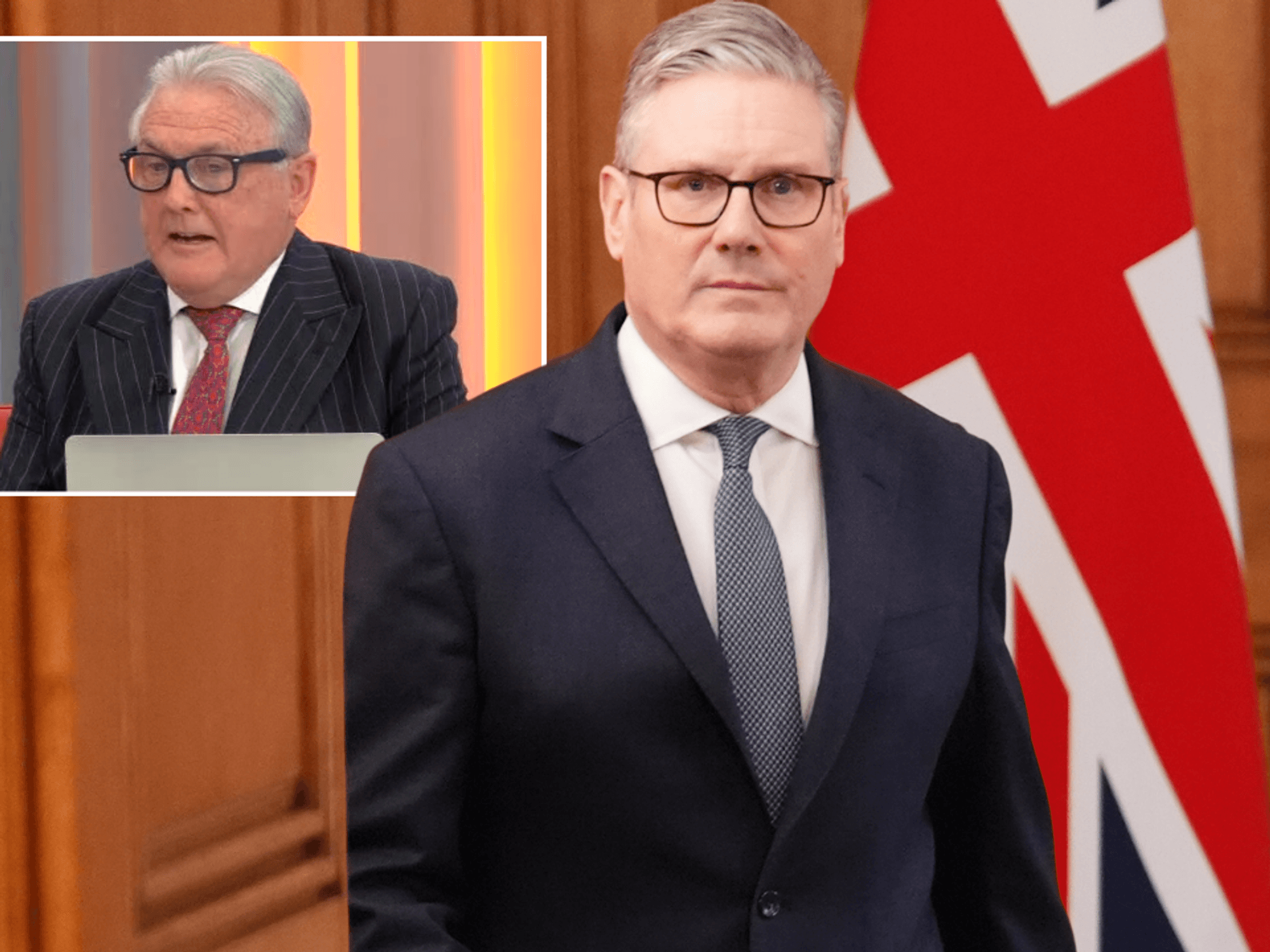

Rachel Reeves under pressure to scrap VAT raid on drivers amid harsh 'stealth tax' plans - 'Disasterclass!'

