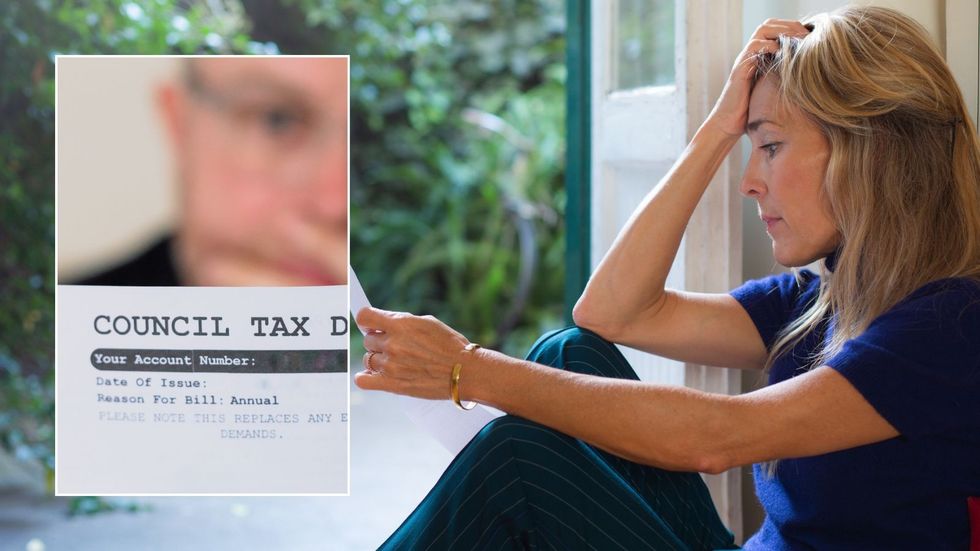

Council tax warning: Middle-class households could face higher bills as MPs demand urgent reform to 'unfair' system

The Institute for Fiscal Studies has cautioned that Britain could experience the most rapid council tax growth in two decades

Don't Miss

Most Read

Wealthy homeowners could soon face higher council tax bills under proposals that would hand sweeping new powers to local councils.

A group of MPs has called for a major shake-up of the system, including the power to revalue homes and raise charges on expensive properties.

The cross-party Housing, Communities and Local Government Committee said councils should be allowed to reassess property values in their area, create new council tax bands, and change discount rules.

It described the current system as "highly regressive" and "extraordinarily unfair" because it is still based on 1991 property values, meaning lower-value homes often pay a higher share relative to their market worth.

The committee has urged the Government to "begin the process of overhauling or replacing council tax" and give more power to local authorities while that work is underway.

These changes could mean higher council tax bills for households in wealthier areas, where property prices have risen the most over the last 30 years.

MPs warned that the current system places an unfair burden on lower-value homes, which often pay more relative to their actual market value.

This imbalance is caused by outdated property valuations from 1991, which no longer reflect today’s housing market across England.

The committee also recommended giving councils the power to introduce a "tourist levy" in busy holiday hotspots, a move supported by deputy Labour leader Angela Rayner but opposed by Chancellor Rachel Reeves.

Council tax bills are set to rise | GETTY

Council tax bills are set to rise | GETTY Elliot Keck, representing the TaxPayers' Alliance, warned: "While there is a case for revaluation and for giving councils some flexibility, households are already being clobbered annually by inflation-busting rate rises on top of the catastrophic tax raid launched in last year's Budget."

He argued that any reforms should prioritise reducing the total council tax burden on families.

The current system places properties worth over £320,000 in the highest band H category, yet these homes contribute only triple the council tax amount paid by band A properties valued under £40,000.

England's council tax structure comprises eight bands ranging from A to H, with thresholds established using 1991 property values that remain unchanged today.

Middle-class households could face higher bills as MPs demand urgent reform

| GETTYProperties in band B fall between £40,000 and £52,000, whilst band D homes are valued between £68,000 and £88,000 based on these outdated assessments.

The middle bands include C (£52,000-£68,000), E (£88,000-£120,000), F (£120,000-£160,000) and G (£160,000-£320,000), creating a framework that no longer aligns with modern property markets.

Local authorities currently possess the authority to establish council tax rates for each band within government-prescribed limits, resulting in substantial variations in bills nationwide.

Remarkably, 11.6 million households - representing 46 per cent of all homes - paid more than the £1,828 band H rate applied to Buckingham Palace during the previous year.

The typical band D property saw its average charge increase by £109 to £2,280, according to Government figures

| GETTYThis marks a significant increase from 2011-12, when 7.5 million households, or 32 per cent, exceeded this threshold.

The typical band D property saw its average charge increase by £109 to £2,280, according to Government figures.

The Institute for Fiscal Studies has cautioned that Britain could experience the most rapid council tax growth in two decades, potentially resulting in half of all local authorities imposing rises exceeding £500 by 2030.

More From GB News