Rachel Reeves could hammer taxi industry with Budget VAT raid as Labour offers 'little support'

'Such a hike in fares could push customers away from using these services and towards public transport'

Don't Miss

Most Read

The taxi and private hire sector could be decimated in the coming months if Rachel Reeves introduces new taxes, an industry group has warned.

New data shows that 70 per cent of Britons would reduce their use of private hire vehicles or stop taking them altogether if a so-called "taxi tax" is introduced.

Experts have hinted that the Chancellor could be planning to launch a VAT raid against private hire vehicles, resulting in customers paying an extra 20 per cent for journeys.

Any taxis or private hire businesses outside of London do not charge VAT on journeys because drivers are considered to be self-employed contractors.

TRENDING

Stories

Videos

Your Say

Research shows that the move would be deeply unpopular, with a third of survey respondents admitting that they use a taxi at least once a week.

Concerningly, almost a quarter said they would slightly reduce the number of private hire journeys they make, while 12 per cent said they would stop using these vehicles entirely.

David Sweeney, head of taxi broking at The Taxi Insurer, said: "If VAT is added to PHV fares, there's a danger it'll make the drivers of those vehicles less competitive.

"Such a hike in fares could push customers away from using these services and towards public transport.

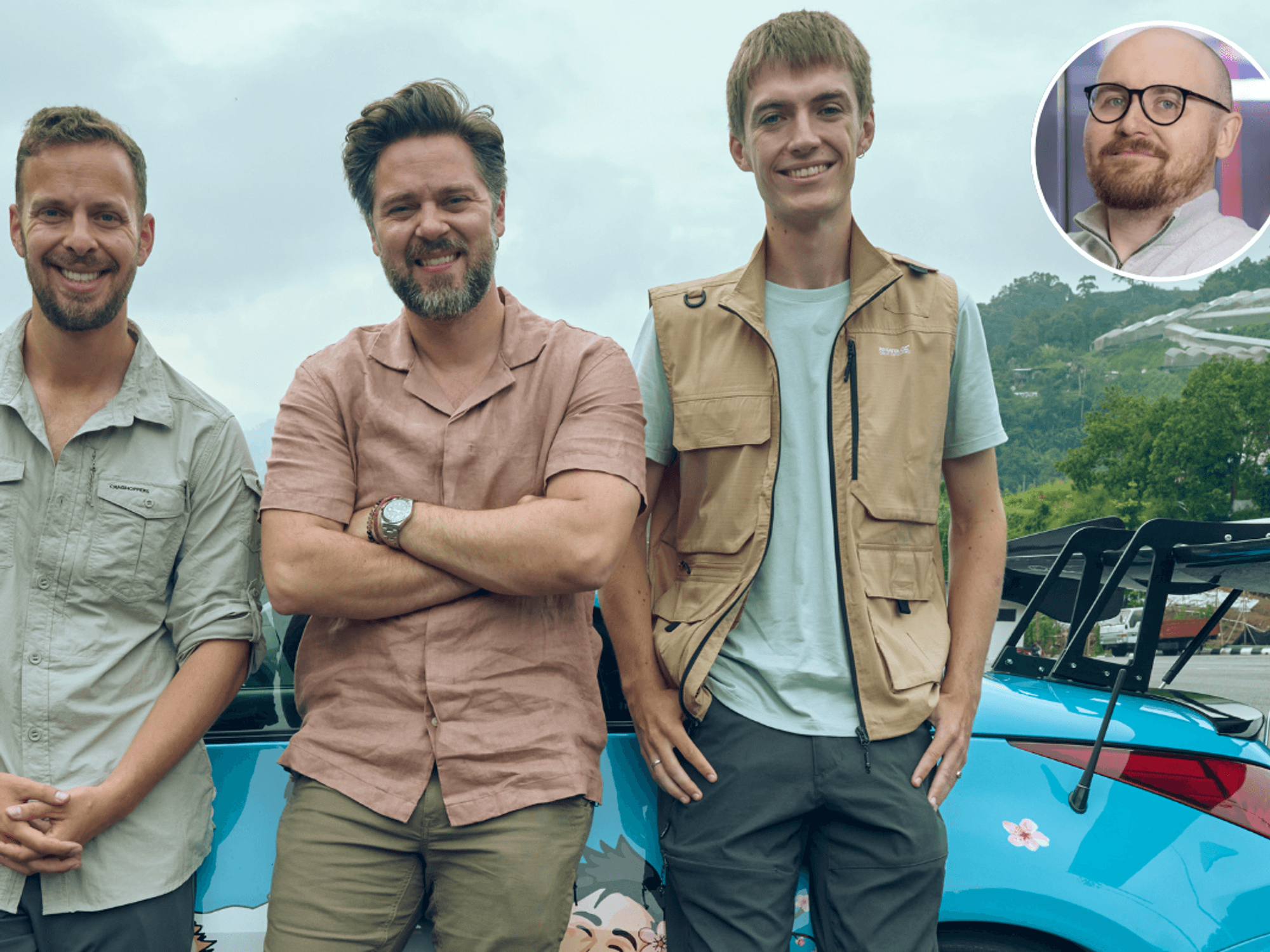

The taxi and private hire vehicle industry has called on Chancellor Rachel Reeves to avoid introducing a 'taxi tax' | PA

The taxi and private hire vehicle industry has called on Chancellor Rachel Reeves to avoid introducing a 'taxi tax' | PA"In a trade where there seems to be little support from the Government, this certainly wouldn't help in what is already a very tough market."

More than a quarter of survey respondents admitted that they relied on cabs to do their weekly shop, while 15 per cent use them for medical appointments.

The Taxi Insurer added that local authorities would be hammered by extra costs when providing school transport for pupils with special educational needs.

This currently stands at £1.5billion, an increase of 21.5 per cent in the 2023-2024 financial year, while mainstream home-to-school transport rose 11.4 per cent to £512million.

LATEST DEVELOPMENTS

The hospitality sector could also be affected, with almost a third of people saying they use cabs when going out to meet friends or family.

Mr Sweeney highlighted that taxi and private hire vehicle drivers were concerned that a hike to insurance premium tax could be the next change.

He explained that it had increased slowly over the last three decades, rising from five per cent in 1999 to the current level of 12 per cent.

Earlier this month, a total of 59 national and regional private hire operators signed an open letter slamming the proposed taxi tax measures.

Taxi drivers could face a 20 per cent VAT hike in the Autumn Budget | GETTY

Taxi drivers could face a 20 per cent VAT hike in the Autumn Budget | GETTYThe group called on the Chancellor to meet with the industry before announcing any drastic measures in the Budget, adding that there should be a "fair and sustainable" solution.

The open letter warned that any decision on VAT rates could have a disastrous impact on local economies, people with mobility issues and the night-time industry.

Nathan Bowles, CEO of Veezu, one of the signatories of the open letter, said: "PHVs keep Britain moving, connecting communities that rely on us for essential journeys, and a 20 per cent VAT hike would hit the elderly, disabled, and rural passengers hardest.

"The open letter is a united call from operators across the UK urging the Government to confirm that PHVs will not be subject to a 20 per cent VAT rate."