WATCH: London's iconic black cabs could go extinct within 20 years with Sadiq Khan urged to act

|GB NEWS

Chancellor Rachel Reeves will confirm any changes to tax policy in the Autumn Budget on November 26

Don't Miss

Most Read

Latest

Rachel Reeves is being urged to rule out new vehicle taxes in the upcoming Budget for thousands of drivers amid warnings that motorists could be forced off the road.

Shadow Transport Secretary Richard Holden has called on the Chancellor to rule out the so-called "taxi tax" amid reports that Labour is looking to target private hire journeys.

As the Government deals with a spiralling £50billion black hole in its finances, the Chancellor has admitted that tax rises could be introduced in the Autumn Budget on November 26.

One of the proposed measures that the Chancellor could introduce is a 20 per cent VAT surcharge on private hire journeys, prompting a serious warning from the Shadow Transport Secretary.

In written Parliamentary answers, the Treasury refused to rule out a new VAT charge on private hire fares when grilled by Mr Holden.

Last year's Autumn Budget acknowledged that the Government was considering responses to a consultation regarding the VAT treatment of private hire vehicles.

It noted that it would also take into account a Court of Appeal judgement. A recent Supreme Court appeal ruled that Uber's rival taxi operators would not have to pay a 20 per cent VAT charge on their profit margins outside of London.

VAT currently applies when an operator is registered and acts as the principal for the journey, with Labour looking to amend rules so that all local operators are treated as VAT principals.

Chancellor Rachel Reeves is being urged to axe proposals that would hike the VAT rate on private hire journeys

|PA

Commenting on the potential introduction of a taxi tax, Richard Holden MP said: "Labour's taxi tax would clobber vulnerable passengers and working families, while dealing a hammer blow to the night-time economy.

"From rural towns to city centres, people who depend on private hire to get home safely after work or a night out would be priced off the road entirely."

The Conservative MP for Basildon and Billericay highlighted industry figures which estimate that the VAT change would raise around £750million a year for the Treasury.

While this would ease the burden on the Chancellor's financial black hole, passengers would see the price of a typical £12 journey jump by around £2 or £3.

The so-called 'taxi tax' could raise around £750million a year for the Treasury

| GETTYLATEST DEVELOPMENTS:

- Volkswagen announces huge price cuts to popular models as 20,000 Britons use Electric Car Grant

- Plug-in hybrids pollute almost as much as petrol cars - 'One of the biggest cons in automotive history'

- Canada threatens to SUE Stellantis over US production move with workers 'sacrificed on the Trump altar'

Shadow Transport Secretary Richard Holden has slammed Labour for targeting motorists

| GB NEWSPeople with disabilities and those living in rural areas could be severely impacted by any changes to the VAT rate on private hire journeys.

Experts from the Campaign for Better Transport have already warned that the NHS could be hammered by the taxi tax, given that it spends £460million a year transporting patients to appointments.

Similarly, the Stop the Taxi Tax campaign commissioned research which found that seven in 10 survey respondents are against a VAT hike of 20 per cent.

Mr Holden also pointed to local authorities across the UK who have already hiked VAT rates between 2.5 per cent and 16 per cent for licensed vehicles, including Ipswich, Stafford and Basingstoke.

He continued, saying that Labour were planning to introduce the hike, describing Prime Minister Sir Keir Starmer as having "no backbone" and "no plan".

"Combined with Rachel Reeves' multi-billion-pound black hole in the public finances, it means yet another stealth tax to paper over their economic disasterclass," the MP said.

The former Minister for Roads and Local Transport called on Labour to "slam the brakes" and definitely rule out the taxi tax ahead of the Autumn Budget.

Speaking to GB News, a HM Treasury spokesperson said: "The Chancellor makes tax policy decisions at fiscal events. We do not comment on speculation around future changes to tax policy."