Bank of England SLAMMED for 'harming ordinary families' after interest rate decision

GB NEWS

The Bank of England's interest rate decision sets the cost for borrowing

Don't Miss

Most Read

The Bank of England is being accused of "harming ordinary households" following the financial institution's base rate announcement earlier this week.

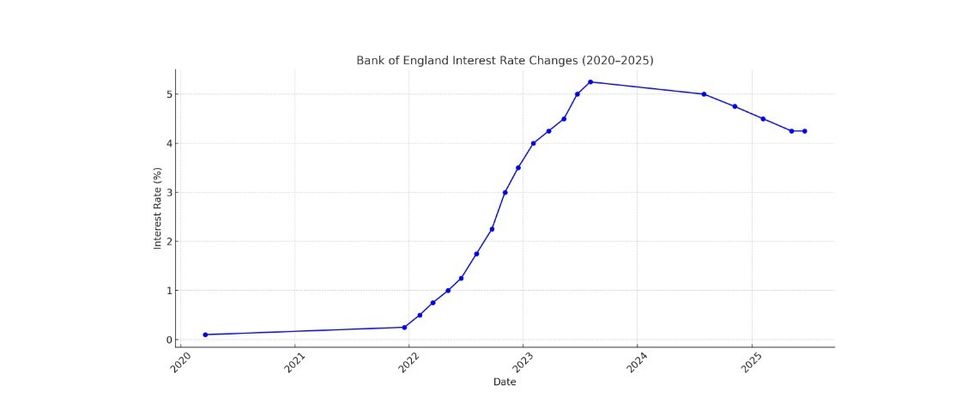

On Thursday (June 19), the central bank voted to keep interest rates unchanged at 4.25 per cent on Thursday, maintaining the benchmark at its lowest level in two years despite mounting pressure for further cuts.

This decision saw a split vote among the Monetary Policy Committee (MPC), with six members voting to hold rates steady whilst three favoured a reduction.

Recently, the Bank has cut rates four times since beginning its easing cycle in May, following an aggressive tightening period during 2022-2023.

The Bank of England is under fire over its interest rate decisions

|GETTY

The base rate, which influences how banks set their lending and savings rates, remains at levels that critics argue are damaging household finances amid sluggish economic growth.

Inflation remains stubbornly elevated at 3.4 per cent, significantly above the Bank's two per cent target, though slightly down from April's 3.5 per cent figure.

As it stands, the central bank's MPC member expects price pressures to persist in the coming months before easing next year.

Rising geopolitical tensions in the Middle East pose additional inflationary risks through potential oil price spikes.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England has made changes to interest rates in recent years

|GETTY

"The risk to energy prices has clearly intensified and moved up the agenda given developments in the Middle East," Sandra Horsfield, an economist for Investec, told AP.

Higher energy costs would feed through to production and transport expenses across the economy, potentially derailing the Bank's inflation forecasts.

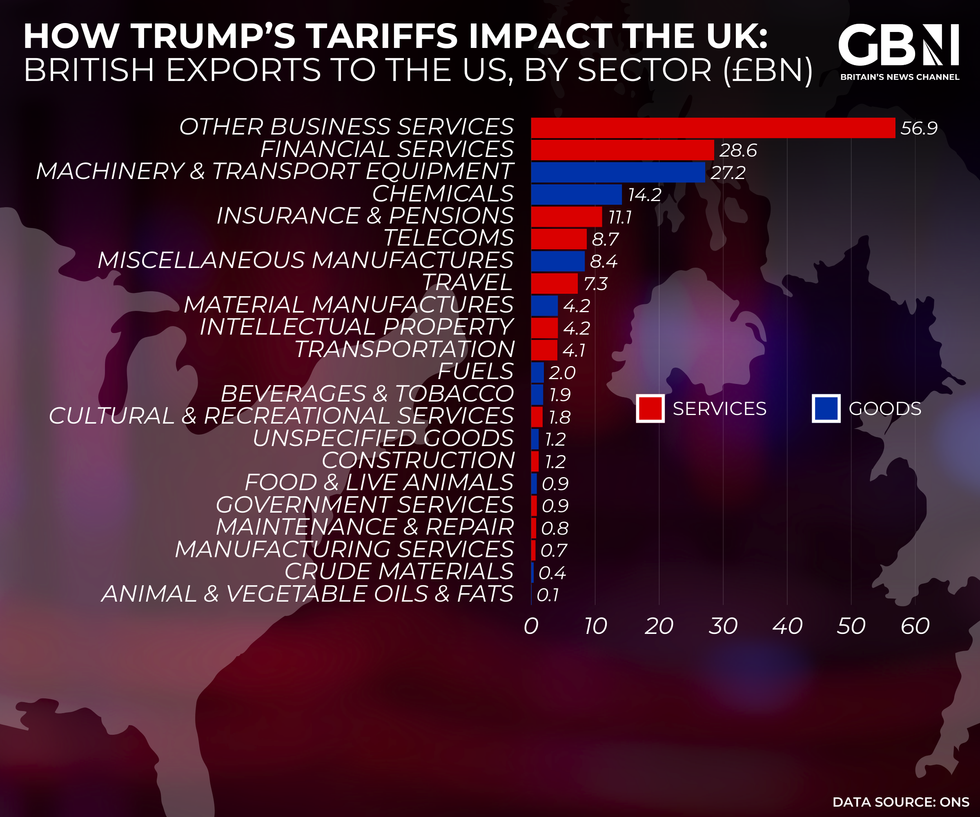

Uncertainty surrounding US tariffs under President Donald Trump adds another layer of complexity to the inflation outlook.

"We are still awaiting the full impact of Donald Trump's tariffs to show up in the prices of goods. We are approaching the end of the 90-day pause on reciprocal tariffs, and what happens from there is really anyone's guess," said Lindsay James, investment strategist at Quilter.

She warned that tariffs imposed on other nations would likely affect UK prices, particularly if Europe fails to reach an agreement with Washington.

Meanwhile, the UK economy showed signs of weakness with output falling 0.3% in April, driven by declining exports to America and rising business costs including tax increases.

LATEST DEVELOPMENTS:

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS"The expectation is the UK economy will stagnate again in the second half, making the need for rate cuts more prominent," James said. "But with risks on the global stage not only uncertain but also substantial, the mantra of rates being higher for longer will continue."

Critics argue the Bank's stance is too restrictive. "The Bank should have continued its rate cutting cycle, by lowering rates by 0.25 today," said Carsten Jung, associate director for economic policy at IPPR.

"This year's GDP growth has been lower than expected, in large part because interest rates are being kept high for long.

"Even when considering still elevated inflation, the Bank continues to run an overly restrictive policy, and it is harming ordinary households."