Council tax loophole exposed as second-home owners dodge 100 per cent tax

Inherited properties can receive council tax exemption for up to twelve months after probate while being marketed

Don't Miss

Most Read

Latest

Property owners are finding new ways to stay one step ahead of tougher taxes aimed at second homes.

Campaigners warn that loopholes are already being exploited, undermining efforts to free up housing for local buyers.

Owners of second homes are avoiding the new 100 per cent council tax surcharge by reclassifying their properties as short-term holiday lets, similar to Airbnb-style rentals.

More than 200 local authorities have already introduced the doubled council tax charge since the powers came into force last April.

A further 38 councils are due to bring in the premium this coming April as part of wider government efforts to boost housing availability for first-time buyers.

However, housing campaign group Generation Rent has raised concerns that some owners are exploiting a loophole by switching their properties to short-term holiday rentals for part of the year, allowing them to dodge the higher council tax bill.

Government data from the Valuation Office Agency shows that the number of second homes in England fell from 279,870 in September 2024 to 268,152 a year later, a drop of more than 11,000 properties.

However, over the same period, the number of properties registered as holiday lets rose by 1.2 per cent, reaching 67,858.

The reason for this shift is simple. A property can be classed as a holiday let if it is available to rent for at least 140 nights a year and is actually let out for at least 70 nights.

Once a property meets these conditions, the owner no longer pays council tax. Instead, they pay business rates, which are based on the property’s estimated rental value.

Council tax loophole exposed as second-home owners dodge 100 per cent tax

| PAIf the property’s potential annual rental value is £12,000 or less, the owner qualifies for small business rate relief, meaning no tax is paid at all.

Dan Wilson Craw from Generation Rent said: "The changes appear to have started an encouraging decline in the number of holiday homes, although it seems that some owners have responded by switching their properties to holiday lets."

He added: "That means there is still more work to do to bring homes back into residential use."

The campaigner warned that the shift from long-term tenants to short-stay tourists is forcing families out of their local areas.

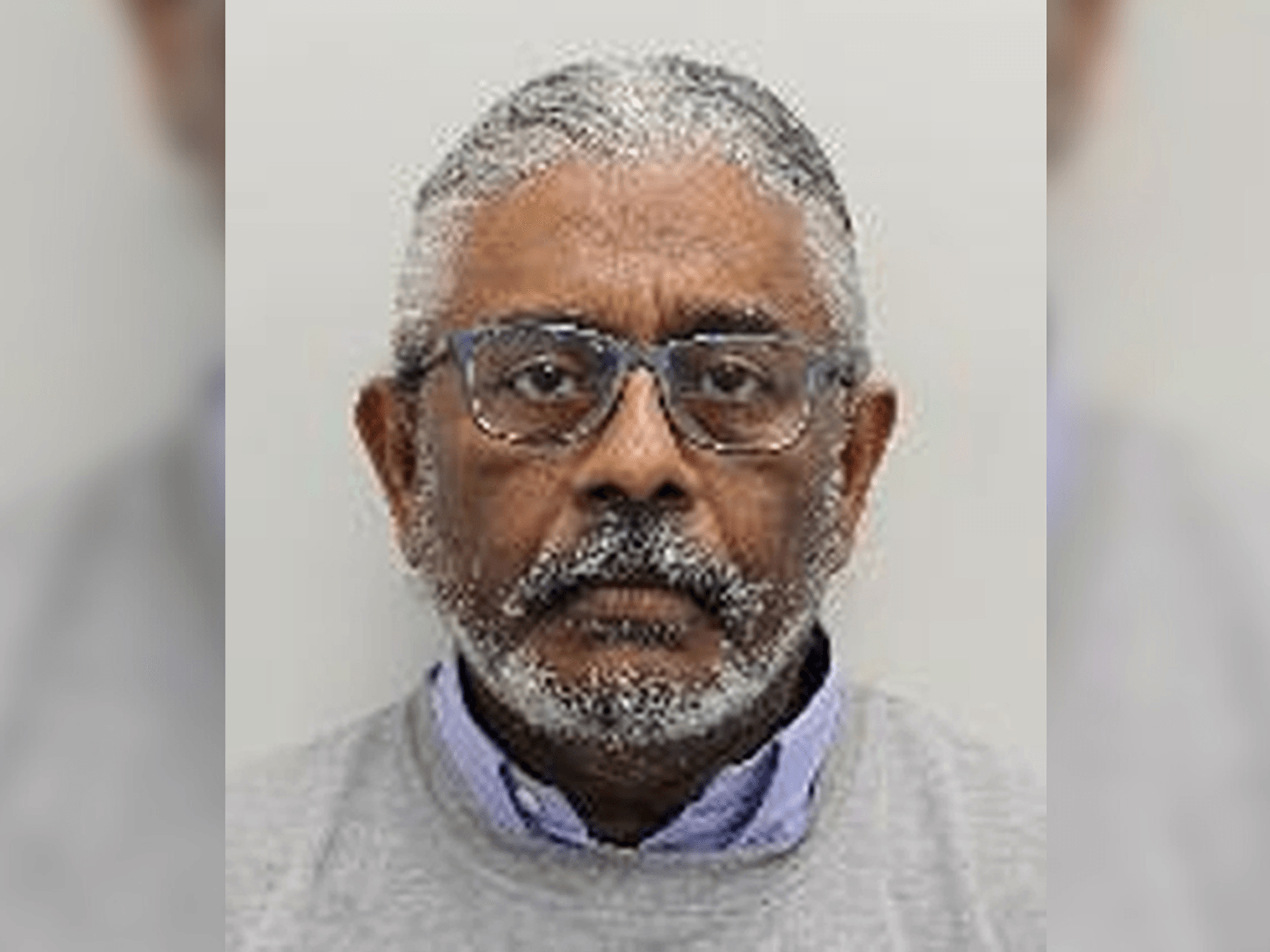

Owners of second homes are avoiding the new 100 per cent council tax surcharge

| GETTY"Everybody needs a secure home they can afford, but in many areas landlords have switched from tenants to tourists, driving families out of their communities," Wilson Craw said.

He urged ministers to grant English councils the authority to license holiday lettings and cap their numbers.

The Isles of Scilly tops the list of areas most affected, with 31 per cent of all properties classified as either holiday lets or second homes, according to Generation Rent analysis.

The City of London ranks second at 24 per cent, followed by North Norfolk at 14 per cent.

Various other exemptions also allow owners to sidestep the surcharge

| GETTYProperty firm Colliers reported that 73,838 holiday lets across England and Wales were receiving full business rate relief as of last June.

Various other exemptions also allow owners to sidestep the surcharge. Properties provided by employers for work purposes are exempt, as are those with planning restrictions preventing residential use.

Inherited properties can receive council tax exemption for up to twelve months after probate while being marketed.

More From GB News