Council tax crisis: Arrears hit record £8.3bn under Labour as 'broken system' blamed for rise in non-payers

GB News

Treasury forecasts show council tax is expected to rise five per cent each year to fund local services, piling further pressure on households

Don't Miss

Most Read

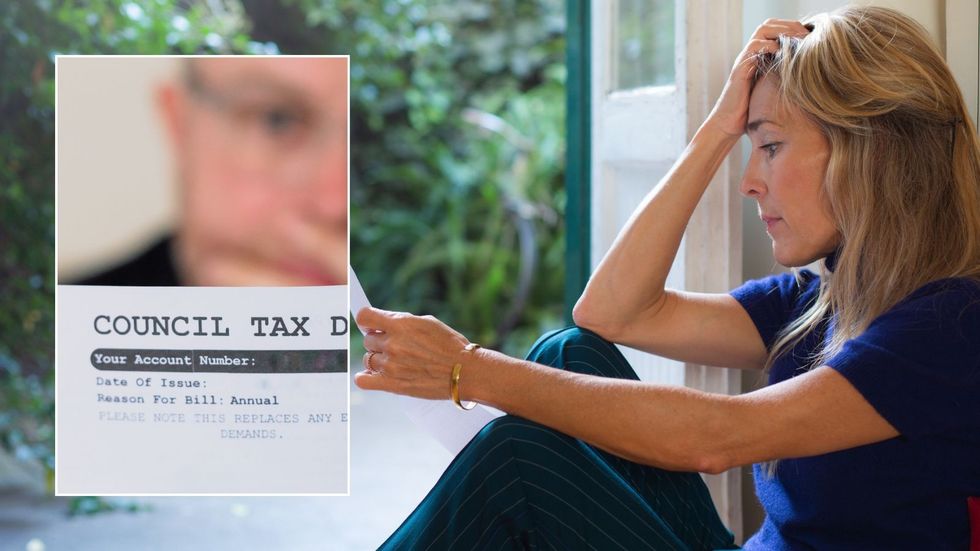

Council tax arrears across Britain have reached a record of nearly £8.3bn, underlining the deepening financial strain on households amid the ongoing cost of living crisis

In the past financial year alone, arrears rose across the country by £802millin – an 11 per cent jump from the previous year.

Figures released today by the Ministry of Housing, Communities and Local Government show that council tax arrears in England have reached more than £6.6bn, while recent figures from Scotland and Wales put arrears at £1.5bn and £0.16bn respectively.

The rise comes as nine in ten local authorities increased council tax by the maximum five per cent this year, pushing average Band D bills to £2,280.

More than 200 councils have also introduced double charges on second homes, leaving owners facing an average bill of £3,672.

Debt Justice found that a third of people in arrears are living below the poverty line, while 79 per cent of those behind on payments fall within the bottom half of earners. StepChange Debt Charity said the figures highlight a deeply flawed system that is hitting the most financially vulnerable.

Peter Tutton, Director of Policy, Research and Public Affairs at StepChange, said: "These figures today are unsurprising and point to a broken system which is repeatedly pushing the most financially vulnerable groups into hardship, as councils scramble to fund essential services against an incredibly difficult financial backdrop."

He added: "As it stands, existing practices around council tax debt collection only exacerbate financial difficulty and the reality is that the current system lacks compassion and clarity."

Council tax bills are set to rise

| GETTY Taxpayers are struggling with the unsustainable burden of council tax | PA

Taxpayers are struggling with the unsustainable burden of council tax | PAPolling by YouGov for StepChange found that 41 per cent of those earning under £35,000 are worried about meeting their council tax payments, while nearly two-thirds said they are saving less due to rising essential bills. Council tax arrears among StepChange clients rose by 16 per cent in the last year, climbing from £1,805 to £2,094 on average.

The charity also warned that current enforcement rules worsen hardship, as a single missed council tax payment can result in councils demanding the full annual amount. Their research found that over four in five people in arrears reported feeling scared, anxious or depressed following contact from their local authority.

Toby Murray, Policy and Campaigns Manager at Debt Justice, said: "The vast majority of people aren’t avoiding council tax, they simply can’t afford it.

"People in council tax arrears are overwhelmingly on low incomes, and many are living in poverty. Rather than help, councils are sending in the bailiffs – punishing people for struggling with their bills. Councils should end the use of bailiffs for council tax debt collection and instead introduce urgent reforms, including a duty of care to protect people most at risk."

Arrears hit record £8.3bn

| GETTYJohn O'Connell, chief executive of the TaxPayers’ Alliance, criticised current council policies, saying: "With a record 4.4m people now in council tax debt, town hall bosses should be focusing on helping struggling households, not hammering second homeowners with punitive premiums."

He added: "Hiking taxes on one group won't solve the growing crisis facing millions of others."

Telegraph analysis shows councils are chasing £4.4 billion in unpaid taxes, with Labour-run local authorities owed more than £2.5 billion, almost four times the £673 million owed to Conservative councils. That means Labour councils are currently pursuing nearly twice as much unpaid council tax as their Tory counterparts.

Treasury documents from the recent spending review suggest council tax is expected to rise by five per cent annually to help fund local services, adding further strain to household finances.

Amid the crisis, the Government has pledged to consult on banning the use of bailiffs to collect arrears and to reform the wider council tax collection process.

A Government spokesman said: "Councils have a duty to behave sympathetically and proportionately towards people in hardship when collecting tax and offer affordable payment plans."

They added: "The Government will also consult on improving the council tax collection system."

As arrears reach record levels, questions are mounting over who is falling behind and why. While most in debt appear to be on low incomes, critics argue that a minority of higher earners may be exploiting weaknesses in the system to avoid payment altogether.

This has sparked debate over whether councils are doing enough to distinguish between those unable to pay and those unwilling to.

The new scheme is modelled on systems in the United States and Canada, where payouts have reached six figures

| PAIn a related effort to clamp down on wider tax avoidance, HMRC has stepped up its use of financial incentives to encourage whistleblowing. In the 2023- 24 financial year, the tax authority paid nearly £1 million to individuals who provided actionable intelligence about tax fraud.

Later in 2025, a formal whistleblower reward programme is expected to launch, offering tipsters between 10 and 25 per cent of any recovered tax.

The new scheme is modelled on systems in the United States and Canada, where payouts have reached six figures. HMRC says the initiative aims to protect public finances and increase pressure on those deliberately avoiding their obligations.