Economy update: Ftse 100 surges AGAIN despite US court reinstating Donald Trump's tariffs

Donald Trump's tariff agenda has hit a roadblock in the UK court system

Don't Miss

Most Read

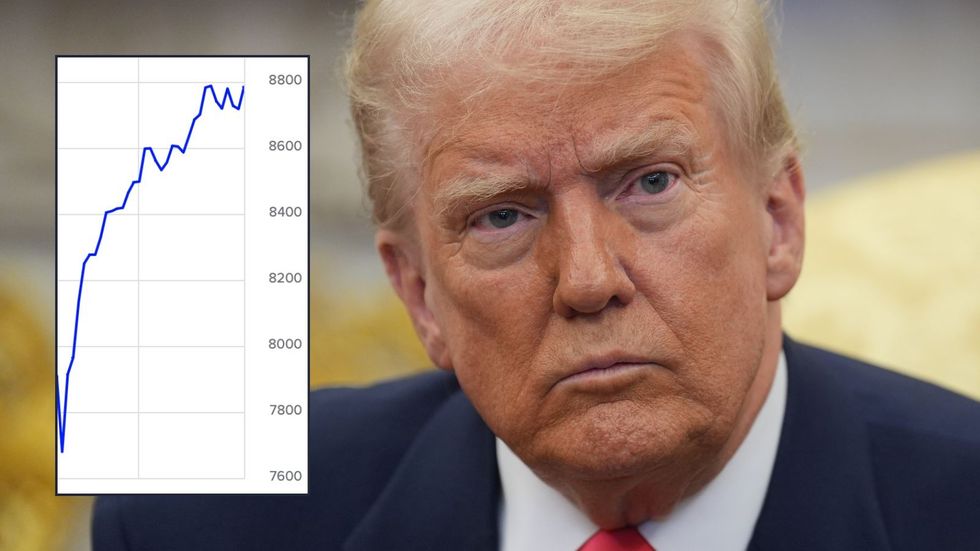

The Ftse 100 jumped 35 points at the open to 8,751.64, looking to end the week on the front foot despite ongoing uncertainty around President Donald Trump's tariffs on trading partners.

Last month, Prime Minister Keir Starmer touted the Labour Government's deal with the White House, which saw tariffs on steel and aluminium scrapped.

However, the Trump administration is still expected to implement taxes on UK imports to some degree in a blow to sections of the UK economy.

Earlier this week, the US Court of International Trade’s ruling struck down the tariffs imposed by Trump on imports from Mexico, Canada, and China in response to a lawsuit put forward by multiple state attorneys and small American companies.

The Ftse has surged despite the economic threat posed by Donald Trump's tariffs

|PA / LONDON STOCK MARKET

Despite the federal court's ruling being temporarily suspended, the FTSE 100 and wider global market appear to be reacting positively to the possibility tariffs may be not implemented in full.

At the Ftse's opening this morning, M&G led the gainers, jumping 6.6 per cent on news of its strategic partnership with Japan's Dai-ichi Life.

The deal is expected to generate $6billion (£4.5billion) in business for the UK group over five years.

Beazley and Hiscox are also near the top of the leaderboard with gains of more than two per cent each, as the usually staid insurance sector burst into life.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

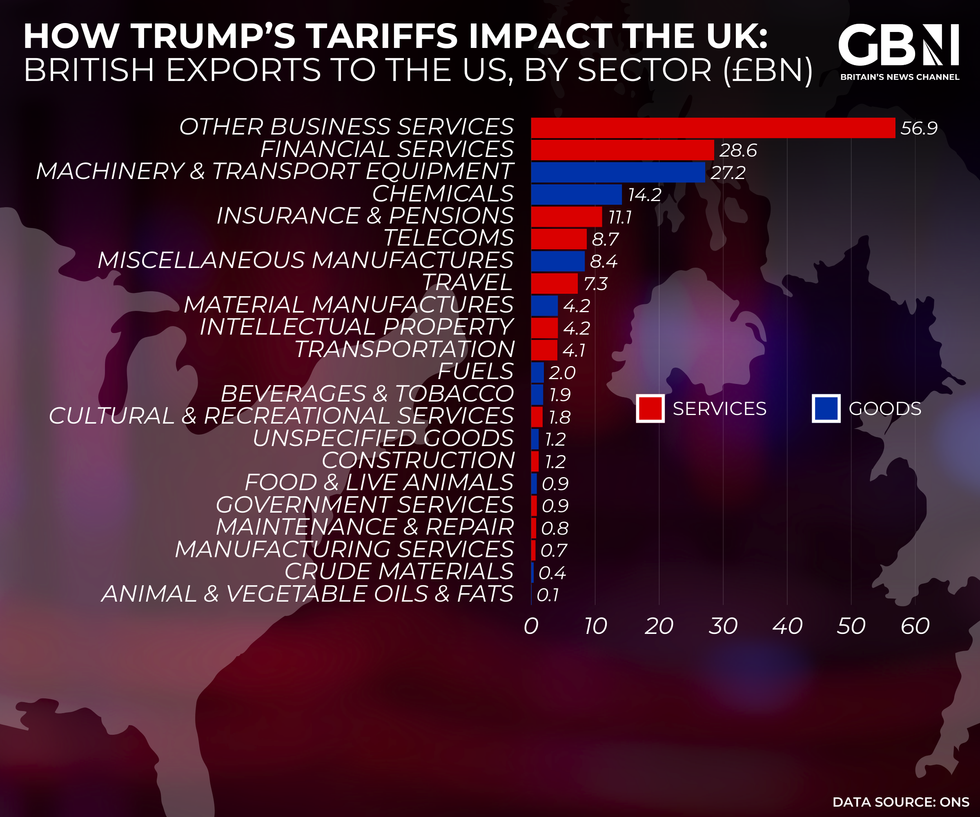

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWSMiners traded lower this morning, with Anglo American, Rio Tinto, Endeavour Mining and Fresnillo all shedding over one per cent.

The M&G partnership with Dai-ichi Life generated excitement in the insurance sector, with AJ Bell investment director Russ Mould noting that "the usually staid insurance sector burst into life as M&G's strategic partnership with Japan's Dai-ichi Life generated excitement".

However, a rally on Wall Street ran out of steam overnight and futures markets are pointing to declines later for the main indices after a federal appeals court has reinstated Trump's tariff plan.

The tariffs now remain in effect and will not be blocked after 10 days as ordered by the Court of International Trade.

"The story on tariffs has more twists than an M. Night Shyamalan film, with a federal court providing the latest plot point overnight," says AJ Bell investment director Russ Mould.

Despite the Ftse's rally, ongoing certainty remains whether President Trump's tariffs will continue in their current form, be negotiated lower, or disappear entirely.

LATEST DEVELOPMENTS:

The UK stock market has rallied despite Trump's commitment to tariffs | GETTY

The UK stock market has rallied despite Trump's commitment to tariffs | GETTY "In less than a week we've had a one-week forward 50 per cent tariff imposed on the EU, the same tariff delayed by 5 weeks, the US Court of International Trade rule that a large swathe of the US Administration's tariffs are illegal, the Court of Appeal yesterday granting a temporary stay that leaves the tariffs in force while it considers the case, as well as news that the Administration will turn to alternative powers if they lose their court appeal," Deutsche Bank's Jim Reid wrote in a note.

"It really is hard to keep up. Trading and analysing this market successfully requires a lot of luck."

More From GB News