Relief for Rachel Reeves as borrowing costs PLUMMET but OBR economy 'downgrade' locked in

James Murray grilled on Rachel Reeves's Budget amid fears of further tax rises |

GB NEWS

The Chancellor is preparing to outline her vision for the economy in the upcoming Autumn Budget

Don't Miss

Most Read

Latest

British Government borrowing costs have decreased offering much-needed relief for Chancellor Rachel Reeves but economists warn this win comes after the Office for Budget Responsibility's (OBR) "downgrade" review of the UK economy has "probably closed".

The Chancellor has already received the OBR's assessment of the UK's economic trajectory as she seeks additional fiscal headroom ahead of her Autumn Budget on November 26.

Both 10-year and 30-year gilt yields fell today, which financial analysts note will likely reduce the borrowing costs that the Treasury is having to contend with going into next month's statement.

However, economists are citing it may be too late for the OBR to update its review with some sounding the alarm that the fiscal watchdog is likely to downgrade Britain's fiscal standing.

The Chancellor has been handed some much-needed relief as borrowing costs plummet

|GETTY / TRADING VIEW / CHATGPT

Simon French, the chief economist at Panmure Liberum, "With quite delicious/annoying timing the UK 10-year gilt yield has just cratered by 20 basis points in the last week, largely a sympathy move to US Treasuries, rather than anything UK-specific.

"This comes at a time when the OBR has probably closed its calculation period for the pre-measures Budget economic forecast. But that kind of move in gilts has £3billion of headroom implications against the current Budget rule.

"Expect representations from the Chancellor's office to get the Office for Budget Responsibility to move their calculation period to the right to capture some of this move."

The decline in gilt yields followed her remarks regarding the looming fiscal statement, in which she said "Of course, we're looking at tax and spending as well" when questioned about her plans.

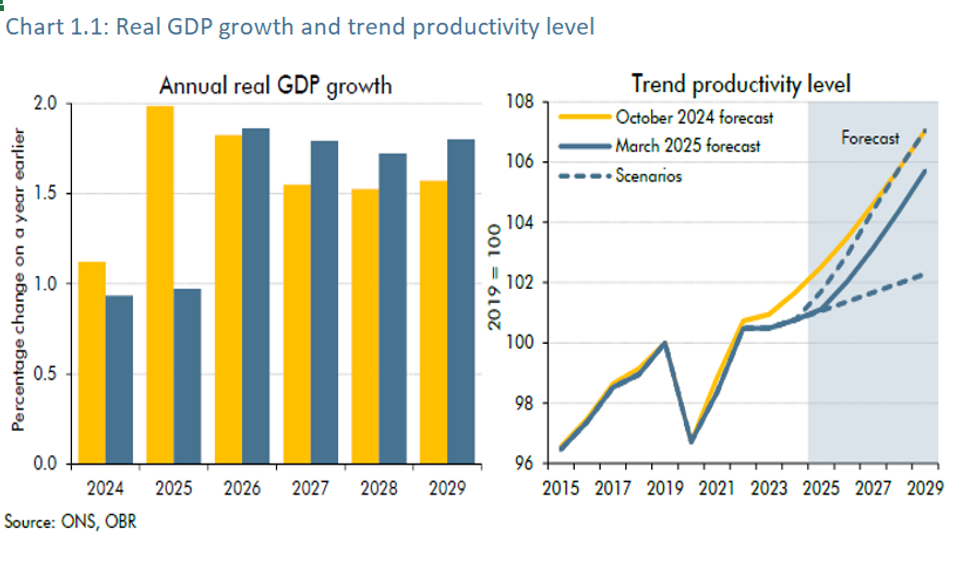

In the UK’s current situation, the forecast for productivity growth up to 2029/30 is also a make-or-break factor for meeting the chancellor’s fiscal rules | ONS/OBR

In the UK’s current situation, the forecast for productivity growth up to 2029/30 is also a make-or-break factor for meeting the chancellor’s fiscal rules | ONS/OBRMarket participants interpreted the Chancellor's comments to Sky News as a signal that revenue-raising measures would help maintain compliance with the government's fiscal framework.

During her attendance at the International Monetary Fund's (IMF) yearly gathering, Ms Reeves also revealed additional sanctions targeting Russia's petroleum sector.

Bank of England Governor Andrew Bailey's remarks about fragility in Britain's employment sector provided additional support for Government debt prices. His cautious assessment strengthened market expectations for additional monetary policy easing.

The benchmark British 10-year Government bond yield retreated to slightly above 4.5 per cent, having reached 4.8 per cent in early September.

Financial analysts attribute this movement partly to anticipated Federal Reserve actions, though deteriorating domestic labour conditions have increased the likelihood of UK rate reductions.

These developments occur as the IMF convenes its annual assembly, where fiscal sustainability remains a central concern for policymakers worldwide. The organisation has cautioned that worldwide government borrowing will reach 100 per cent of global economic output within four years.

Furthermore, the IMF's Fiscal Monitor publication revealed that collective state debt has increased more sharply than anticipated prior to the coronavirus crisis, when authorities intervened to safeguard populations and rescue struggling enterprises.

The body recommended that nations redirect expenditure towards productivity-enhancing sectors including infrastructure and education. Such investments would strengthen economic expansion and improve the sustainability of debt burdens, according to the fund's assessment presented at its Washington gathering.

LATEST DEVELOPMENTS:

The reduction in gilt yields offers significant advantages for the Treasury's budget calculations, according to financial experts.

Danni Hewson, head of financial analysis at AJ Bell, noted that the Chancellor "will be happy to see gilt yields falling back" as she prepares her fiscal statement.

Market observers suggest that economists face considerable uncertainty when projecting the funding requirements for balancing public finances.

"Estimates vary considerably, but one thing they have in common is they are all very big numbers," Ms Hewson explained.

More From GB News