DWP 'scandal' erupts as Britons lose £60 in Universal Credit payments due to 'harsh treatment'

GB NEWS

The DWP is being compared to 'harsh' lenders in its treatment of Universal Credit claimants

Don't Miss

Most Read

Latest

The Department for Work and Pensions (DWP) employs debt collection methods far harsher than those permitted for commercial lenders, according to new research from the Money and Mental Health Policy Institute.

As it stands, the DWP can deduct 15 per cent of monthly Universal Credit payments when benefits have been overpaid, often implementing this within just one month of identifying an overpayment.

For a single adult aged 25 and over, this amounts to £60 monthly which could a significant financial blow for those already on low incomes in the ongoing cost of living crisis.

Recipients receive minimal warning through an letter and online message stating: "You have been paid more Universal Credit than you are entitled to. This will now be taken back."

Universal Credit claimants are losing money due to 'harsh treatment' from the DWP

|GETTY

Analysts note that the DWP's approach starkly contrasts with consumer creditor requirements. Commercial lenders must secure a court order before forcibly taking money from someone's income, a process typically requiring six to twelve months.

Consumer creditors like banks, credit card companies and utility firms must engage extensively with debtors, proactively offering opportunities to arrange affordable repayment plans.

However, critics argue the DWP provides little explanation about negotiating payment arrangements.

Even when individuals manage to contact the DWP and agree a repayment plan, the department still takes an initial 15 per cent deduction from their Universal Credit payment, regardless if this amount is affordable.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

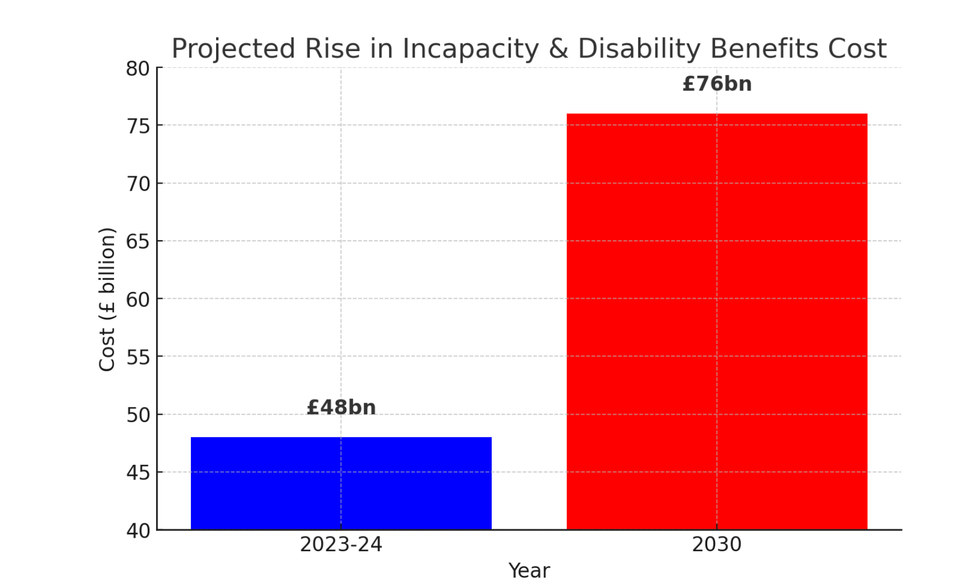

The cost of incapacity benefits is set to skyrocket over the next five years | ChatGPT

The cost of incapacity benefits is set to skyrocket over the next five years | ChatGPTOne participant described the impact: "Having money deducted from my benefits has made it difficult for me to make ends meet and some days I have been not eating because I can't afford to, which is leaving my mental health in tatters."

The research indicates 1.1 million people across the UK currently owe money to the DWP from benefits overpayments.

Money and Mental Health is urging the government to reform its collection processes before the DWP gains additional powers through the Public Authorities (Fraud, Error and Recovery) Bill.

These new powers would enable direct deductions from bank accounts of those no longer receiving benefits or in PAYE employment, without court orders.

Helen Undy, the chief executive of the Money and Mental Health Policy Institute, said: "The Government’s harsh treatment of people who’ve been overpaid benefits is reminiscent of the Carers’ Allowance scandal.

"When people are paid more in Universal Credit than they are entitled to, it’s often through no fault of their own, and sometimes the first they know of it is when the government takes sudden and brutal steps to claw those payments back.

LATEST DEVELOPMENTS:

Universal Credit is the primary benefit administered by the DWP

| PA"Many people we work with are already running out of money for food before the end of the month, suddenly taking £60 from what they have left plunges them into further financial hardship and needless distress.

"The Government has pledged to overhaul how it reclaims Carers’ Allowance, now it needs to do the same for how it collects Universal Credit overpayments. Above all, that means proactively giving people a real chance to negotiate a payment plan that they can actually afford, instead of just taking money out of people’s income with barely any warning.”

"We’d also like to see better standards applied across all government debt collection. It cannot be right that the state is lagging far behind the standards that consumer creditors have to meet in treating people fairly and with respect if they fall behind on payments."

A DWP spokesperson said that the department "would always support those struggling with repayments to agree affordable plans". They added: "We have introduced a new Fair Repayment Rate, which caps debt repayments made in Universal Credit at 15%, allowing 1.2 million households to keep more of their Universal Credit."

"Our new Fraud Bill will help us to identify overpayments at the earliest stage so we can help prevent people falling into debt, and to do so in a way that is fair and proportionate."