Aldi issues cost of living warning as thousands of shoppers hit by '£800 postcode penalty'

The supermarket giant is breaking down the impact of inflation-hiked prices on supermarket shopping bills

Don't Miss

Most Read

British households living in more than 200 towns across the country are being hit with a significant "postcode penalty" on their weekly food shop, according to fresh research published today.

The analysis from Aldi reveals that families without access to a discount supermarket are spending as much as £2,437 extra each year on groceries compared to those who can shop at budget retailers.

Communities ranging from Stonehaven in Scotland to Totnes in Devon are among those identified as facing this substantial cost burden, with the research highlighting what it describes as a considerable "discounter gap" affecting shoppers nationwide.

The research pinpoints 220 locations where shoppers face inflated grocery bills, spanning every region of Britain. The South East accounts for 35 affected towns, while the East of England has 30 and Scotland 25.

Aldi has issued a warning about the £800 'postcode penalty'

|GETTY

Households in these areas pay an average of £826 more annually, with the figure climbing to £2,437 where the priciest supermarkets dominate the local market.

Jonathan Neale, the managing Director of National Real Estate at Aldi UK, said: "No one should pay more for their weekly shop simply because of where they live.

"We believe every household should have access to high-quality, affordable food.

"With household budgets under intense pressure, local access to a discounter isn't just convenient it can save families hundreds of pounds a year."

Major supermarkets, including Aldi, are making cuts

| PAThe grocery cost burden comes as broader economic pressures show little sign of easing for British consumers, as inflationary concerns continue to impact consumers.

According to the British Chambers of Commerce’s (BCC) latest quarterly economic survey (Q4 2025) found that 52 per cent of firms expect to raise prices over the next three months.

The business group warns that the journey back to stable price growth this year could prove bumpy, potentially prompting the Bank of England to exercise caution when considering the speed of any interest rate reductions.

Financial experts have expressed alarm to Newspage at the persistence of elevated prices despite weakening consumer demand.

Anita Wright, Chartered Financial Planner at Ribble Wealth Management, said it was "worrying" that prices are not coming down.

She added: "If you look out on the high street and in people's bank accounts, the story is pretty simple: the UK consumer is skint.

"The middle of the country has been taxed to the hilt, debt is high, and people are not spending like they used to."

Ms Wright warned that the central bank now faces the difficult task of tackling both inflation and recession simultaneously, describing the problem as "embedded rather than solved".

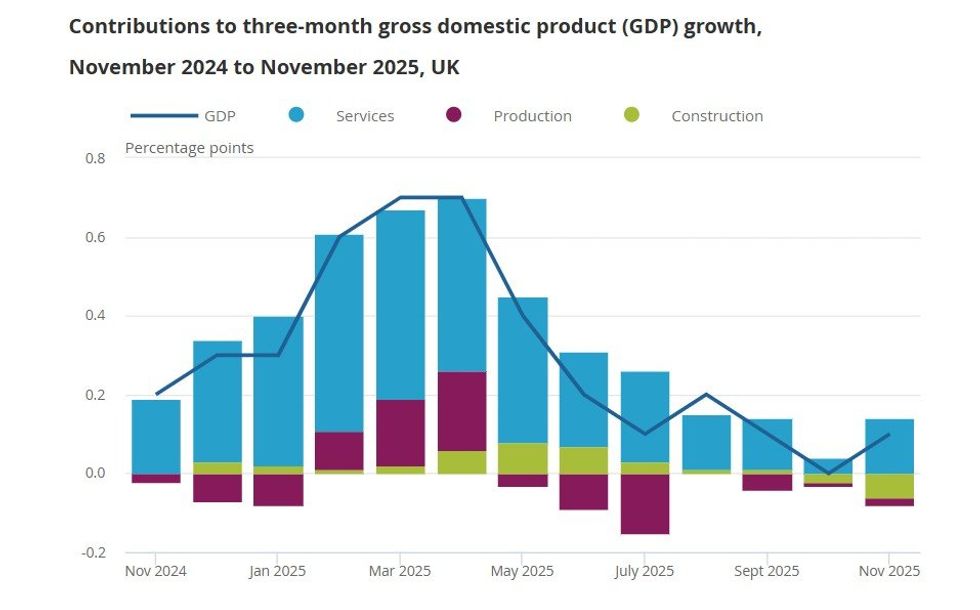

How has GDP changed in the past year? | ONS

How has GDP changed in the past year? | ONS Tony Redondo, the founder at Newquay-based Cosmos Currency Exchange, noted that gross domestic product (GDP) growth will be affected if inflation comes down.

He added: "What this boils down is the UK going into recession in 2026. The BCC’s report of 52% of firms planning price hikes signals that ‘sticky’ inflation remains a major hurdle for 2026.

"While headline rates may dip, domestic price pressures are becoming embedded, likely forcing the BoE to maintain higher interest rates for longer to prevent a new inflation spiral.

"Households and SMEs will be the primary losers in this scenario. Consumers face a continued squeeze on disposable income as real wage growth stalls, while SMEs, lacking the scale to absorb rising overheads risk losing market share or facing insolvency."

More From GB News