Best savings account of the week: Britons implored to 'snap up' 7.5% interest rates - full list

Savers urged to be careful of tax on savings interest |

GB NEWS

Nationwide Building Society and NatWest are among the financial institutions offering the best savings interest rates of the week

Don't Miss

Most Read

Latest

Savers are being reminded to "snap up" the best savings accounts of the week while interest rates remain relatively high.

Experts from Moneyfactscompare have compiled a list of the top savings products currently on offer, with major banks and building societies being in the ranking.

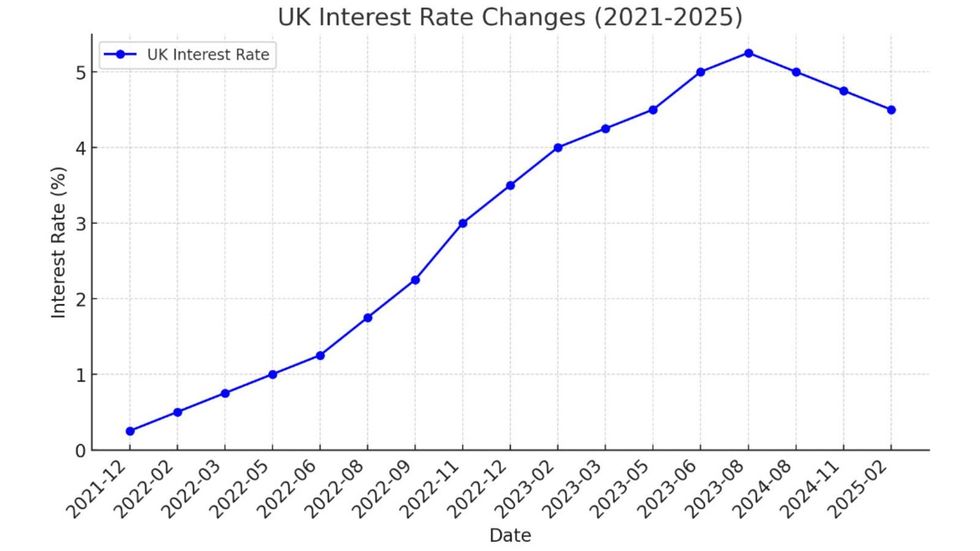

Savings account customers have benefited from recent hikes to the base rate from the Bank of England, which has attempted to ease inflation.

With the consumer price index (CPI) rate easing, the cost of borrowing in the UK has been reduced to 4.25 per cent, but this is likely to impact savings account offerings.

What are the best savings accounts of the week? | GETTY

What are the best savings accounts of the week? | GETTY Best regular savings accounts:

Here is a list of the best regular savings accounts currently on offer for the week with interest rates attached:

- Principality BS – 7.50 per cent AER / 7.36 per cent Gross

- Zopa – 7.10 per cent AER / 6.87 per cent Gross

- The Co-operative Bank – Seven per cent AER / Gross

- Nationwide BS – 6.5 per cent AER / Gross

- Melton BS – 6.5 per cent AER / Gross

- West Brom BS – Six per cent AER / Gross

- Market Harborough BS – 5.8 per cent AER / Gross

- NatWest – 5.5 per cent AER / 5.37 per cent Gross

- Royal Bank of Scotland – 5.5 per cent AER / 5.37 per cent Gross

- Progressive BS – 5.5 per cent AER / Gross.

Best fixed-rate savings accounts

Here is a list of the best savings accounts offering a one-year fixed interest rate:

- GB Bank - 4.58 per cent AER / Gross

- Marcus by Goldman Sachs® – 4.55 per cent AER / Gross

- Cynergy Bank – 4.52 per cent AER / Gross

- Vanquis Bank – 4.50 per cent AER / Gross

- Castle Trust Bank – 4.51 per cent AER / Gross

- LHV Bank – 4.5 per cent AER / Gross

- Zenith Bank (UK) Ltd – 4.47 per cent AER / Gross

- Union Bank of India (UK) Ltd – 4.457per cent AER / Gross

- Union Bank of India (UK) Ltd – 4.47 per cent AER / Gross

- Oxbury Bank– 4.45 per cent AER / Gross

- Close Brothers Savings - 4.45 per cent AER / Gross.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTYBest cash ISAs

