Petrol and diesel drivers could see car taxes soar to £5,690 within months

Electric car drivers will likely see the same first year VED rate as last year

Don't Miss

Most Read

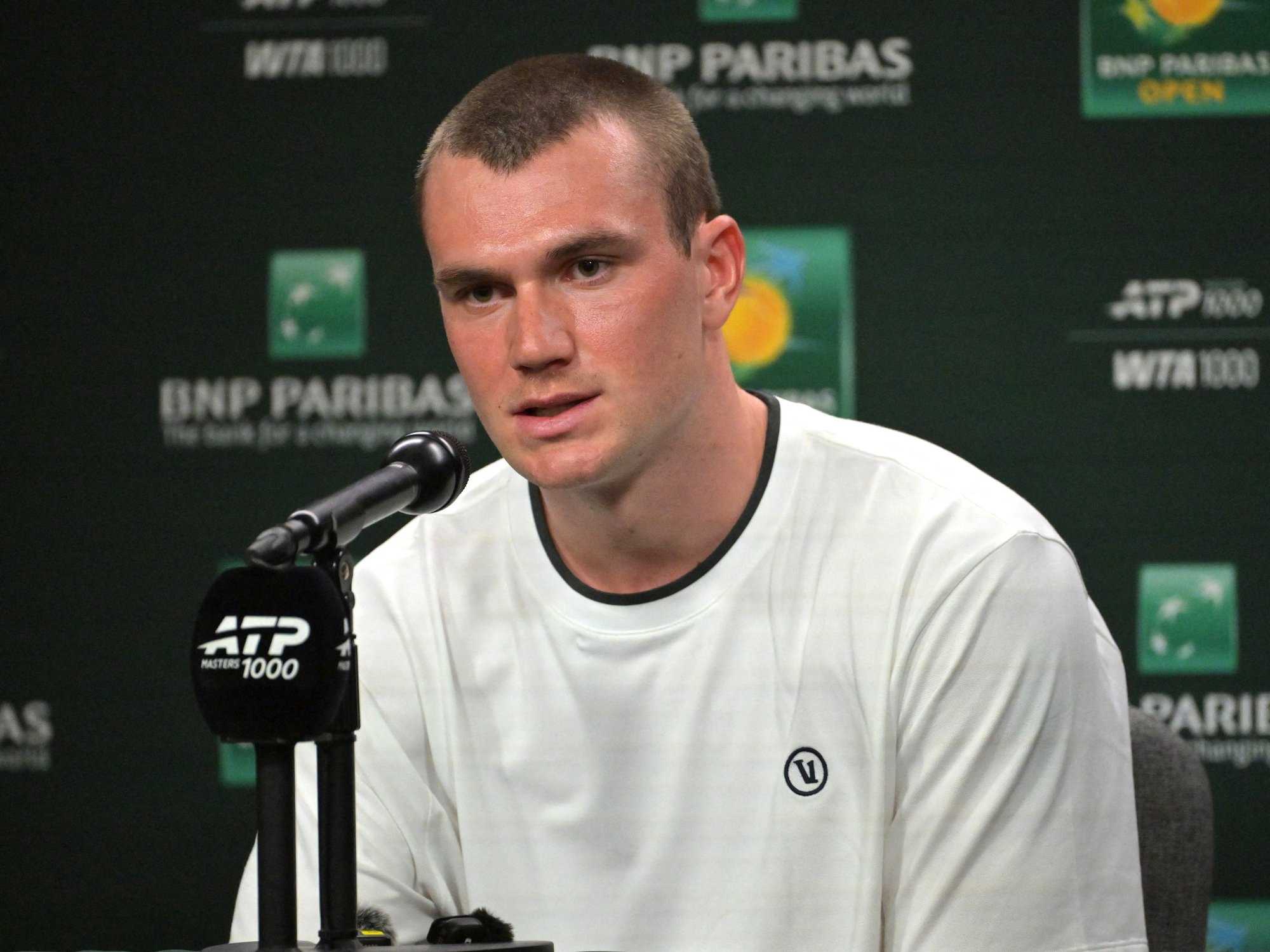

Drivers are being warned of new car tax changes launching in the coming months that could see some petrol and diesel vehicle owners slapped with enormous charges.

Ahead of the new financial year in April, experts are warning Britons of new car tax rates being rolled out for petrol, diesel and electric car owners.

