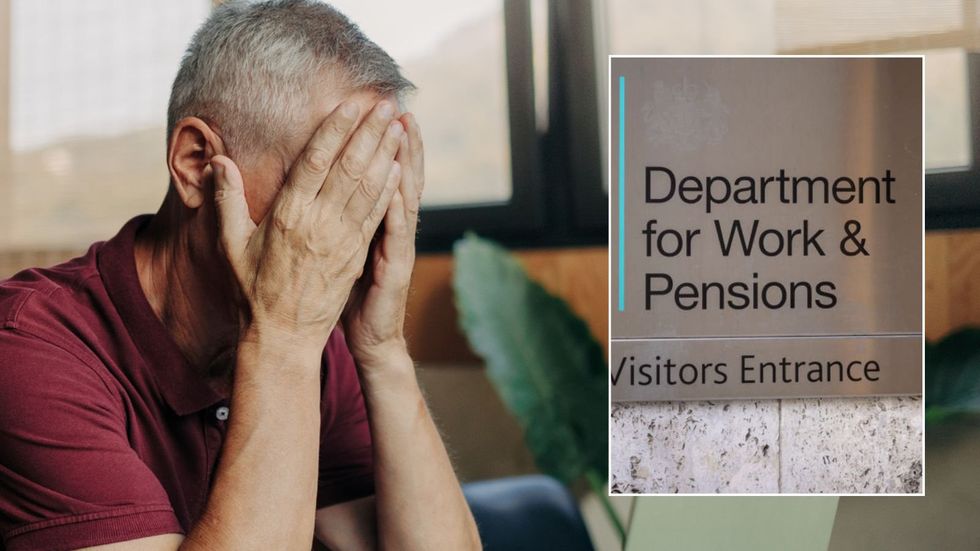

DWP warning as millions of Universal Credit claimants could face cuts of up to £624 a year

Millions are losing an average of £52 a month from their benefits

Don't Miss

Most Read

More than 3.1 million households claiming Universal Credit are now subject to automatic deductions from their monthly payments, according to Department for Work and Pensions figures from August 2025.

These claimants are losing an average of £52 each month, amounting to approximately £624 annually, as the government recovers debts ranging from previous overpayments to emergency advance loans.

The number of affected households has risen substantially, with 400,000 more families experiencing deductions compared to September 2024.

The money is withheld before payments reach recipients, covering obligations that include benefit advances taken during financial hardship, historical overpayments made by the DWP itself, and arrears owed to third parties such as landlords and utility companies.

Conor Lawlor, benefits expert at Turn2us, says: "These debts can accrue in several ways, including for Universal Credit and other benefit overpayments (even if the overpayment was made in error by DWP), benefit advances and recovering hardship payments."

He adds: "The DWP can also deduct on behalf of third parties if a claimant is in debt to them, including for rent and service charge arrears, council tax arrears, court fines, child maintenance, and for utilities like electricity, gas and water."

Not all deductions are mandatory, however, with some arrangements being voluntary.

Million of Universal Credit claimants face cuts of up to £624 a year

| GETTYAmong the most frequent causes of reduced payments is the advance payment system, which allows claimants to borrow money during the initial waiting period before their first Universal Credit payment arrives.

New Universal Credit claimants typically face a five-week wait before receiving their first payment, as funds arrive seven days after the initial four-week assessment period concludes.

Those struggling to cover essential costs such as rent or food during this period can request an advance, though this functions as a loan requiring full repayment.

Deductions begin immediately with the first regular payment, and recipients must clear the debt within 24 months for new claims or six months if the advance relates to changed circumstances.

Claimants facing genuine hardship may request a delay to their repayments

| GETTYClaimants facing genuine hardship may request a delay to their repayments, with new applicants potentially securing a three-month postponement and those with circumstance changes eligible for one month's grace.

Such deferrals are only granted in exceptional situations, and the DWP notifies recipients of deduction amounts through their online journal or by letter.

The standard cap on monthly deductions stands at 15 per cent of a claimant's Universal Credit standard allowance, though this limit does not apply when last-resort deductions are in place.

Last-resort deductions exist specifically to prevent eviction or disconnection from essential utilities, with payments going directly to creditors such as landlords or energy suppliers.

Third-party deductions are typically fixed at five per cent of the standard allowance per creditor

| GETTYThird-party deductions are typically fixed at five per cent of the standard allowance per creditor, but rent arrears attract higher rates ranging from 10 to 20 per cent.

Only three third-party deductions can operate simultaneously, and claimants receive notification through their online journal when such arrangements commence.

For joint claims, any debts held by either partner are deducted from the household's combined payment before it reaches the recipients.

More From GB News