Small businesses in the UK 'left behind' as nine in 10 firms struck by late payments

GB NEWS

Construction and transport sectors report longest waits as late payment crisis deepens

Don't Miss

Most Read

British companies are facing a severe payment crisis, with nine out of ten firms experiencing delayed payments averaging 32 days, according to new research from trade credit insurer Coface.

The situation contrasts sharply with international standards, with UK businesses suffering far worse than their global counterparts.

Nearly half of affected companies said payment delays have become more frequent than before.

The UK's 90 per cent late payment rate significantly exceeds European nations including France at 85 per cent, Germany at 81 per cent and Poland at 60 per cent.

The problem extends beyond Europe, with Asian markets reporting late payments at 49 per cent, and Latin American businesses at 51 per cent. This highlights the severity of Britain's payment culture.

Almost half of micro and small firms reported increased payment delays, compared with 39 per cent of mid-sized companies and 42 per cent of large corporations.

These smaller businesses typically extend credit for 46 days on average, while larger firms offer 56-day terms, reflecting the limited financial buffers available to smaller operators.

Benoit Urbin, Coface's country manager for the United Kingdom and Ireland, said: "Late payments have become a defining challenge for UK businesses, threatening the financial stability of the most vulnerable firms."

British companies are grappling with a serious payment crisis

| GETTYDespite recent regulatory changes including the 2024 Payment Practices Regulations and Fair Payment Code, just 68.5 per cent of micro and small enterprises anticipate improved cash flow, compared with more optimistic projections from larger organisations.

The construction industry faces the most severe difficulties, with 95 per cent of firms reporting increased payment delays and an average wait of 38.2 days.

Automotive and transport sectors follow at 93 per cent, while business services companies also face lengthy delays averaging 38.1 days.

Publishing, communications and media firms report the shortest delays at 21 days, though half still experience significant cash flow impacts.

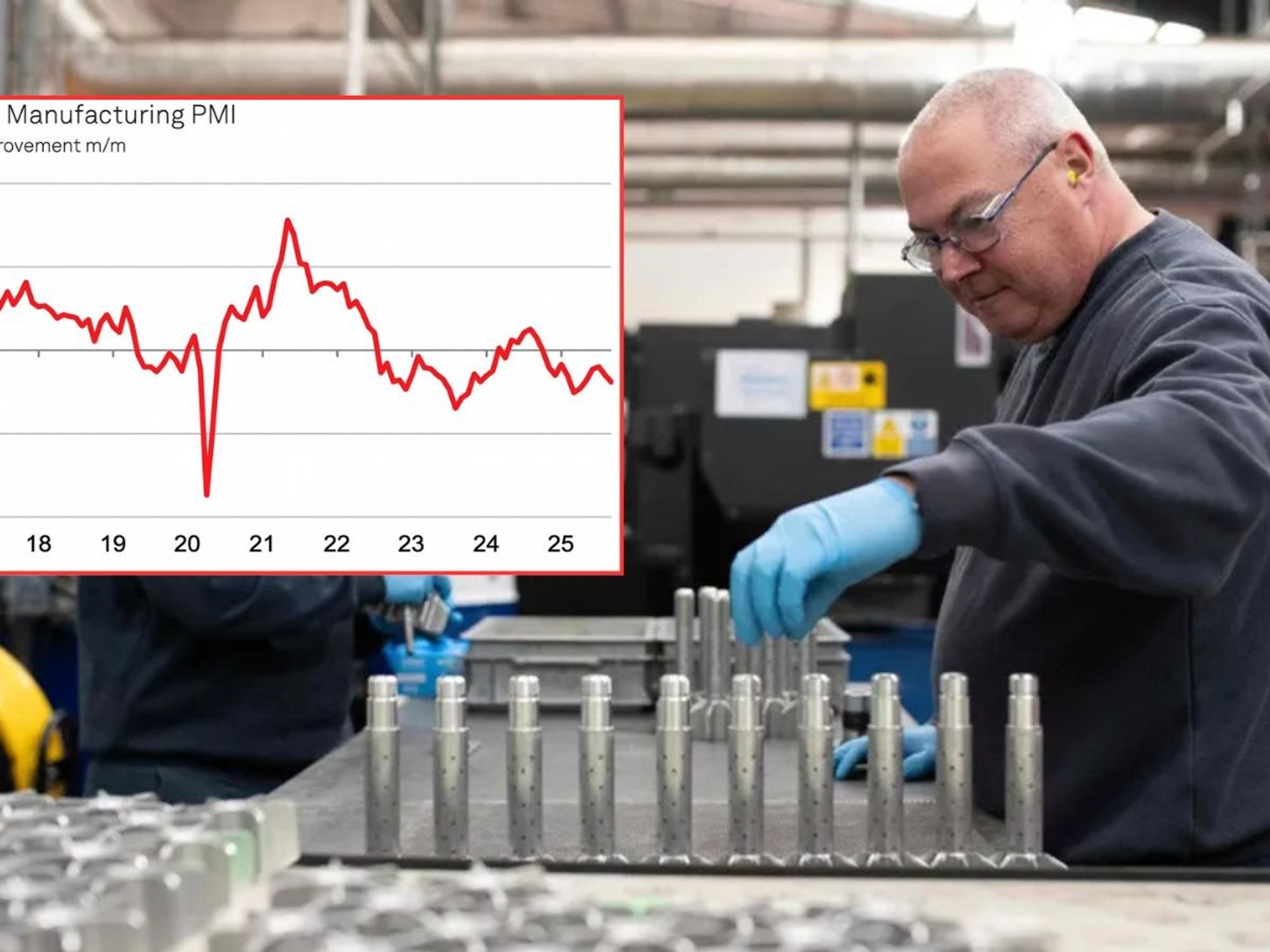

Coface Payment Survey graph

|Coface

The agricultural food sector and non-profit, Government and education organisations fare relatively better, with 78 per cent experiencing delays.

The causes of late payments vary by industry.

Construction, hospitality and paper or wood sectors point to rising interest rates as their main concern.

Business services, chemicals, energy, plastics, finance and ICT identify cybersecurity threats as their leading risk, while automotive, transport, manufacturing and retail point to supply chain disruptions.

Looking ahead to 2026, 37 per cent of companies anticipate a reduction in payment delays, citing expectations of enhanced profitability and stronger cash flow.

LATEST DEVELOPMENTS:

Average Payment terms by sector

|Coface

However, this optimism is not shared equally, as smaller enterprises remain far less confident, with 66 per cent believing the UK economy will either deteriorate or stagnate through 2026.

Mr Urbin said: "While new regulations and improving sentiment offer hope, the recovery must be broad-based to ensure that smaller companies are not left behind as payment practices evolve."

The research, based on Coface's analysis of £600billion in global trade, shows that payment delays have shifted from operational issues to reflect buyers' financial difficulties.

Some firms also reported deliberate postponements unrelated to liquidity constraints.