.

In her position, Ms Cook serves as one of seven board governors and participates in the twelve-member committee that determines US monetary policy.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How have long-term borrowing costs changed since Labour got into power

The constitutional standoff has amplified uncertainty across financial markets, contributing to the sharp rise in UK borrowing costs.

Prior to this development, British government bonds have suffered disproportionately compared to other major economies since the beginning of August.

The yield on 30-year gilts has climbed 0.21 percentage points during this period, nearly double the 0.11 percentage point increase seen in German Bunds and significantly exceeding the 0.03 percentage point rise in US Treasuries

Economists note this divergence reflects mounting concerns about Britain's economic prospects, compounded by the global bond market turbulence triggered by Trump's Federal Reserve confrontation.

MEMBERSHIP:

- A mere 36 seconds in this hellhole made my heart sink. A snapshot of what's coming — Peter Bleksley

- REVEALED: How one 'dreadful' secret email risks Tory defection deluge to Nigel Farage's Reform UK

- We are ruled by an 800-pound gorilla that shields sex offenders, activist lawyers and open borders - Chris Philp

- REVEALED: The eight ex-Tory MPs on ‘defection watch’ as Nigel Farage eyes up big hitters to join Reform UK

- POLL OF THE DAY: Should we follow Trump’s lead and sentence flag burners to one year in jail? VOTE NOW

The gilt market's underperformance has emerged despite broader international pressures, including Germany's plans to expand borrowing and spending.

Yields retreated slightly to 5.59 per cent later in Wednesday's trading session.

LATEST DEVELOPMENTS:

Donald Trump is targeting the US central bank

| GETTYAnalysts are sounding the alarm that sustained elevation in gilt yields threatens to dramatically constrain the Chancellor's fiscal options ahead of her upcoming Autumn Budget.

According to Capital Economics economist Alex Kerr, the recent yield increases would slash the Chancellor's financial cushion from £9.9billion at the Spring Statement to merely £5.3billion

The combination of higher debt servicing costs and potential downgrades to growth projections by the Office for Budget Responsibility (OBR) could create a funding shortfall of up to £27billion.

"A jump in US Treasury yields indicates that bond investors aren’t happy about how Trump continues to meddle with the Fed and threaten its independence,” Russ Mould, investment director at AJ Bell, said.

More From GB News