FTSE 100 skyrockets after Donald Trump's U-turn on EU tariff threats in boon for UK economy: 'Huge rebound!'

Labour's history of economic woes and recessions |

GB NEWS

Donald Trump has postponed his decision to impose a 50 per cent tariff on the European Union

Don't Miss

Most Read

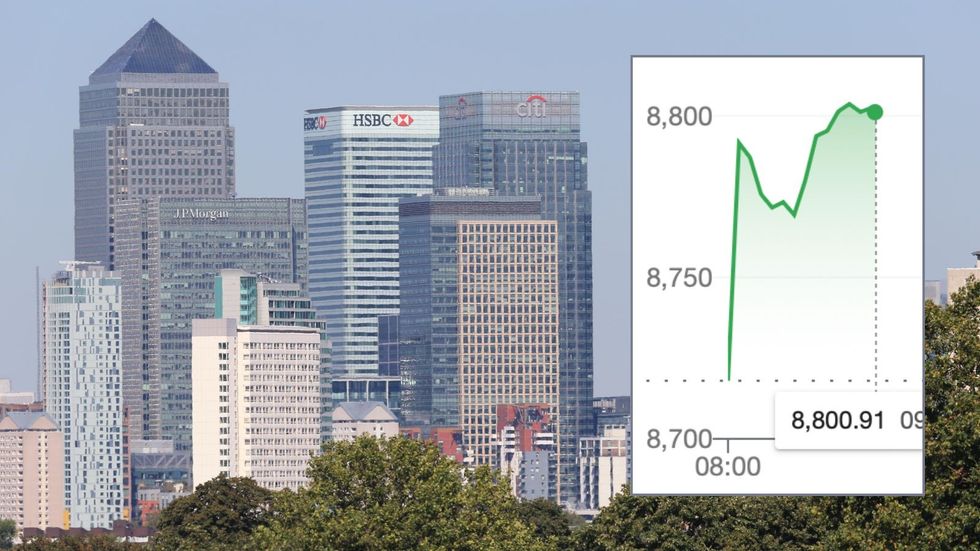

The FTSE 100 skyrocketed 72 points to 8,790.67 in initial trading earlier this morning, as London markets play catch-up with European indices following the UK's bank holiday weekend.

In a boon for the economy, London benchmark is making solid gains after European markets rallied yesterday, with investors responding positively to developments in US-EU trade relations after President Donald Trump's tariff threats.

The index had ended last week on a downward note but is now rebounding strongly as trading resumes after the long weekend. Finance and aerospace stocks are leading the rise in the FTSE 100, with several key companies showing strong performance.

Among the top gainers are Melrose Industries, BAE Systems, IAG, and Rolls-Royce from the aerospace sector. Financial stocks are also performing well, with St James's Place, Intermediate Capital and Schroders all making significant contributions to the index's upward movement.

The FTSE has surged this morning

|GOOGLE / PA

Meanwhile, precious metals miners are lagging behind, as the gold price has dropped $40 from Friday's levels. The positive market sentiment follows a significant development in US-EU trade relations.

Over the bank holiday, the White House announced it will delay the introduction of a 50 per cent tariff on all EU imports until July 9, allowing more time for trade negotiations between the blocs.

This decision came after a phone call between President Trump and EU Commission President Ursula von der Leyen, who had requested additional time for ongoing discussions.

On May 25,, Donald Trump wrote on social media that he was pushing his initial deadline back, after a "very nice" call with the European Commission chief, who also claimed the EU was "ready to advance talks swiftly and decisively".

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Donald Trump has made tariffs the focus of his economic agenda | REUTERS

Donald Trump has made tariffs the focus of his economic agenda | REUTERSEuropean markets responded favourably to this news yesterday, with the German DAX and French CAC adding 1.7 per cent and 1.2 per cent respectively, after a period of stagnation.

Jim Reid, a research strategist at Deutsche Bank notes that the size of Friday's market fall "showed that markets are getting more accustomed to Trump's threats and now partly assume the full threat won't immediately materialise".

"There is certainly fear fatigue," Reid adds, observing that the dollar has not rallied since Friday's news and has instead edged lower.

He suggests that "investors are seemingly of the view that continued aggressive tariff headlines chip away at investors desire to hold US assets," pointing out that European bond markets rallied yesterday while 30-year yields were two-to-five basis points lower.

Asian markets are mainly higher this morning, with Japan's Nikkei up 0.4 per cent and the Hang Seng gaining 0.3 per cent, though the Shanghai Composite has dipped 0.2 per cent.

Reid points this "could have been a problem if we were still facing the June 1 50 per cent tariff deadline for the EU," but the extension to July 9th has alleviated immediate concerns for investors.

LATEST DEVELOPMENTS:

Rachel Reeves is attempting to grow the UK economy

| GettyFurthermore, retail investors seem to becoming more interested in UK stocks after a survey by Hargreaves Lansdown found that confidence among clients is up 70 per cent compared with April.

Confidence in UK economic growth increased at an even quicker pace, rising 85 per cent on the previous month.

Victoria Hasler, the head of fund research at Hargreaves Lansdown, explained:: “After a terrible month in April, May saw a huge rebound in investor confidence among HL clients.

"The pause in tariffs, combined with opportunities presented by the fall in markets, saw investor confidence rise across all regions in our survey."

More From GB News