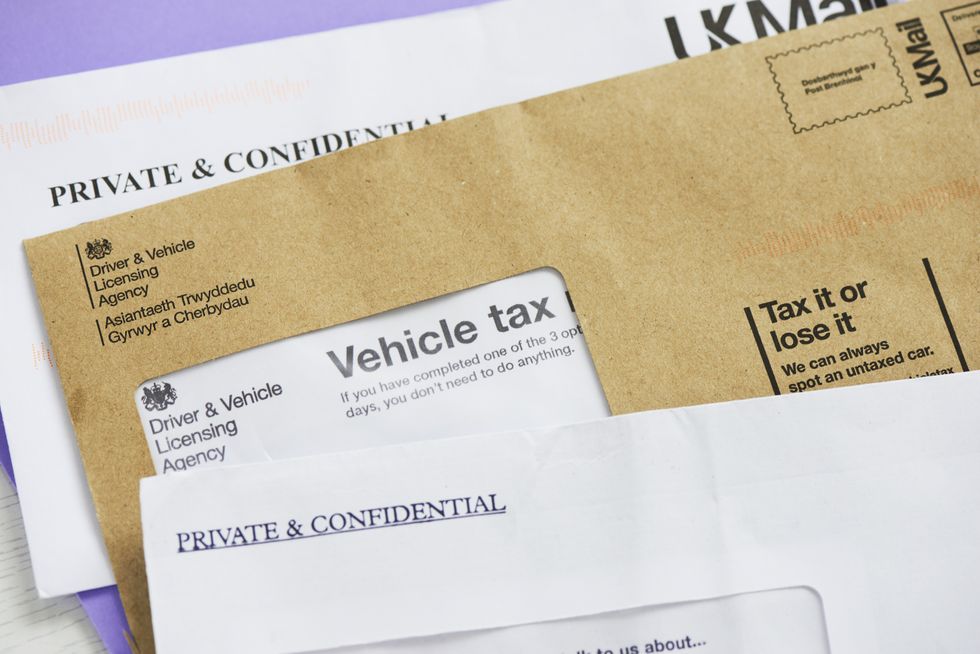

'Tax it or lose it!' DVLA warns drivers to make sure vehicles are properly registered as new rates roll out

DVLA states it can always spot an untaxed car

Don't Miss

Most Read

The DVLA has warned drivers to ‘tax it or lose it’ as it rolls out the latest vehicle excise duty fares for drivers which sees motorist pay at least £100 more yearly.

The new tax rates came into effect on April 1 having been originally announced at last years Autumn Statement by Chancellor of the Exchequer Jeremy Hunt.

The changes see drivers now pay up to £140 more this year, which will be on top of steep car insurance premiums and guzzling petrol costs.

Under the changes to VED, drivers with higher polluting cars will face tougher rates as the UK looks to crack down and move away from emission-heavy vehicles.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The average petrol car produces roughly 140 grams of CO2 emissions

| GETTYThe average petrol car produces roughly 140 grams of CO2 emissions while a diesel car produces more at 164g.

Motorists with vehicles that fall in the 131g to 150g of CO2 per kilometre threshold, will now pay an upfront cost of £270 for a petrol car, £680 for a diesel car and £260 for alternative fuel cars, such as hybrid models.

The roughly £35 hike in costs comes as both inflation, the rising costs of fuel and the Government's own agenda to get people to drive more eco-friendly cars, came into force.

Vehicle tax rates for cars registered between March 1, 2001, and March 31, 2017, will also see increases unless their vehicles produce less than 120g/km.

Vehicle excise duty is a tax paid annually by drivers of vehicles that are driven or parked on public roads.

The increase is calculated in line with inflation and is based on the Retail Price Index.

Drivers with vehicles between car tax bands D and L can expect to pay between £10 and £35 more compared to last year.

The final tax band, M (over 255g/km), will see a £40 price hike, with almost all car tax payments becoming more expensive if they choose to pay using Direct Debit instalments.

Another change which came into effect included the way in which electric car road tax would now be dealt with.

The Treasury revealed that starting next year, EV drivers will be required to pay for VED from April 1, 2025.

Commenting on the Budget announcement, RAC head of policy Simon Williams had previously stated: “While it’s good news that fuel duty has been kept low, it’s unlikely drivers will be breathing a collective sigh of relief as we don’t believe they’ve fully benefited from the cut that was introduced just two years ago due to retailers upping margins to cover their ‘increased costs’.

“This has meant fuel prices have been higher than they would otherwise have been. What’s more, despite the positive news it’s still the case that drivers are once again enduring rising prices at the pumps, sparked by the oil price going up.”

LATEST DEVELOPMENTS:

How much drivers pay for road tax will depend on the type of vehicle

| PAHow much drivers pay for road tax will depend on the type of vehicle they drive and the date it was first registered.

Drivers can search for the exact changes via the DVLA website.