Cost of living alert: 16 million Britons slapped with 'unexpected' £5k bill over past year

Rachel Reeves attempting to ease cost of living while Labour aims to 'put more money in people's pockets' |

GB News

Nearly 16 million hit by major unexpected costs in past year

Don't Miss

Most Read

Nearly 16 million people across Britain have experienced "unexpected" financial shocks of more than £5,000 in the past twelve months, according to new research from Howden Life and Health.

The findings, drawn from the firm’s Health Gap report based on a survey of 3,000 adults, highlight widespread financial strain facing households across the UK.

Some 29 per cent of respondents reported encountering these large, unforeseen expenses during the previous year.

The study suggests that many households are being left exposed when sudden costs arise.

TRENDING

Stories

Videos

Your Say

Furthermore, 71 per cent said they turned to savings or investments to cover at least part of the financial burden.

Millions of others, however, were forced to seek alternative funding as rising prices continued to erode disposable income.

The data reveals sharp differences in how age groups responded to these pressures. Around 5.6 million people relied on credit cards or personal loans to manage the costs, rising to 47 per cent among those aged 35-44.

Family and friends were used as financial support by about four million people, representing 26 per cent of those affected.

Nearly 16 million hit by major unexpected costs in past year

|GETTY

Younger adults depended most heavily on this route, with almost half of 18-24 year-olds seeking support from loved ones.

The report indicates that many younger households lack the emergency savings needed to deal with sudden financial shocks. Researchers found a clear link between age and reliance on informal borrowing.

Notably, the pressures extend beyond conventional borrowing, with many people taking steps that could undermine their long-term financial resilience.

Approximately 2.4 million adults cancelled or paused insurance protection policies, including private medical insurance, life cover and income protection.

LATEST DEVELOPMENTS

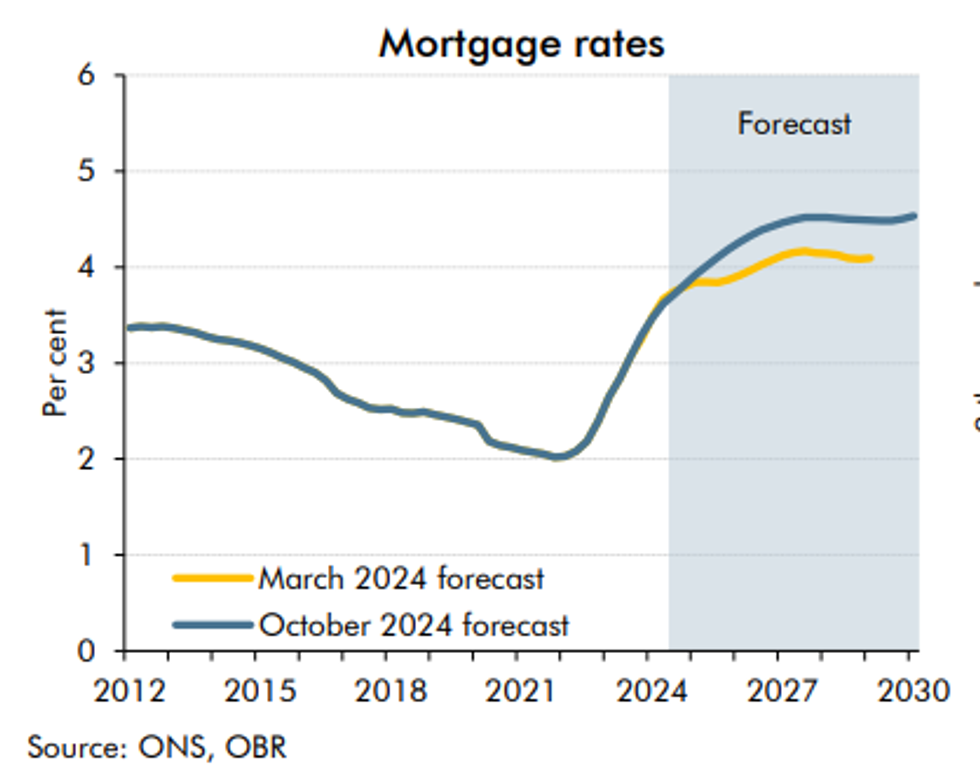

Mortgage rates are set to fall in a boost for holders | OBR

Mortgage rates are set to fall in a boost for holders | OBROne in five people under 34 had abandoned their insurance cover, suggesting younger households were again the most affected by rising financial demands.

Additionally, 14 per cent of all respondents reduced their pension contributions to free up additional monthly income.

Property-related measures were used by 12 per cent of those surveyed, including remortgaging or arranging mortgage payment holidays.

These steps carried significant long-term implications but were taken by households seeking immediate financial relief.

The report notes that the willingness to forgo key financial protections reflects the intensity of pressure felt across many parts of the country.

Jon Carroll, executive director at Howden Life and Health, expressed concern about the trends highlighted in the research.

"With rising living costs and wages failing to keep pace, it's understandable that many people are struggling to cope with unexpected expenses. But it's really worrying to see so many turning to credit, friends and family, or even cancelling their insurance to make ends meet.

Protection policies are there to provide a safety net when the unexpected happens - giving up that cover can leave people far more financially vulnerable in the long run."

Mr Carroll said households should seek professional advice before making major decisions affecting their long-term security.

He added: "Advice-led decisions can make a real difference to long-term insurability and overall financial resilience."

Families are urged to explore alternatives before cancelling policies altogether

|GETTY

He urged families to explore alternatives before cancelling policies altogether.

Mr Carroll explained: "By speaking with an adviser, households can often find more affordable ways to stay protected - whether that's switching to a better value provider, adjusting levels of cover, or exploring alternative products - rather than losing protection altogether."

Howden Life and Health said maintaining reduced cover is typically more beneficial than cancelling protection completely.

The firm encourages consumers to review current policies and compare market options before making permanent changes.

More From GB News