Hard-working Britons to lose £15k in spending power after Rachel Reeves's 'disastrous' Budget

Millions of Britons are considered to be high earners but not rich yet, otherwise known as Henry's

Don't Miss

Most Read

Latest

Hard-working Britons face losing up to £15,000 in "purchasing power" by 2029 due to policies unveiled by Chancellor Rachel Reeves during her Budget statement last month.

Young workers, considered to be High Earners Not Rich Yet (Henry's), face a substantial erosion of their spending power over the coming years as a consequence of the Budget reforms.

Research conducted by IG, the investment and trading platform, reveals that individuals in the top income bracket will experience a real-terms reduction in purchasing power exceeding £15,000 by 2029.

The study examined how frozen tax thresholds, welfare measures and Government spending choices will affect households across all income levels through to the end of the current Spending Review period in 2028-29.

Henry's will lose up to £15k in spending power, research has found

|GETTY / PA

Those earning around £103,700 annually face a net income impact of minus 0.3 per cent, the research found.

Workers in the ninth income decile, typically bringing home approximately £65,700, can expect their real purchasing power to fall by £8,935 over the same timeframe.

For those at the very top of the earnings scale, the picture is considerably bleaker, with a reduction of £15,658 projected for individuals on average salaries of £103,700.

The mechanism driving these losses is fiscal drag, whereby static tax thresholds gradually pull more earnings into higher tax bands as wages rise with inflation.

The Chancellor is under fire over her Budget decisions

| GETTYMeanwhile, those on the £65,700 threshold receive no net benefit whatsoever from the Budget measures, the IG analysis found.

Chris Beauchamp, chief market analyst at IG, said: "While the Chancellor met her fiscal rules and avoided increases to income tax or national insurance, the combination of policy measures and frozen thresholds will have a disproportionately large effect on Henry households."

He added: "As the name suggests, many in these income bands carry high living costs and wouldn't recognise themselves as 'rich'."

Mr Beauchamp warned that once inflation and fiscal drag are accounted for, the pressure on disposable income will compel some households to reconsider their spending, saving and long-term financial strategies.

Separate modelling by RSM UK for FT Adviser indicated that most high earners from 2021 will be roughly £28,000 worse off in total by the decade's end due to frozen thresholds, equating to approximately £2,300 annually in additional income tax.

The Budget has also sparked a political row, with Rachel Reeves defending herself against accusations from opposition figures that she exaggerated the scale of fiscal challenges facing the country.

Speaking to broadcasters, the Chancellor stated she "of course" did not mislead the public when presenting a pessimistic economic outlook in early November.

"Anyone who thinks that there was no repair job to be done on the public finances, I just don't accept that," she said directly after her fiscal statement.

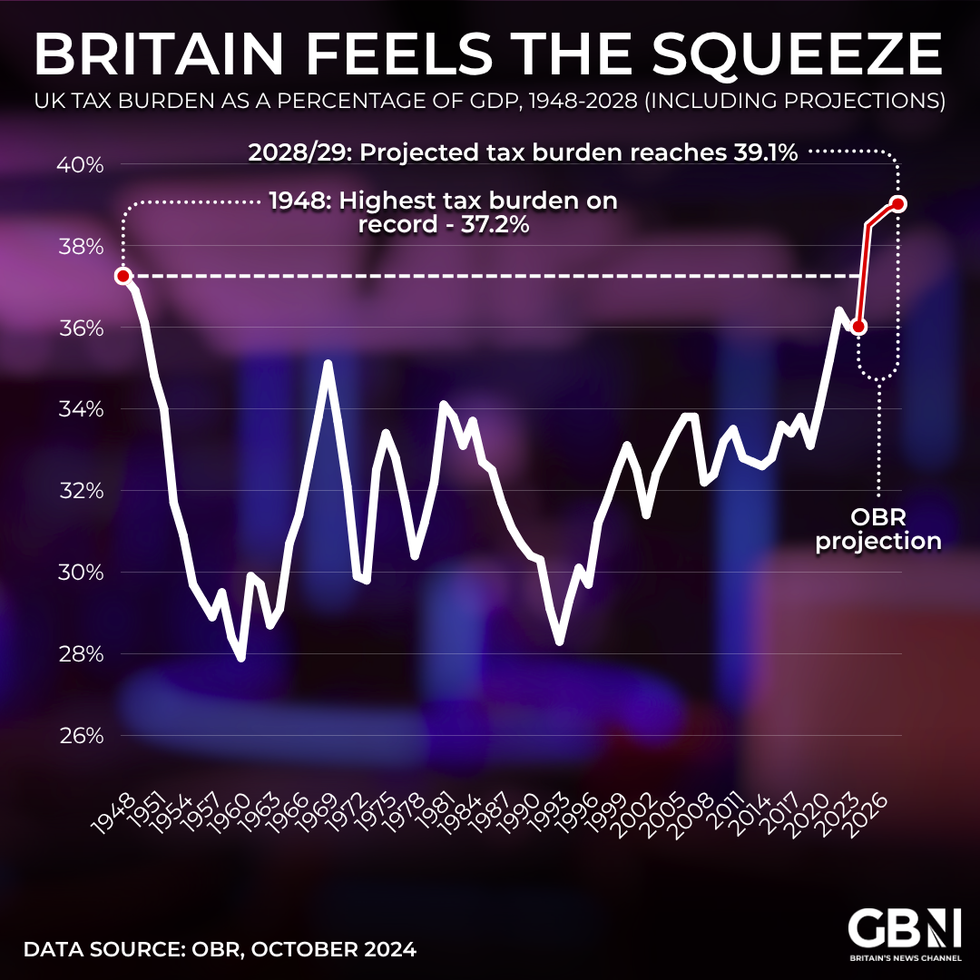

Tax Burden as a percentage of GDP | GETTY

Tax Burden as a percentage of GDP | GETTYConservative leader Kemi Badenoch has accused Reeves of being "misleading", arguing the OBR had already provided forecasts showing conditions were better than suggested.

Last week, the Chancellor was dealt with another blow when the gross domestic product (GDP) figure for October 2025 came in at negative 0.1 per cent, according to the Office for National Statistics (ONS).

Dan Coatsworth, head of markets at AJ Bell, shared: "The constant rumour mill about what might or might not be in November’s Budget caused consumers and businesses to put the brakes on spending in October.

"A worse than expected GDP figure is the result of a country going into a freeze, fearing that the Chancellor would hike taxes and leave less money in people’s pockets. There is a real chance that November’s GDP figure will be equally as gloomy given the Budget didn’t happen until the end of month.

"It’s a disastrous situation for Rachel Reeves, who put economic growth at the heart of her Budget plan. She will have hoped that the country ended the year on the front foot, with economic progression and optimism as we move into 2026. This lacklustre GDP data paints a very different picture."

More From GB News