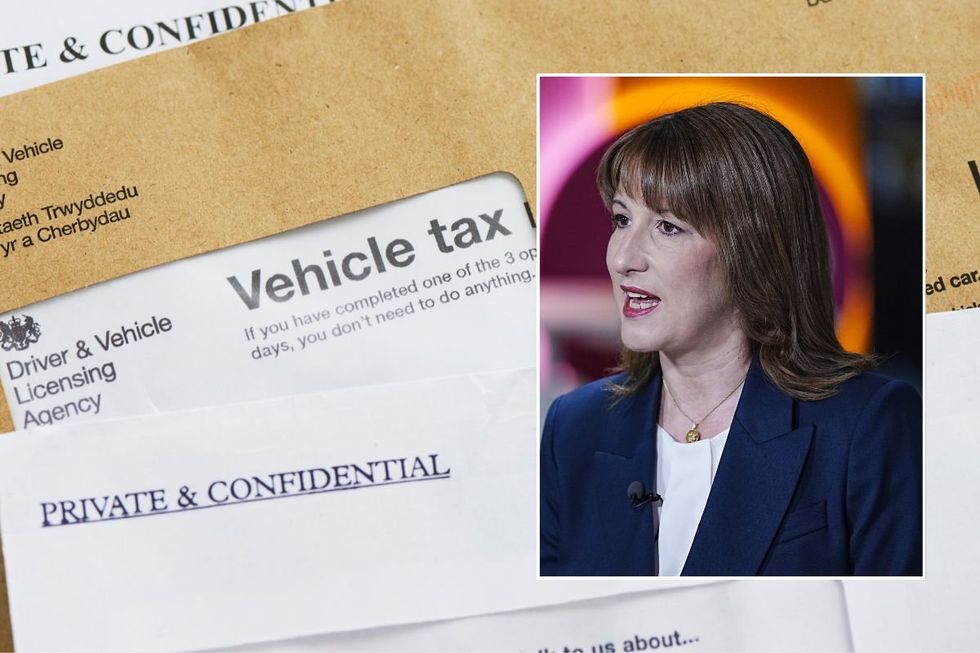

Chancellor Rachel Reeves announced in last year's Autumn Budget that Vehicle Excise Duty charges would rise in line with inflation from April 1, for cars, vans and motorcycles.

This followed the 2024 Budget, which saw the Chancellor introduce new VED first year rates for drivers who buy new vehicles.

TRENDING

Stories

Videos

Your Say

The Government stated that it would strengthen existing incentives to buy new zero and low emission vehicles by "widening the differentials" between ZEVs, hybrids and internal combustion engine vehicles.

Under the new car tax regime, any newly registered zero emission vehicles will pay the lowest first year rate of £10 until 2029-2030.

Further increases were seen for cars emitting between one and 50g of CO2 per kilometre, rising to £110, while cars emitting 51-75g/km would pay £130.

All other rates for cars emitting 76g/km and above would double from their current rate, leaving some drivers hundreds or even thousands of pounds out of pocket.

Rachel Reeves' Budget confirmed that Vehicle Excise Duty rates would rise in line with inflation

| GETTY/PADrivers opting for the most polluting petrol and diesel cars saw costs rise to a staggering £5,490 for the first year of registration.

Motoring expert Pete Barden has now suggested how these rates could rise further as they increase in line with inflation from April 1, 2026.

The most polluting band for new vehicles, which applies to vehicles that emit more than 255g/km, could see costs rise from £5,490 to £5,690.

Other motorists will see a significant increase, while zero emission vehicles are expected to retain the £10 first year tax rate.

LATEST DEVELOPMENTS

Rachel Reeves delivered the Budget in the Commons on November 26 | PA

Rachel Reeves delivered the Budget in the Commons on November 26 | PAExpected first year car tax rates from April 1, 2026

0g/km - Remains at £10

1-50g/km - Rising from £110 to £115

51-75g/km - Rising from £130 to £135

76-90g/km - Rising from £270 to £280

91-100g/km - Rising from £350 to £365

101-110g/km - Rising from £390 to £405

111-130g/km - Rising from £440 to £455

131-150g/km - Rising from £540 to £560

151-170g/km - Rising from £1,360 to £1,410

171-190g/km - Rising from £2,190 to £2,270

191-225g/km - Rising from £3,300 to £3,420

226-255g/km - Rising from £4,680 to £4,850

Over 255gkm - Rising from £5,490 to £5,690