Here is a list of the best cash ISAs with a one year fixed interest rate attached currently on offer:

- Hodge Bank – 4.32 per cent AER / Gross

- Close Brothers Savings – 4.32 per cent AER / Gross

- Castle Trust Bank – 4.31 per cent AER / Gross

- Vanquis Bank – 4.30 per cent AER / Gross

- Vida Savings – 4.25 per cent AER / Gross

- Kent Reliance – 4.25 per cent AER / Gross

- United Trust Bank – 4.25 per cent AER / Gross

- Marsden BS – 4.25 per cent AER / Gross

- Gatehouse Bank - 4.25 per cent AER / Gross

- Charter Savings Bank - 4.17 per cent AER / Gross.

Here is a full list of the best cash ISAs with a variable interest rate attached currently on offer:

- Plum – 4.98 per cent AER / 4.86 per cent Gross

- Moneybox – 4.65 per cent AER / Gross

- Tembo Money – 4.64 per cent AER / 4.54 per cent Gross

- Trading 212 – 4.50 per cent AER / 4.41 per cent Gross

- Marsden - 4.50 per cent AER / Gross

- Moneybox – 4.45 per cent AER / Gross

- Charter Savings Bank – 4.40 per cent AER / Gross

- Principality BS - 4.40 per cent / Gross

- Aldermore – 4.40 per cent AER / Gross

- Kent Reliance – 4.38 per cent AER / Gross.

Best easy access savings accounts

Here is a full list of the best easy access savings accounts without a bonus attached:

- Cahoot – Five per cent AER / Gross

- Atom Bank – 4.75 per cent AER / 4.65 per cent Gross

- Snoop – 4.60 per cent AER / 4.50 per cent Gross

- Cahoot – 4.55 per cent AER / Gross

- Coventry BS – 4.50 per cent AER / Gross

- Kent Reliance – 4.46 per cent AER / Gross

- Secure Trust Bank – 4.45 per cent AER / 4.36 per cent Gross

- Close Brothers Savings – 4.45 per cent AER / Gross

- Newcastle BS – 4.40 per cent AER / Gross

- Hodge Bank – 4.40 per cent AER / 4.31 per cent Gross

- Chase – Five per cent AER / 4.89 per cent Gross

- Sidekick – 4.51 per cent AER / 4.43 per cent Gross

- Skipton BS – 4.50 per cent AER / Gross

- Chip – 4.33 per cent AER / 4.25 per cent Gross

- Chip – 4.33 per cent AER / 4.24 per cent Gross

- Cynergy Bank – 4.30 per cent AER / Gross

- Principality BS – 4.25 per cent AER / Gross

- Tesco Bank – 4.15 per cent AER / Gross

- Nottingham BS – 4.05 per cent AER / Gross

- Marcus by Goldman Sachs – 4.01 per cent AER / 3.94 per cent Gross

LATEST DEVELOPMENTS:

The Bank of England has made multiple changes to the base rate over the years | CHAT GPT

The Bank of England has made multiple changes to the base rate over the years | CHAT GPT Adam French, a consumer expert at Moneyfactscompare.co.uk, said: "Tax-savvy savers who are conscious of not exceeding their Personal Savings Allowance may want to snap up the best paying one-and two-year fix ISA rates after we lost a handful of market leading deals in the past week.

"Some of the best returns can currently be found with easy access accounts, such as Plum’s Cash ISA, which is paying 4.98 per cent, or the Cahoot Sunny Day Saver which is paying five per cent on balances of up to £3,000. However, these rates are variable, and they are liable to be cut if the base rate of interest continues to fall as expected this year.

“It’s a good idea to regularly review and switch savings pots. Some of the best rates on the market come from challenger banks and digital providers, which should not be overlooked.

"Taking time out to check any old savings accounts against the latest competition could be one of the easiest ways to boost your wealth, as is signing up to rate alerts or newsletters to keep in the know."

More From GB News