Coventry Building Society launches 'flexible' 5% savings interest rate with £50k prize draw up for grabs

Banks and building societies, including Coventry, are offering competitive savings accounts to customers

Don't Miss

Most Read

Coventry Building Society has launched a new exclusive savings account offering a five per cent interest rate with customers having the chance to win a share of a £50,000 prize draw.

The Loyalty Regular Saver (3) account is available to members who have held a savings account or mortgage with the society since at least January 1, 2025.

This prize draw will award 50 prizes of £1,000 each to qualifying members and savers will need to have at least £100 in their account by May 31, 2025 to be eligible .

The new account forms part of Coventry's strategy to reward loyal customers with the product having a 12-month term.

Coventry Building Society has launched a new savings account

| COVENTRY BUILDING SOCIETYThanks to the Loyalty Saver, Coventry Building Society will be able to deposit up to £250 each month. Members can make multiple deposits throughout the month as long as they don't exceed the monthly limit.

If customers save the maximum amount every month, they could earn £3,080.89 in total after a year, including interest, according to the lender.

Furthermore, the savings account's minimum balance requirement is just £1, making the account accessible to most savers.

The prize draw offers 50 chances to win £1,000, providing an additional incentive beyond the competitive interest rate.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are looking for best savings deals

| GETTYDuring 2024, Coventry Building Society provided £401million in extra value to customers with this value came from offering savings rates higher than the market average.

The higher interest rates applied to both new and closed accounts, benefiting existing customers.

Bethaney Cozens, a savings manager at Coventry Building Society, broke down why the financial institution's latest product is beneifical for customers.

She explained: "Our loyalty accounts are one of the ways we can reward our two million members for saving their money with us.

LATEST DEVELOPMENTS:

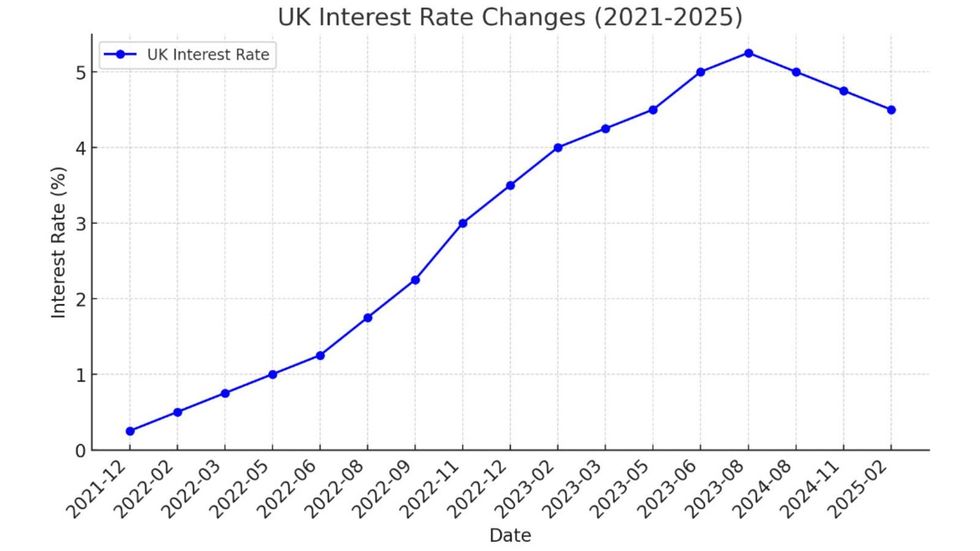

The Bank of England has made multiple changes to the base rate over the years | CHAT GPT

The Bank of England has made multiple changes to the base rate over the years | CHAT GPT "But the cherry on top of the cake is the prize draw. With 50 chances for our loyal members to win an extra £1,000, there’s plenty of incentive to save a little and often in a Loyalty Regular Saver.

"We’ve tried to be as flexible as we can to cater for our members who want to build up their savings in different ways. Some may want to save every week, for others it may be once a month.

"We’ve kept the minimum balance at just £1 and there’s no limit on the number of times savers can put money in over the year, as long as it doesn’t exceed £250 a month."

The Bank of England's Monetary Policy Committee (MPC) next meeting to discuss interest rates falls on May 8, 2025.